Home /

Expert Answers /

Accounting /

zoum-corporation-had-the-following-transactions-during-2017-issued-250-000-of-par-value-common-sto-pa457

(Solved): Zoum Corporation had the following transactions during 2017: Issued $250,000 of par value common sto ...

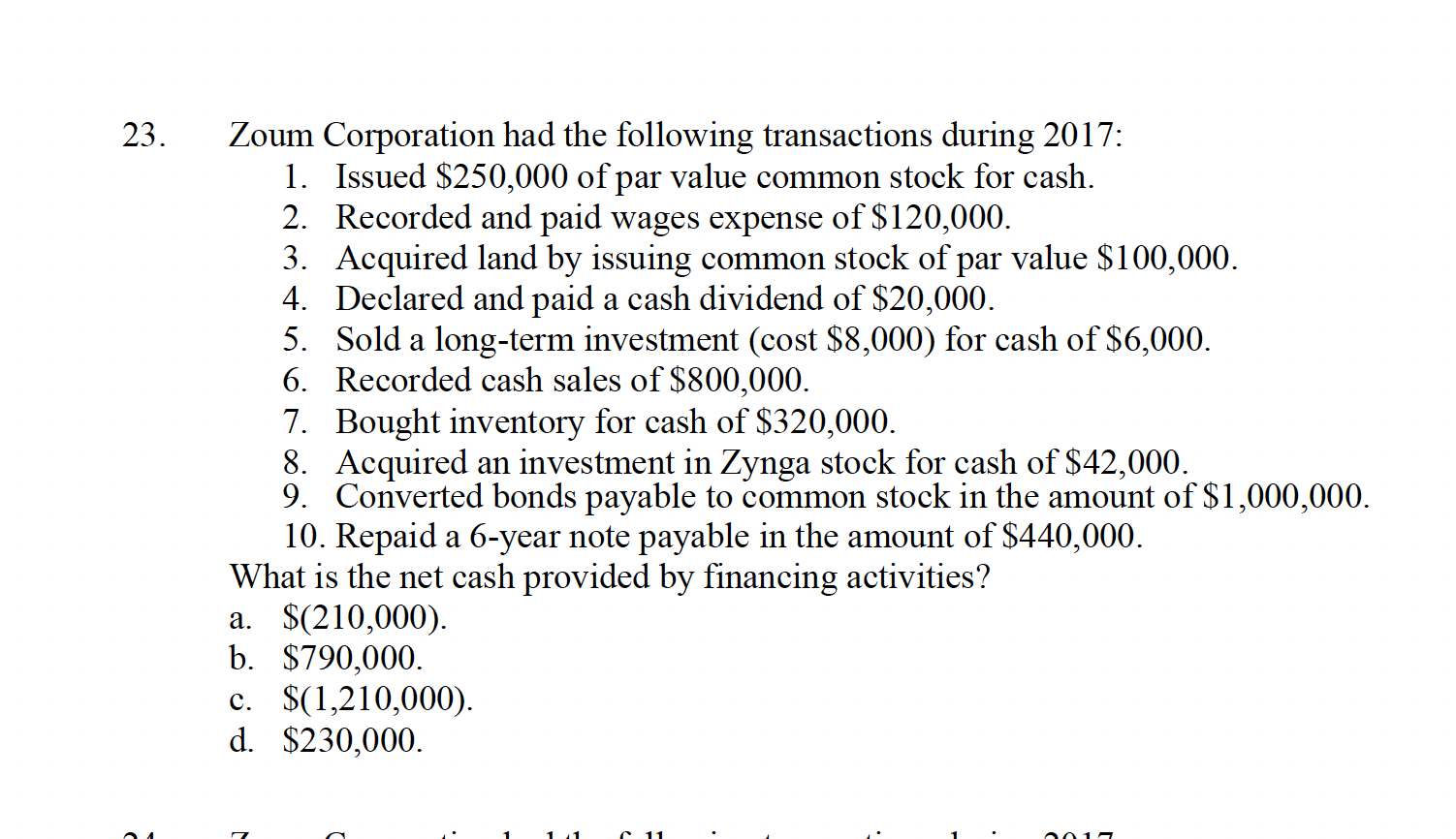

Zoum Corporation had the following transactions during 2017:

Issued $250,000 of par value common stock for cash.

Recorded and paid wages expense of $120,000.

Acquired land by issuing common stock of par value $100,000.

Declared and paid a cash dividend of $20,000$8,000 $6,000.

Recorded cash sales of $800,000.

Bought inventory for cash of $320,000.

Acquired an investment in Zynga stock for cash of $42,000.

Converted bonds payable to common stock in the amount of $1,000,000.

Repaid a 6-year note payable in the amount of $440,000.

What is the net cash provided by financing activities?

a. $(210,000).

b. $790,000.

c. $(1,210,000).

d. $230,000.