Home /

Expert Answers /

Economics /

when-using-net-present-worth-calculations-to-compare-two-projects-which-of-the-following-could-in-pa469

(Solved): When using net present worth calculations to compare two projects, which of the following could in ...

When using net present worth calculations to compare two projects, which of the following could invalidate the calculation? (A) differences in the magnitudes of the projects (B) evaluating over different time periods (C) mutually exclusive projects (D) nonconventional cash flows

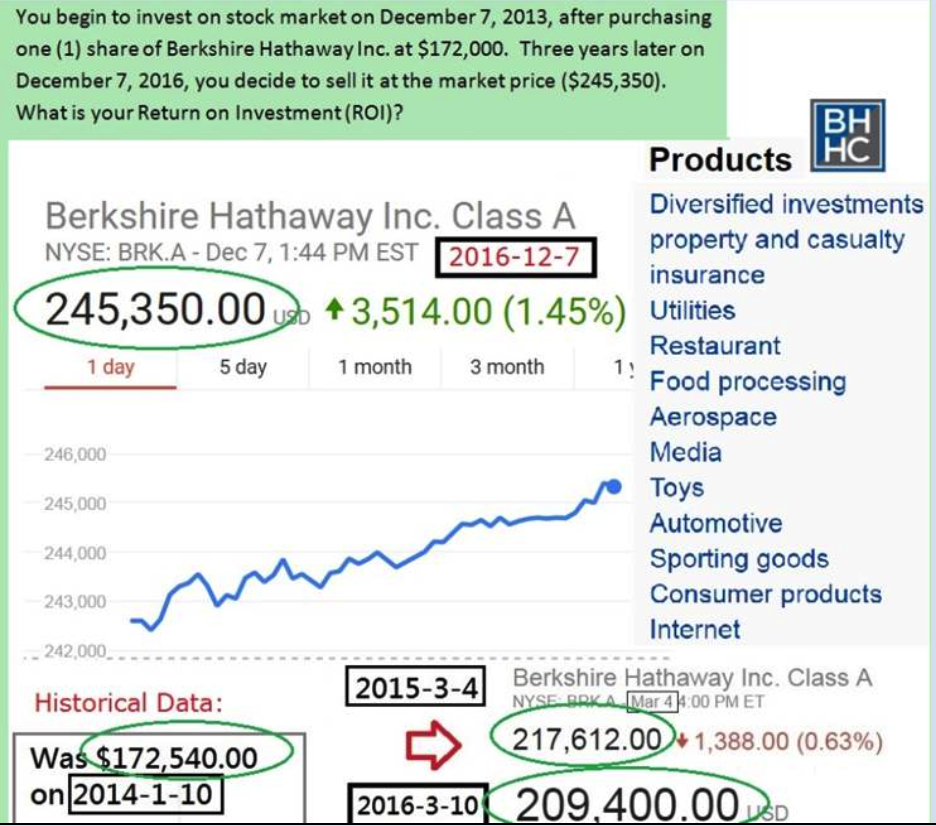

You begin to invest on stock market on December 7, 2013, after purchasing one (1) share of Berkshire Hathaway Inc. at $172,000. Three years later on December 7, 2016, you decide to sell it at the market price ($245,350). What is your Return on Investment (ROI)? BH Berkshire Hathaway Inc. Class A NYSE: BRK.A - Dec 7, 1:44 PM EST 2016-12-7 Products HC Diversified investments property and casualty insurance 245,350.00 +3,514.00 (1.45%) Utilities USD Restaurant 1 day 5 day 1 month 3 month 1! Food processing Aerospace Media Toys Automotive Sporting goods Consumer products Internet Berkshire Hathaway Inc. Class A NYSE BRKA [Mar 44:00 PM ET 217,612.00+1,388.00 (0.63%) 246,000 245,000 244,000 243,000 _242,000 Historical Data: Was $172,540.00 on 2014-1-10 2015-3-4 2016-3-10 209.400.00D

Expert Answer

1. Correct Answer: B Explanation: When projects are of different time periods, then the best project can