Home /

Expert Answers /

Accounting /

the-general-ledger-of-the-karlin-company-a-consulting-company-at-january-1-2024-contained-the-pa746

(Solved): The general ledger of the Karlin Company, a consulting company, at January 1, 2024, contained the ...

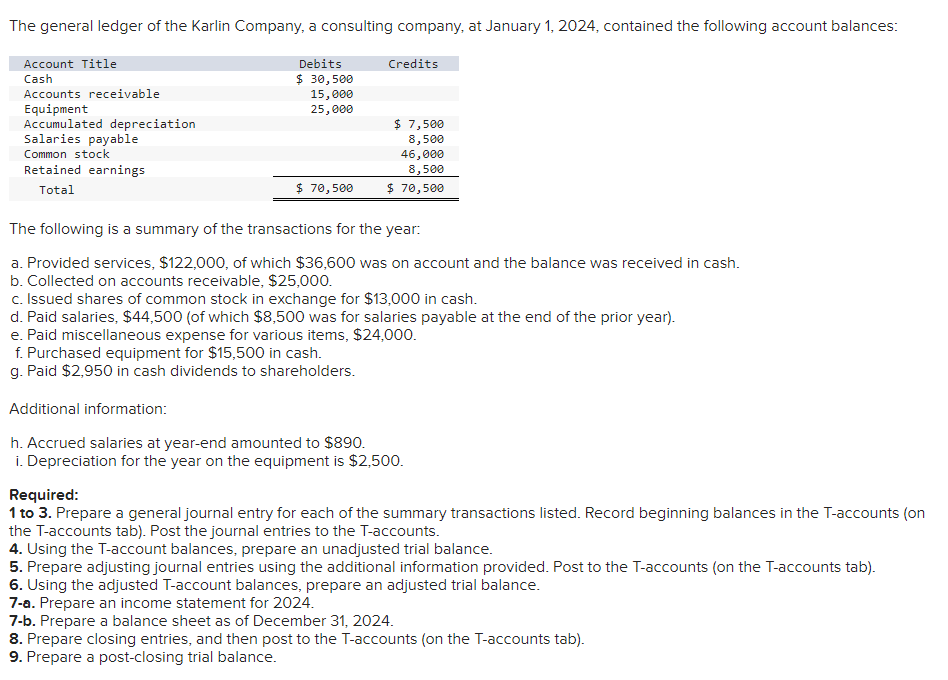

The general ledger of the Karlin Company, a consulting company, at January 1, 2024, contained the following account balances: The following is a summary of the transactions for the year: a. Provided services, \( \$ 122,000 \), of which \( \$ 36,600 \) was on account and the balance was received in cash. b. Collected on accounts receivable, \( \$ 25,000 \). c. Issued shares of common stock in exchange for \( \$ 13,000 \) in cash, d. Paid salaries, \( \$ 44,500 \) (of which \( \$ 8,500 \) was for salaries payable at the end of the prior year). e. Paid miscellaneous expense for various items, \( \$ 24,000 \). f. Purchased equipment for \( \$ 15,500 \) in cash. g. Paid \( \$ 2,950 \) in cash dividends to shareholders. Additional information: h. Accrued salaries at year-end amounted to \( \$ 890 \). i. Depreciation for the year on the equipment is \( \$ 2,500 \). Required: 1 to 3. Prepare a general journal entry for each of the summary transactions listed. Record beginning balances in the T-accounts (on the T-accounts tab). Post the journal entries to the T-accounts. 4. Using the T-account balances, prepare an unadjusted trial balance. 5. Prepare adjusting journal entries using the additional information provided. Post to the T-accounts (on the T-accounts tab). 6. Using the adjusted T-account balances, prepare an adjusted trial balance. 7-a. Prepare an income statement for \( 2024 . \) 7-b. Prepare a balance sheet as of December 31, \( 2024 . \) 8. Prepare closing entries, and then post to the T-accounts (on the T-accounts tab). 9. Prepare a post-closing trial balance.

Expert Answer

Answer to Question (1) to (3): Journal Entries Date Particulars Debit($) Credit($) a Cash 85,400 Account Receivable 36,600 Service Revenue 1,22,000 Sales of Service b Cash 25,000 Account Receivable 25,000 Collected on Account Receivable c Cash 13,000