Home /

Expert Answers /

Accounting /

tableau-da-11-3-mini-case-comparing-dividends-on-noncumulative-and-cumulative-preferred-stock-lo-pa186

(Solved): Tableau DA 11-3: Mini-Case, Comparing dividends on noncumulative and cumulative preferred stock LO ...

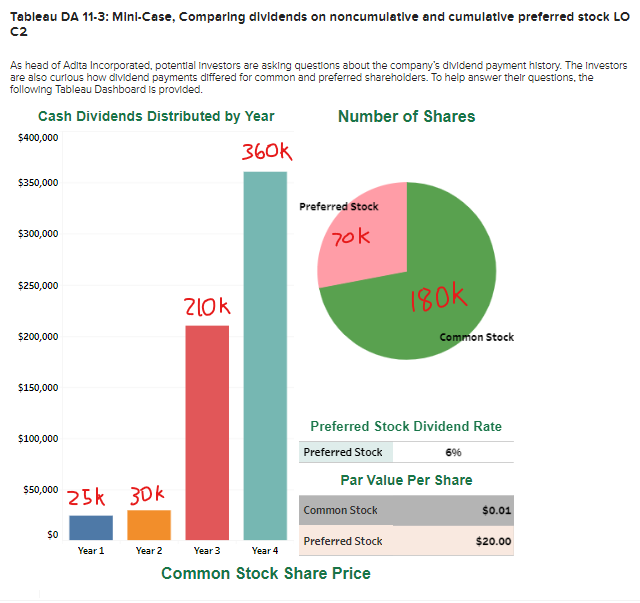

Tableau DA 11-3: Mini-Case, Comparing dividends on noncumulative and cumulative preferred stock LO C2 As head of Adita Incorporated, potential investors are asking questions about the company's dividend payment history. The Investors are also curious how dividend payments differed for common and preferred shareholders. To help answer their questions, the following Tableau Dashboard is provided. Cash Dividends Distributed by Year Number of Shares $400,000 360k $350,000 $300,000 $250,000 $200,000 $150,000 $100,000 $50,000 $0 25k 30k Year 1 Year 2 210k Preferred Stock 70k Common Stock Preferred Stock 180k Preferred Stock Dividend Rate Preferred Stock 696 Par Value Per Share Year 3 Year 4 Common Stock Share Price Common Stock $0.01 $20.00

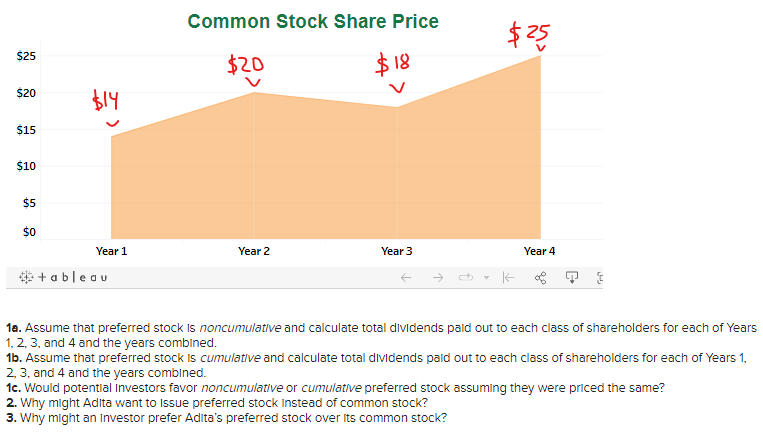

$25 $20 $15 $10 $5 $0 $14 Year 1 +ableau Common Stock Share Price $20 $18 Year 2 Year 3 $25 K Year 4 1a. Assume that preferred stock is noncumulative and calculate total dividends paid out to each class of shareholders for each of Years 1, 2, 3, and 4 and the years combined. 1b. Assume that preferred stock is cumulative and calculate total dividends paid out to each class of shareholders for each of Years 1, 2, 3, and 4 and the years combined. 1c. Would potential Investors favor noncumulative or cumulative preferred stock assuming they were priced the same? 2. Why might Adita want to Issue preferred stock instead of common stock? 3. Why might an Investor prefer Adita's preferred stock over its common stock?

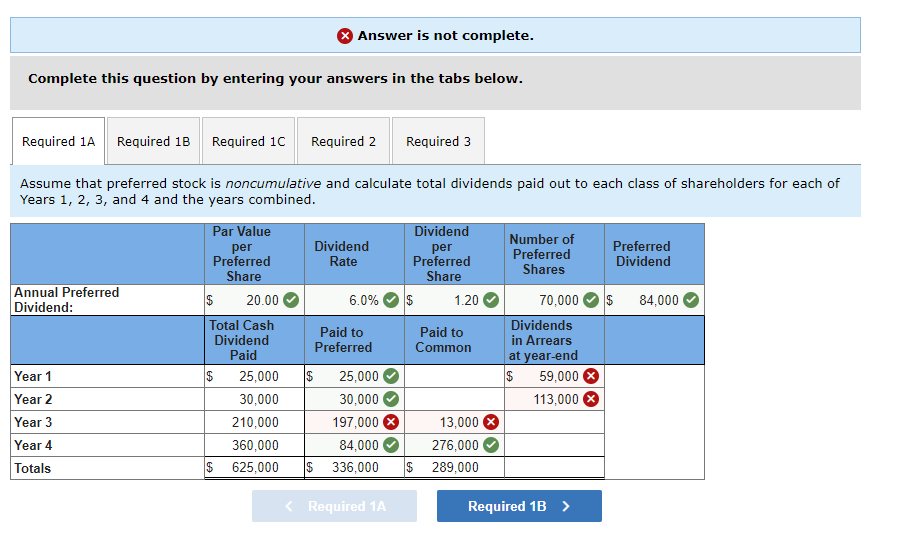

Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 1C Required 2 Assume that preferred stock is noncumulative and calculate total dividends paid out to each class of shareholders for each of Years 1, 2, 3, and 4 and the years combined. Annual Preferred Dividend: Year 1 Year 2 Year 3 Year 4 Totals Par Value per Preferred Share $ 20.00 Total Cash Dividend Paid Answer is not complete. $ $ Dividend Rate 6.0% Paid to Preferred 25,000 $ 25,000 30,000 30,000 210,000 197,000 360,000 84,000 625,000 $ 336,000 Required 1A Required 3 Dividend per Preferred Share $ 1.20 Paid to Common 13,000 276,000 $ 289,000 Number of Preferred Shares 70,000 $ 84,000 Dividends in Arrears at year-end $ 59,000 113,000 Preferred Dividend Required 1B >

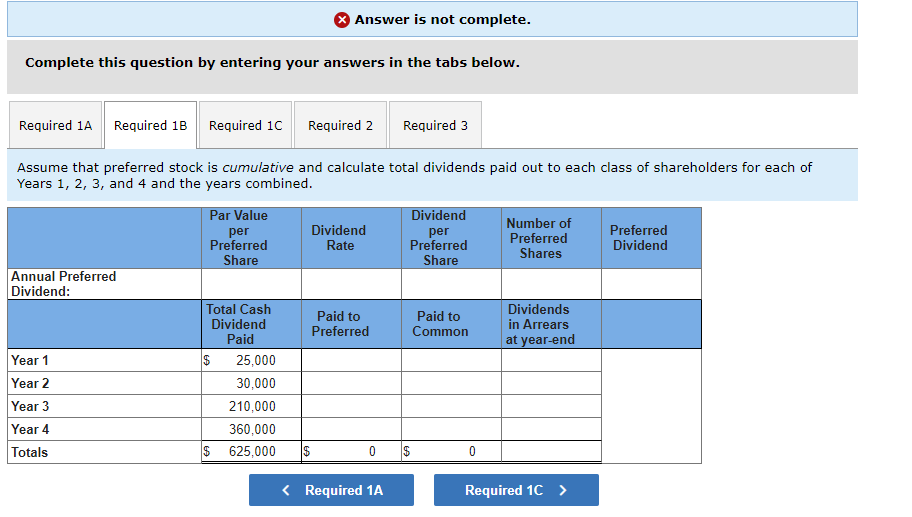

Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 1C Required 2 Assume that preferred stock is cumulative and calculate total dividends paid out to each class of shareholders for each of Years 1, 2, 3, and 4 and the years combined. Annual Preferred Dividend: Year 1 Year 2 Year 3 Year 4 Totals Par Value per Preferred Share Total Cash Dividend Paid $ $ Answer is not complete. 25,000 30,000 210,000 360,000 625,000 Dividend Rate Paid to Preferred $ 0 < Required 1A Required 3 Dividend per Preferred Share $ Paid to Common 0 Number of Preferred Shares Dividends in Arrears at year-end Required 1C > Preferred Dividend

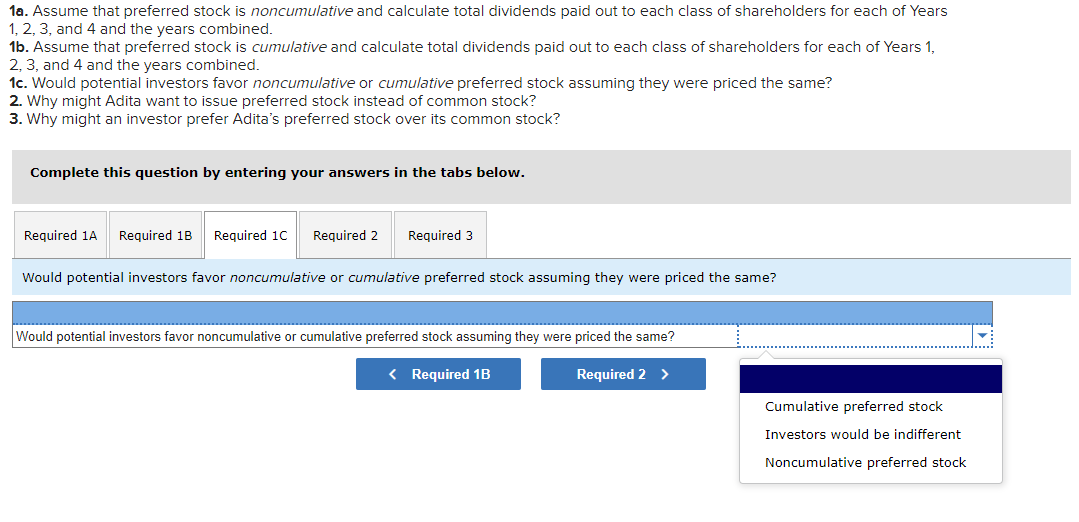

1a. Assume that preferred stock is noncumulative and calculate total dividends paid out to each class of shareholders for each of Years 1, 2, 3, and 4 and the years combined. 1b. Assume that preferred stock is cumulative and calculate total dividends paid out to each class of shareholders for each of Years 1, 2, 3, and 4 and the years combined. 1c. Would potential investors favor noncumulative or cumulative preferred stock assuming they were priced the same? 2. Why might Adita want to issue preferred stock instead of common stock? 3. Why might an investor prefer Adita's preferred stock over its common stock? Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 1C Required 2 Required 3 Would potential investors favor noncumulative or cumulative preferred stock assuming they were priced the same? Would potential investors favor noncumulative or cumulative preferred stock assuming they were priced the same? < Required 1B Required 2 > Cumulative preferred stock Investors would be indifferent Noncumulative preferred stock

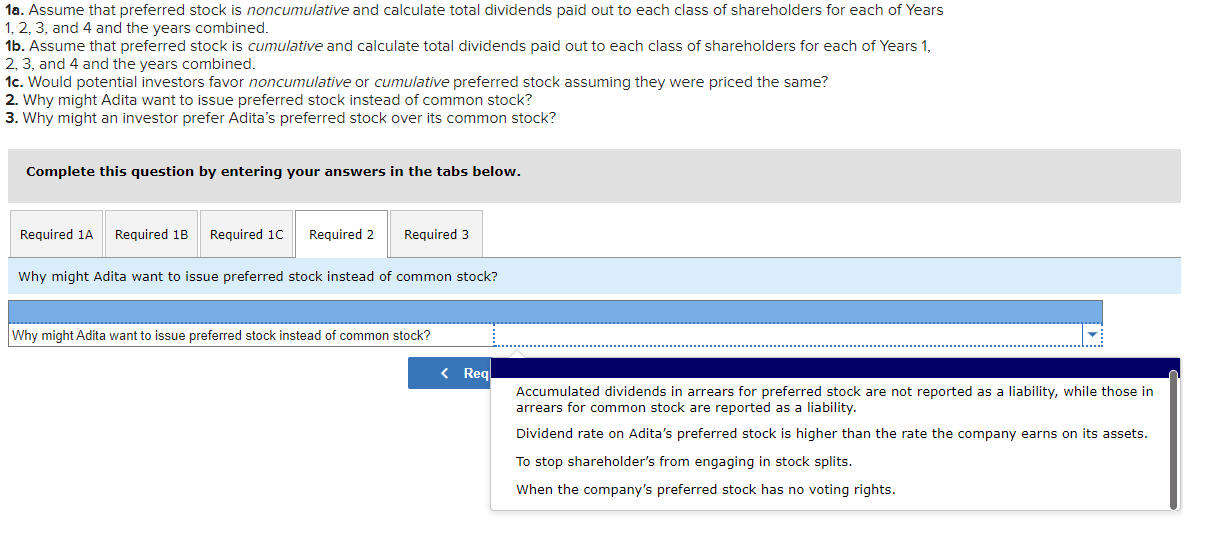

1a. Assume that preferred stock is noncumulative and calculate total dividends paid out to each class of shareholders for each of Years 1, 2, 3, and 4 and the years combined. 1b. Assume that preferred stock is cumulative and calculate total dividends paid out to each class of shareholders for each of Years 1, 2, 3, and 4 and the years combined. 1c. Would potential investors favor noncumulative or cumulative preferred stock assuming they were priced the same? 2. Why might Adita want to issue preferred stock instead of common stock? 3. Why might an investor prefer Adita's preferred stock over its common stock? Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 1C Required 2 Required 3 Why might Adita want to issue preferred stock instead of common stock? Why might Adita want to issue preferred stock instead of common stock? < Req Accumulated dividends in arrears for preferred stock are not reported as a liability, while those in arrears for common stock are reported as a liability. Dividend rate on Adita's preferred stock is higher than the rate the company earns on its assets. To stop shareholder's from engaging in stock splits. When the company's preferred stock has no voting rights.

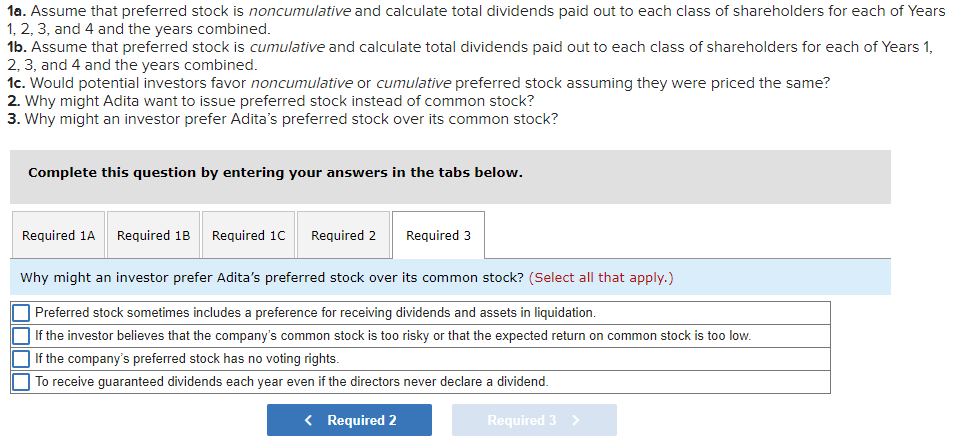

1a. Assume that preferred stock is noncumulative and calculate total dividends paid out to each class of shareholders for each of Years 1, 2, 3, and 4 and the years combined. 1b. Assume that preferred stock is cumulative and calculate total dividends paid out to each class of shareholders for each of Years 1, 2, 3, and 4 and the years combined. 1c. Would potential investors favor noncumulative or cumulative preferred stock assuming they were priced the same? 2. Why might Adita want to issue preferred stock instead of common stock? 3. Why might an investor prefer Adita's preferred stock over its common stock? Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 1C Required 2 Required 3 Why might an investor prefer Adita's preferred stock over its common stock? (Select all that apply.) Preferred stock sometimes includes a preference for receiving dividends and assets in liquidation. If the investor believes that the company's common stock is too risky or that the expected return on common stock is too low. If the company's preferred stock has no voting rights. To receive guaranteed dividends each year even if the directors never declare a dividend. < Required 2 Required 3 >

Expert Answer

Answer · Requirement 1A >Non Cumulative Preferred stock = No Dividend in Arrear Par Value per Preferred Share Dividend rate Dividend per Preferred Share No. of Preferred Shares Preferred Dividend Annual Preferred Dividend: $20.00 6.00% $1.200 70,000