Home /

Expert Answers /

Finance /

table-3-6-personal-tax-rates-2022-jse-table-3-6-note-do-not-round-intermediate-calculations-e-pa694

(Solved): TABLE 3.6 Personal tax rates, 2022. Jse Table 3,6. Note: Do not round intermediate calculations. E ...

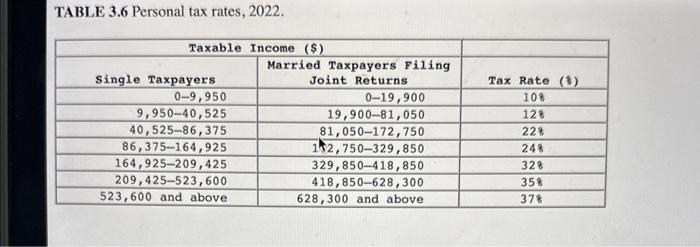

TABLE 3.6 Personal tax rates, 2022.

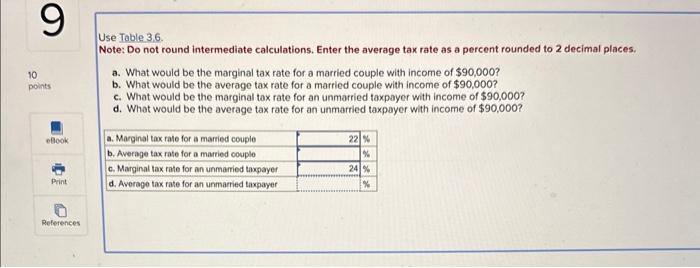

Jse Table 3,6. Note: Do not round intermediate calculations. Enter the average tax rate as a percent rounded to 2 decimal places. a. What would be the marginal tax rate for a married couple with income of \( \$ 90,000 \) ? b. What would be the average tax rate for a married couple with income of \( \$ 90,000 \) ? c. What would be the marginal tax rate for an unmarried taxpayor with income of \( \$ 90,000 \) ? d. What would be the average tax rate for an unmarried taxpayer with income of \( \$ 90,000 \) ?

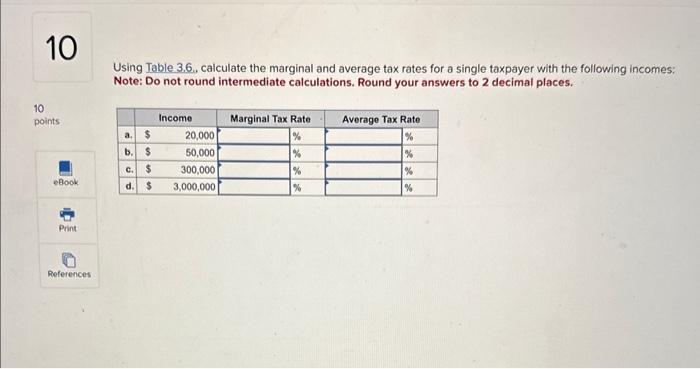

Using Table 3.6., calculate the marginal and average tax rates for a single taxpayer with the following incomes: Note: Do not round intermediate calculations. Round your answers to 2 decimal places.

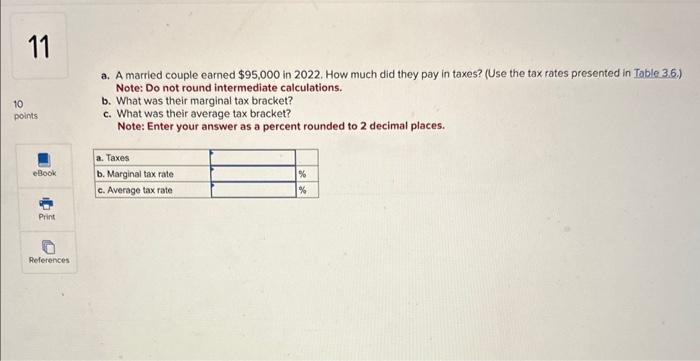

a. A married couple earned \( \$ 95,000 \) in 2022. How much did they pay in taxes? (Use the tax rates prosented in Table 3.6.) Note: Do not round intermediate calculations. b. What was their marginal tax bracket? c. What was their average tax bracket? Note: Enter your answer as a percent rounded to 2 decimal places.

Expert Answer

Tax liability of the Married taxpayer for income of 900