Home /

Expert Answers /

Accounting /

sales-transactions-and-t-accounts-using-t-accounts-for-cash-accounts-receivable-sales-tax-payable-pa524

(Solved): Sales Transactions and T Accounts Using T accounts for Cash, Accounts Receivable, Sales Tax Payable ...

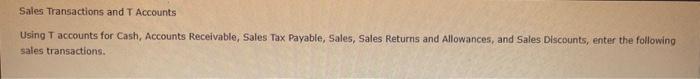

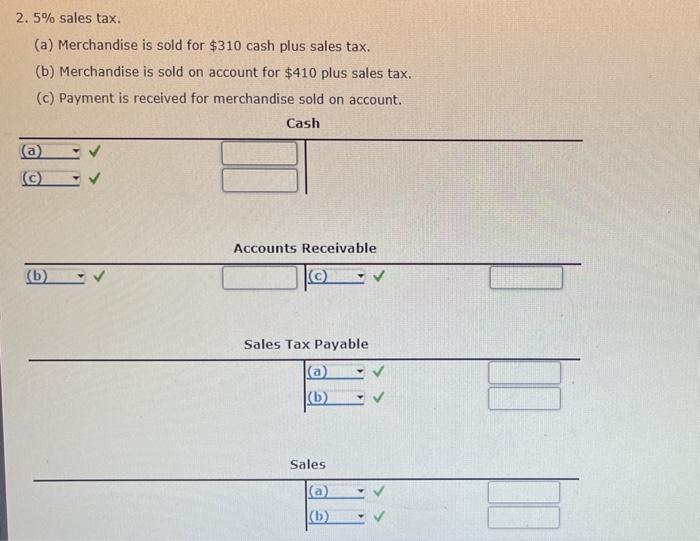

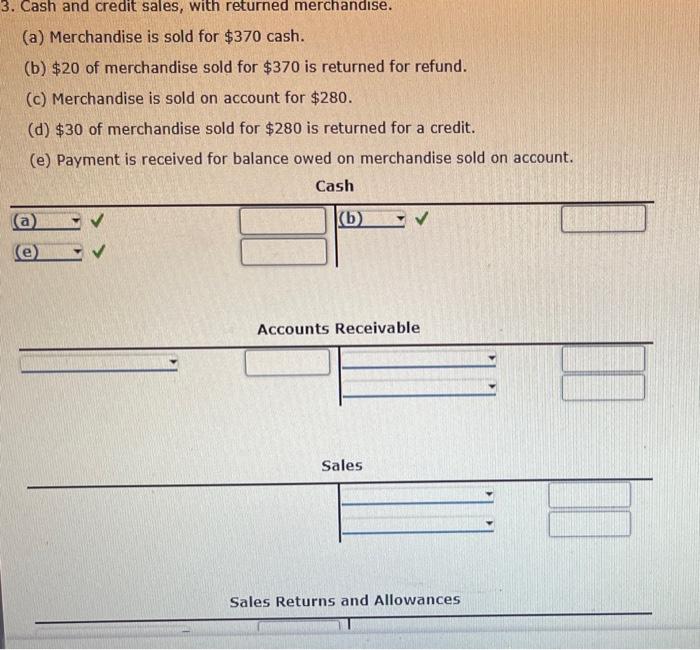

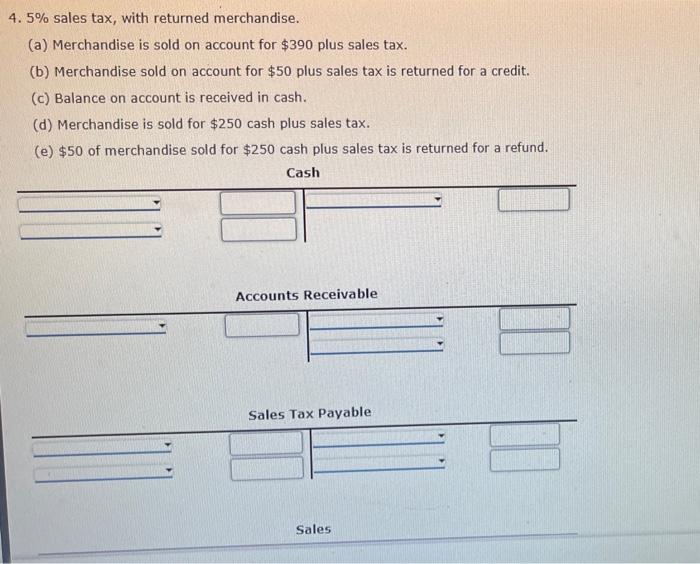

Sales Transactions and T Accounts Using T accounts for Cash, Accounts Receivable, Sales Tax Payable, Sales, Sales Returris and Allowances, and Sales Discounts, enter the following sales transactions.

2. \( 5 \% \) sales tax. (a) Merchandise is sold for \( \$ 310 \) cash plus sales tax. (b) Merchandise is sold on account for \( \$ 410 \) plus sales tax. (c) Payment is received for merchandise sold on account.

(a) Merchandise is sold for \( \$ 370 \) cash. (b) \( \$ 20 \) of merchandise sold for \( \$ 370 \) is returned for refund. (c) Merchandise is sold on account for \( \$ 280 \). (d) \( \$ 30 \) of merchandise sold for \( \$ 280 \) is returned for a credit. (e) Payment is received for balance owed on merchandise sold on account.

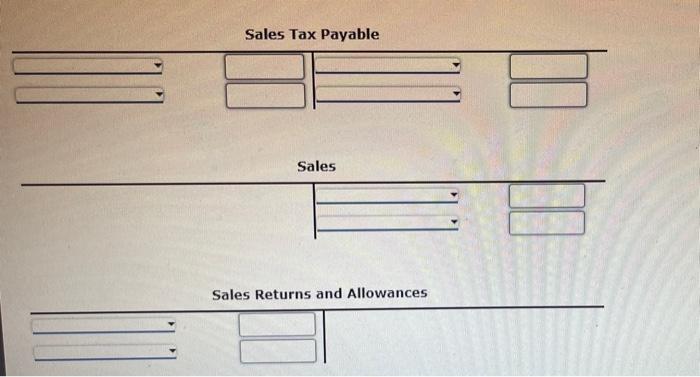

4. \( 5 \% \) sales tax, with returned merchandise. (a) Merchandise is sold on account for \( \$ 390 \) plus sales tax. (b) Merchandise sold on account for \( \$ 50 \) plus sales tax is returned for a credit. (c) Balance on account is received in cash. (d) Merchandise is sold for \( \$ 250 \) cash plus sales tax. (e) \( \$ 50 \) of merchandise sold for \( \$ 250 \) cash plus sales tax is returned for a refund.

Sales Tax Payable Sales Sales Returns and Allowances

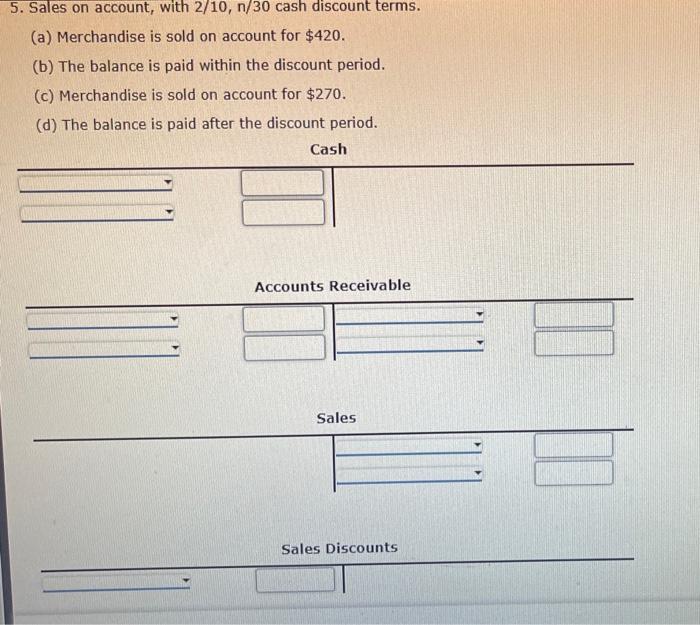

5. Sales on account, with \( 2 / 10, n / 30 \) cash discount terms. (a) Merchandise is sold on account for \( \$ 420 \). (b) The balance is paid within the discount period. (c) Merchandise is sold on account for \( \$ 270 \). (d) The balance is paid after the discount period.