Home /

Expert Answers /

Accounting /

rom-corp-began-business-in-year-1-and-reported-taxable-income-of-50-000-on-its-year-1-tax-return-pa340

(Solved): Rom Corp. began business in Year 1 and reported taxable income of $50,000 on its Year 1 tax return. ...

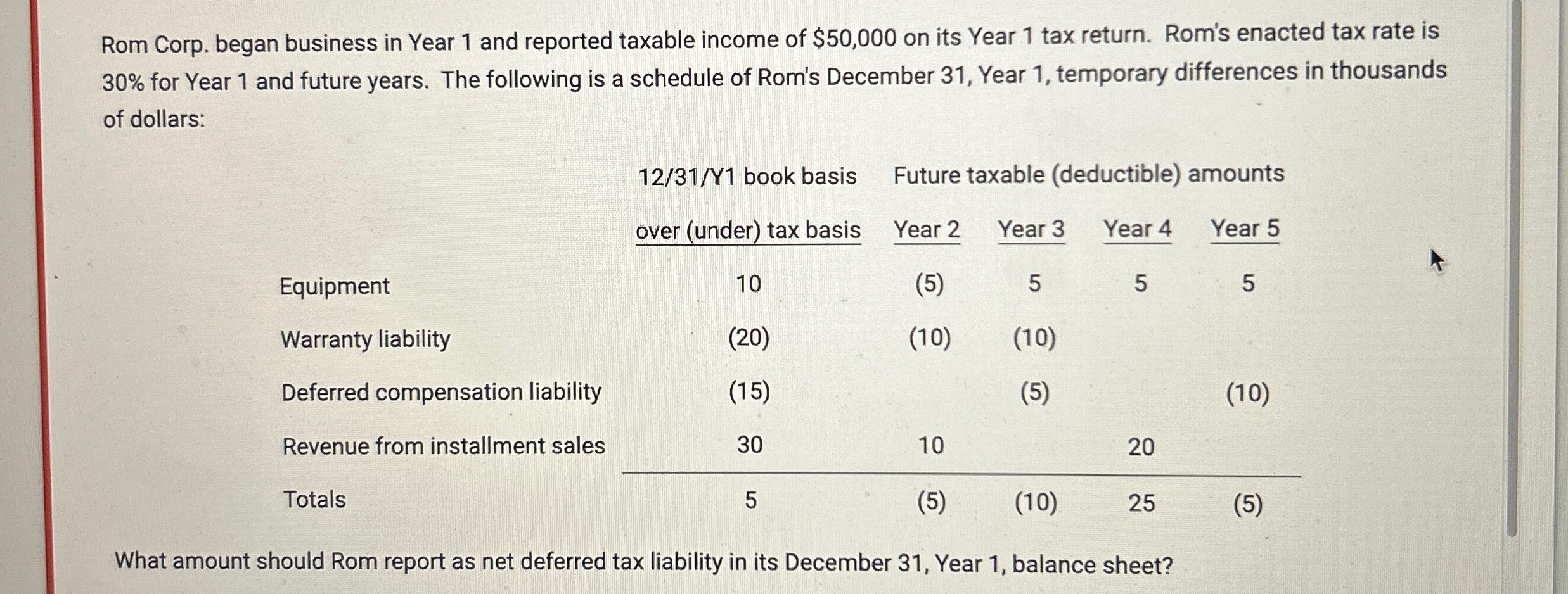

Rom Corp. began business in Year 1 and reported taxable income of

$50,000on its Year 1 tax return. Rom's enacted tax rate is

30%for Year 1 and future years. The following is a schedule of Rom's December 31, Year 1, temporary differences in thousands of dollars: \table[[,12/31/Y1 book basis,Future taxable (deductible) amounts],[,over (under) tax basis,Year 2,Year 3,Year 4,Year 5],[Equipment,10,

(5),5,5,5],[Warranty liability,

(20),

(10),

(10),,],[Deferred compensation liability,

(15),,

(5),,

(10)