Home /

Expert Answers /

Accounting /

question-2-income-tax-on-multiple-sources-of-inccome-8-marks-mr-bakhtawar-a-individual-perso-pa859

(Solved): Question 2 - Income Tax on Multiple Sources of Inccome (8 Marks) Mr. Bakhtawar, a Individual Perso ...

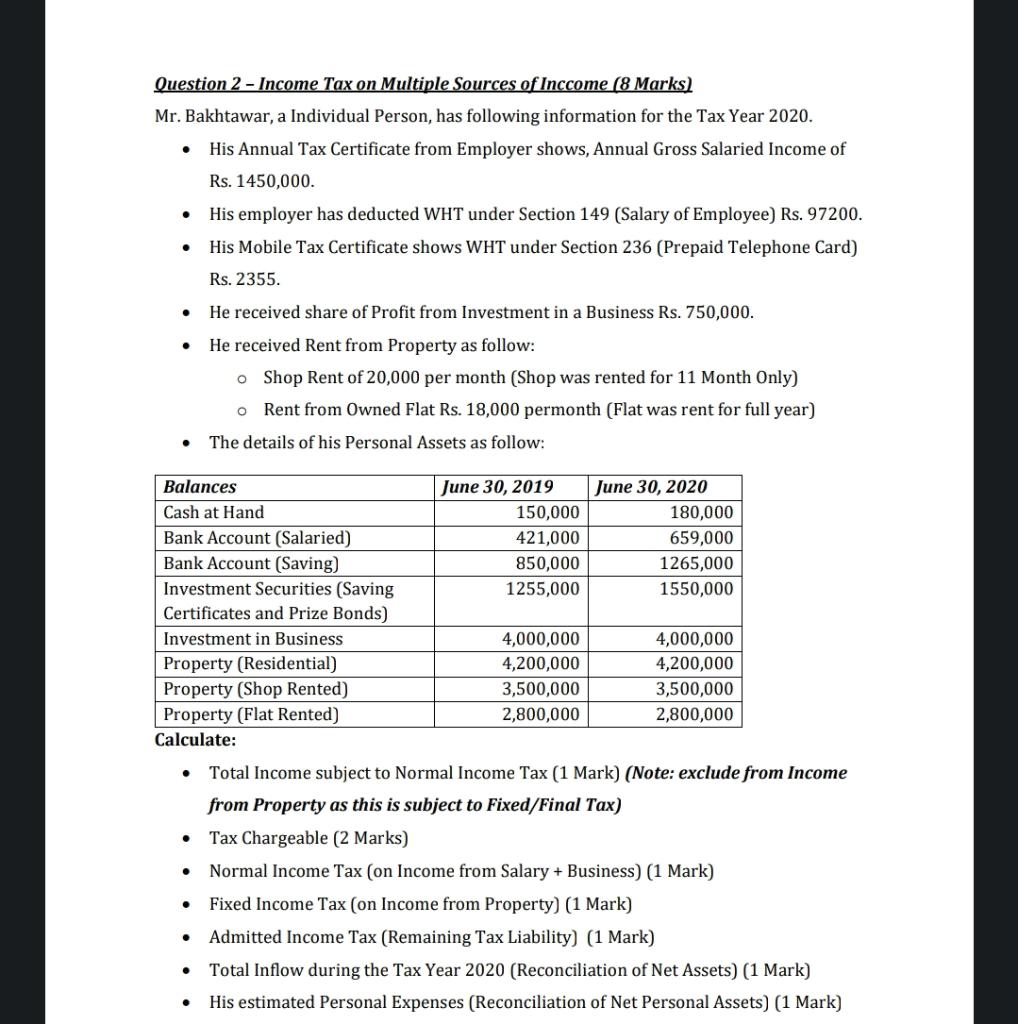

Question 2 - Income Tax on Multiple Sources of Inccome (8 Marks) Mr. Bakhtawar, a Individual Person, has following information for the Tax Year 2020. - His Annual Tax Certificate from Employer shows, Annual Gross Salaried Income of Rs. 1450,000 . - His employer has deducted WHT under Section 149 (Salary of Employee) Rs. 97200. - His Mobile Tax Certificate shows WHT under Section 236 (Prepaid Telephone Card) Rs. 2355. - He received share of Profit from Investment in a Business Rs. 750,000. - He received Rent from Property as follow: Shop Rent of 20,000 per month (Shop was rented for 11 Month Only) Rent from Owned Flat Rs. 18,000 permonth (Flat was rent for full year) - The details of his Personal Assets as follow: - Total Income subject to Normal Income Tax (1 Mark) (Note: exclude from Income from Property as this is subject to Fixed/Final Tax) - Tax Chargeable (2 Marks) - Normal Income Tax (on Income from Salary + Business) (1 Mark) - Fixed Income Tax (on Income from Property) (1 Mark) - Admitted Income Tax (Remaining Tax Liability) (1 Mark) - Total Inflow during the Tax Year 2020 (Reconciliation of Net Assets) (1 Mark) - His estimated Personal Expenses (Reconciliation of Net Personal Assets) (1 Mark)