Home /

Expert Answers /

Finance /

problem-4-1-computing-taxable-income-lo4-2-ross-martin-arrived-at-the-following-tax-information-pa256

(Solved): Problem 4-1 Computing Taxable Income [LO4-2] Ross Martin arrived at the following tax information: ...

![Problem 4-1 Computing Taxable Income [LO4-2]

Ross Martin arrived at the following tax information:

What amount would Ross rep](https://media.cheggcdn.com/study/1db/1db74bda-cd99-4606-b863-8a0df989077e/image)

![Problem 4-2 Determining Tax Deductions [LO4-2]

If Lola Harper had the following itemized deductions, should she use Schedule](https://media.cheggcdn.com/study/cb7/cb790a06-54e4-43d9-81d9-e50927bbf99f/image)

![Problem \( 4-5 \) Calculating Average Tax Rate [LO4-2]

What would be the average tax rate for a person who paid taxes of \( \](https://media.cheggcdn.com/study/21a/21af3e25-c3f2-4f25-9b76-116be0c2bb34/image)

![Problem 4-6 Determining a Refund or Taxes Owed [LO4-2]

Based on the following data, would Ann and Carl Wilton receive a refun](https://media.cheggcdn.com/study/008/008e7c59-b2de-457c-867e-d42a8b722729/image)

![Problem 4-9 Opportunity Cost of Tax Refunds [LO4-2]

If 471,000 people each receive an average refund of \( \$ 2,300 \), based](https://media.cheggcdn.com/study/3c3/3c30b967-73e2-4057-9cc2-8cff396bc775/image)

![Problem 4-10 Using Federal Tax Rate Schedules [LO4-3]

Using the tax rate schedule in Exhibit 4-6, determine the amount of tax](https://media.cheggcdn.com/study/6e9/6e99bf8a-1975-4d0d-8f0e-56d197b0c882/image)

![Problem 4-12 Comparing Taxes on Investments [LO4-5]

Would you prefer a fully taxable investment earning \( 10.8 \) percent or](https://media.cheggcdn.com/study/747/7474a24c-ffde-4866-bcff-563645e9cf26/image)

![Problem 4-14 Future Value of a Tax Savings [LO4-5]

On December 30 you decide to make a \( \$ 3,900 \) charitable donation. (A](https://media.cheggcdn.com/study/0d6/0d6bf1ed-63f0-49c3-a1b0-06e18f0f576e/image)

![Problem 4-15 Tax Deferred Retirement Benefits [LO4-5]

If a person in the 32 percent tax bracket makes a deposit of \( \$ 7,50](https://media.cheggcdn.com/study/6a7/6a781291-00e7-4a3d-9c0a-758d206ac3a2/image)

Problem 4-1 Computing Taxable Income [LO4-2] Ross Martin arrived at the following tax information: What amount would Ross report as taxable income?

Problem 4-2 Determining Tax Deductions [LO4-2] If Lola Harper had the following itemized deductions, should she use Schedule A or the standard deduction? The standard deduction for her tax situation is \( \$ 12,550 \).

Problem \( 4-5 \) Calculating Average Tax Rate [LO4-2] What would be the average tax rate for a person who paid taxes of \( \$ 6.525 \) on a taxable income of \( \$ 43,500 \) ? Note: Enter your answer as a percent rounded to nearest whole number.

Problem 4-6 Determining a Refund or Taxes Owed [LO4-2] Based on the following data, would Ann and Carl Wilton receive a refund or owe additional taxes? Note: Input the amount as a positive value.

Problem 4-9 Opportunity Cost of Tax Refunds [LO4-2] If 471,000 people each receive an average refund of \( \$ 2,300 \), based on an interest rate of 4 percent, what would be the lost annual income from savings on those refunds? Note: Do not round intermediate calculations.

Problem 4-10 Using Federal Tax Rate Schedules [LO4-3] Using the tax rate schedule in Exhibit 4-6, determine the amount of taxes for the following taxable incomes:

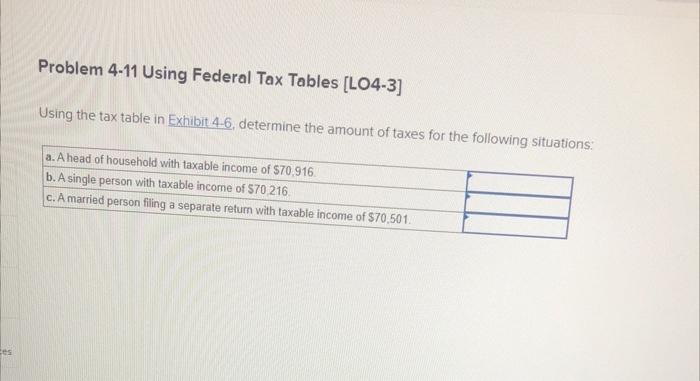

Using the tax table in Exhibit 4-6, determine the amount of taxes for the follnwinn aw....

Problem 4-12 Comparing Taxes on Investments [LO4-5] Would you prefer a fully taxable investment earning \( 10.8 \) percent or a tax-exempt investment earning \( 8.2 \) percent? (Assume a 24 percent tax rate)

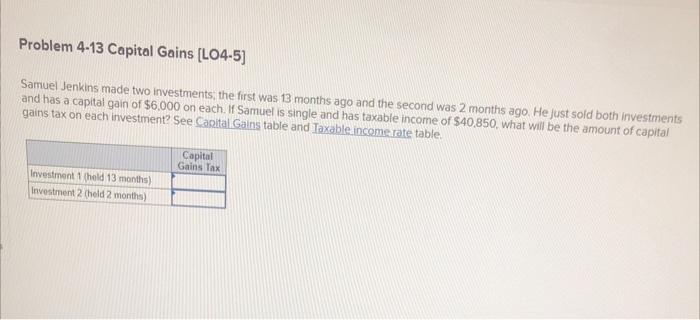

Samuel Jenkins made two investments, the first was 13 months ago and the second was 2 months ago. He just sold both investments and has a capital gain of \( \$ 6.000 \) on each. If Samuel is single and has taxable income of \( \$ 40.850 \), what will be the amount of capital gains tax on each investment? See Canital Gains table and Iaxable income rate table.

Problem 4-14 Future Value of a Tax Savings [LO4-5] On December 30 you decide to make a \( \$ 3,900 \) charitable donation. (Assume you itemize your deductions) 0. If you are in the 22 percent tax bracket and you expect to itemize your deductions, how much will you save in taxes for the current year? b. IIf you deposit that tax savings in a savings account for the next five years at 5 percent, what will be the future value of that account? Use Exhibit.1-A Note: Round time value factor to 3 decimal places and final answer to 2 decimal places.

Problem 4-15 Tax Deferred Retirement Benefits [LO4-5] If a person in the 32 percent tax bracket makes a deposit of \( \$ 7,500 \) to a tax-deferred retirement account, what amount would be saved on current taxes?

Expert Answer

NOTE: As per revised Chegg guidelines, we are allowed t