Home /

Expert Answers /

Economics /

problem-1-for-the-cash-flows-shown-use-an-annual-worth-comparison-and-an-interest-rate-of-10-per-pa343

(Solved): Problem 1. For the cash flows shown, use an annual worth comparison and an interest rate of 10% per ...

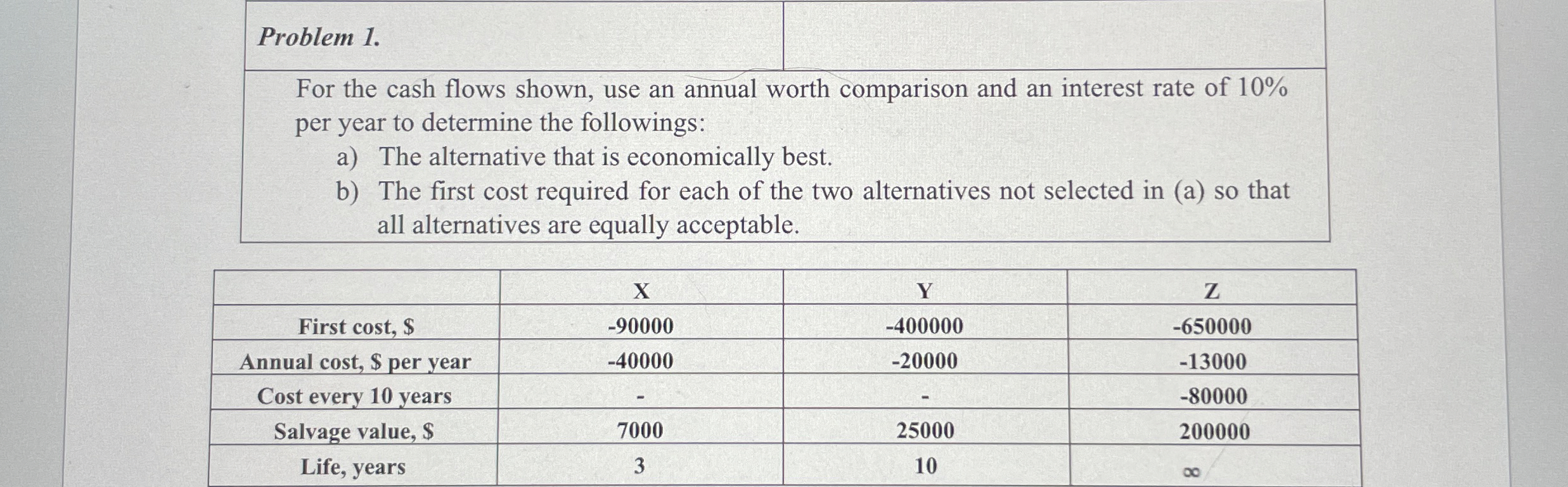

Problem 1. For the cash flows shown, use an annual worth comparison and an interest rate of

10%per year to determine the followings: a) The alternative that is economically best. b) The first cost required for each of the two alternatives not selected in (a) so that all alternatives are equally acceptable. \table[[,X,Y,Z],[First cost,

$,-90000,-400000,-650000],[Annual cost, $ per year,-40000,-20000,-13000],[Cost every 10 years,-,-,-80000],[Salvage value, $,7000,25000,200000],[Life, years,3,10,

\infty