Home /

Expert Answers /

Accounting /

prepare-journal-entries-to-record-the-following-merchandising-transactions-of-cabela-39-s-which-uses-pa782

(Solved): Prepare journal entries to record the following merchandising transactions of Cabela's, which uses ...

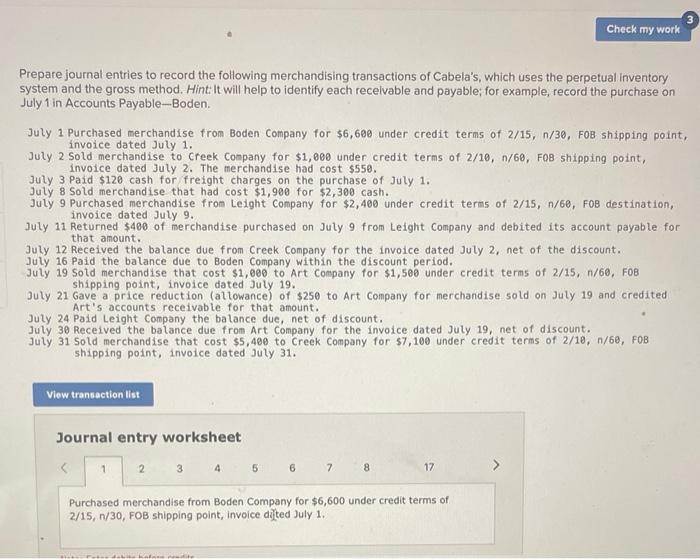

Prepare journal entries to record the following merchandising transactions of Cabela's, which uses the perpetual inventory system and the gross method. Hinti it will help to identify each recelvable and payable; for example, record the purchase on July 1 in Accounts Payable-Boden. July 1 Purchased merchandise from Boden Company for \( \$ 6,600 \) under credit termis of \( 2 / 15, n / 30 \), F0B shipping point, July 2 invold merchandise to \( 1 . \) July 2 Sold merchandise to Creek Company for \( \$ 1,060 \) under credit terms of 2/10, n 760 , FoB shipping point, invoice dated July 2 . The merchandise had cost \( \$ 550 \). July 3 Paid \( \$ 120 \) cash for freight charges on the purchase of July 1 . July 8 Sold merchandise that had cost \( \$ 1,900 \) for \( \$ 2,300 \) cash. July 9 Purchased merchandise from Leight Company for \( \$ 2,400 \) under credit terms of \( 2 / 15, n / 60 \), FOB destination, July 11 Returned dated July \( 9 . \) Juty 11 Returned \( \$ 400 \) of merchandise purchased on July 9 from Leight Company and debited its account payable for that amount. July 12 Received the balance due from Creek Company for the invoice dated July 2 , net of the discount. July 16 Paid the balance due to Boden Company within the discount period. July 19 Sotd merchandise that cost \( \$ 1,000 \) to Art Company for \( \$ 1,500 \) under credit terms of \( 2 / 15, n / 60 \), F0B Shipping point, invoice dated July \( 19 . \) July 21 Gave a price reduction (allowance) of \( \$ 250 \) to Art Company for merchandise sold on July 19 and credited Art's accounts receivable for that amount. July 24 Paid Leight Company the balance due, net of discount. July 30 Received the balance due from Art Company for the invoice dated July 19, net of discount. July 31 Sold merchandise that cost \( \$ 5,480 \) to Creek Company for \( \$ 7,100 \) under credit terms of \( 2 / 10, n / 60 \), FOB shipping point, invoice dated July 31 . Journal entry worksheet Purchased merchandise from Boden Company for \( \$ 6,600 \) under credit terms of \( 2 / 15, \mathrm{n} / 30, \mathrm{FOB} \) shipping point, invoice d?) ted July \( 1 . \)

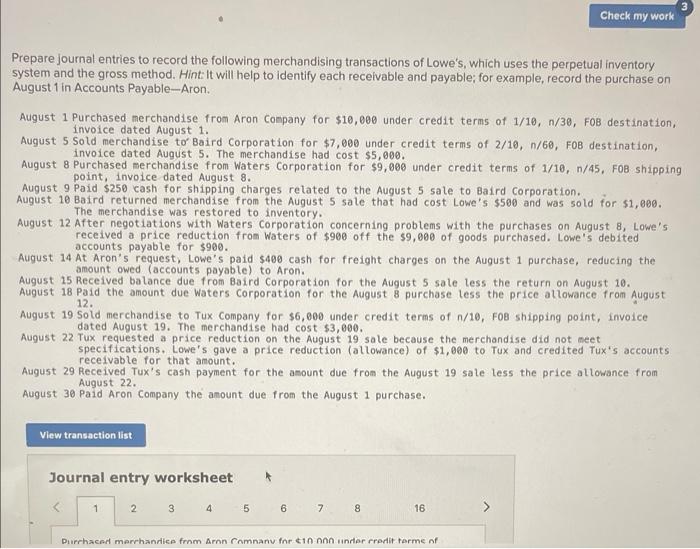

Prepare journal entries to record the following merchandising transactions of Lowe's, which uses the perpetual inventory system and the gross method. Hint: It will help to identify each receivable and payable; for example, record the purchase on August 1 in Accounts Payable-Aron. August 1 Purchased merchandise from Aron Company for \( \$ 10,080 \) under credit terms of \( 1 / 10, n / 30 \), F08 destination, August 5 Sold merchandise to Baird Corporation for \( \$ 7,000 \) under credit terms of \( 2 / 10, n / 60 \), F0B destination, August 8 Purchase dated August 5. The merchandise had cost \( \$ 5,000 \). 8 Purchased merchandise from Waters Corporation for \( \$ 9,000 \) under credit terms of \( 1 / 10, n / 45 \), F08 shipping point, invoice dated August 8 . August 9 Paid \( \$ 250 \) cash for shipping charges retated to the August 5 sale to Baird Corporation. August 10 Baird returned merchandise from the August 5 sale that had cost Lowe's \( \$ 500 \) and was sold for \( \$ 1,000 . \) The merchandise was restored to inventory. August 12 After negotiations with Waters Corporation concerning problems with the purchases on August 8 , Lowe's received a price reduction from Waters of \( \$ 900 \) off the \( \$ 9,000 \) of goods purchased. Lowe's debited accounts payable for \( \$ 900 \). August 14 At Aron's request, Lowe's paid \( \$ 400 \) cash for freight charges on the August 1 purchase, reducing the amount owed (accounts payable) to Aron. August 15 Received balance due from Baird Corporation for the August 5 sale less the return on August \( 10 . \) August 18 Paid the amount due Waters Corporation for the August 8 purchase less the price atlowance from August Auqust 19 sold August 19 Sotd merchandise to Tux Company for \( \$ 6,000 \) under credit terms of \( n / 10 \), F08 shipping point, invoice dated August 19. The merchandise had cost \( \$ 3,000 . \) August 22 Tux requested a price reduction on the August 19 sale because the merchandise did not meet specifications. Lowe's gave a price reduction (allowance) of \( \$ 1,000 \) to Tux and credited Tux's accounts receivable for that amount. August 29 Received Tux's cash payment for the amount due from the August 19 sale less the price allowance from August \( 22 . \) August 30 Paid Aron Company the amount due from the August 1 purchase.

Expert Answer

Perpetual Inventory system This system of inventory method records the inventory continuously , thus the cost of goods sold is updated as and when the