Home /

Expert Answers /

Accounting /

prepare-journal-entries-for-transactions-nbsp-brothers-herm-and-steve-hargenrater-began-operations-pa151

(Solved): prepare journal entries for transactions Brothers Herm and Steve Hargenrater began operations ...

prepare journal entries for transactions

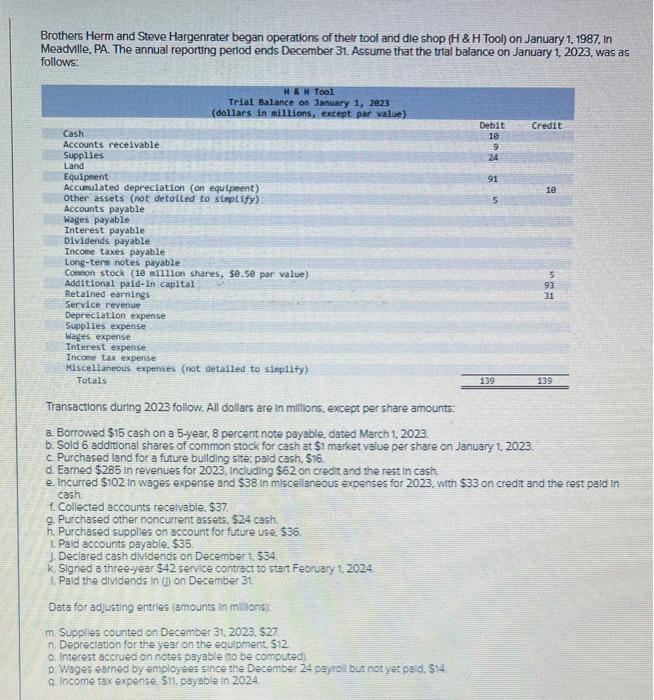

Brothers Herm and Steve Hargenrater began operations of their tool and die shop (H \& H Tool) on January 1, 1987, in Meadville. PA. The annual reporting period ends December 31. Assume that the tral balance on January 1, 2023, was as follows: Transactions during 2023 follow. All dollars are in millions, except per share amounts: a. Borrowed \( \$ 15 \) cash on a 5 -year, 8 percent note payable, dated March \( 1,2023 \). b. Sold 6 addittonal shares of common stock for cash at \$1 market value per share on January 1, 2023. c. Purchased land for a future bulling site: paid cash. \( \$ 16 \). d. Eamed \( \$ 285 \) in revenues for 2023 , including \( \$ 62 \) on credt and the rest in cash. e. incurred \( \$ 102 \) in wages expense and \$38 in miscellaneous expenses for 2023 , with \( \$ 33 \) on credit and the rest paid in cash. f. Collected accounts recelvabie. \( \$ 37 \). g. Purchased other noncurrent assets, \( \$ 24 \) cash. h. Purchased supplies on account for future use, \( \$ 36 \). L. Pald accounts payable, \( \$ 35 \) 1. Declared cash dividendis on December 1, \( \$ 34 \). k. Signed a three-year \( \$ 42 \) service contrsct to start February 1, 2024 . 1. Paid the dividends in (j) on December 3t. Data for adjusting entries (amounts in millonsk: m. Supples counted on December 31, 2023, 527. n. Depreciation for the year on the equipment. \( \$ 12 \) o, Interest accrued on notes payable to be computed. p. Wages earned by employees since the December 24 payroil but not yet paid. 514 q. Income tax expense, S11, payabie in 2024

Expert Answer

Journal Entries for transactions a through l. ($ in million) Account titles and explanations Debit Credit a Cash $15 Notes payable $15 [To record issu