Home /

Expert Answers /

Accounting /

please-help-me-complete-the-10-column-worksheet-the-following-unadjusted-trial-balance-is-for-pa919

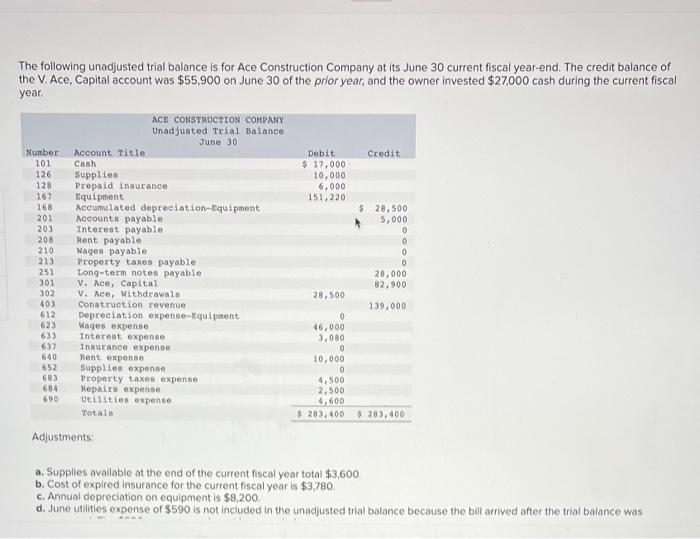

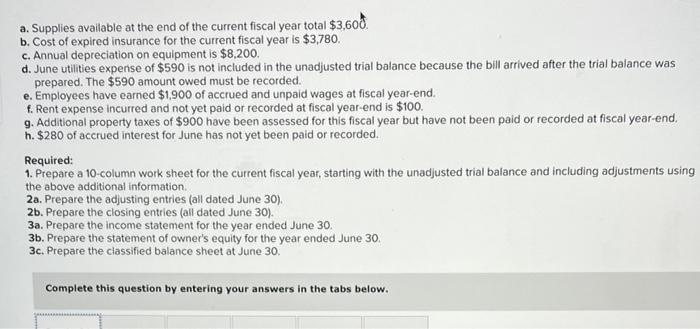

(Solved): please help me complete the 10 column worksheet! \) The following unadjusted trial balance is for ...

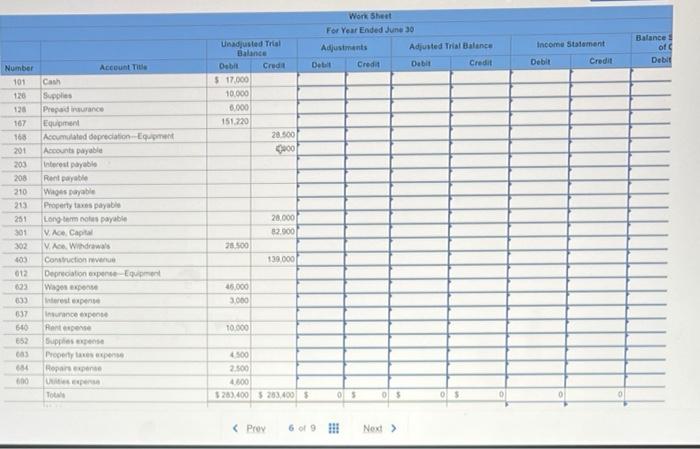

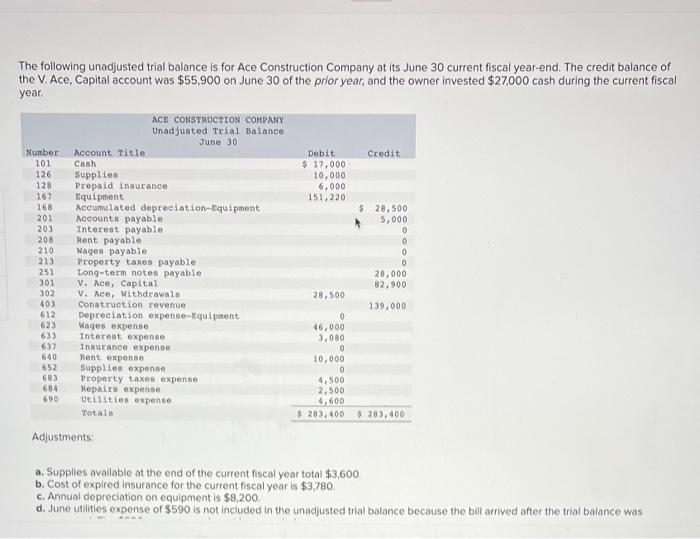

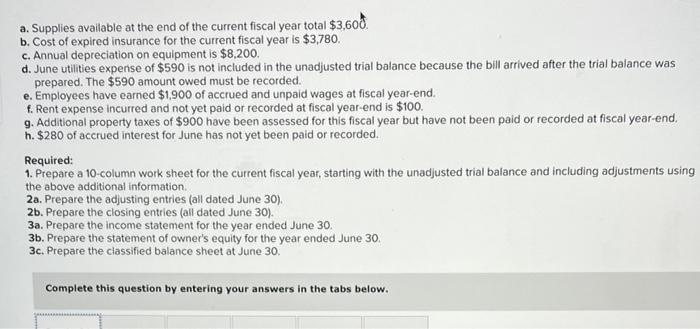

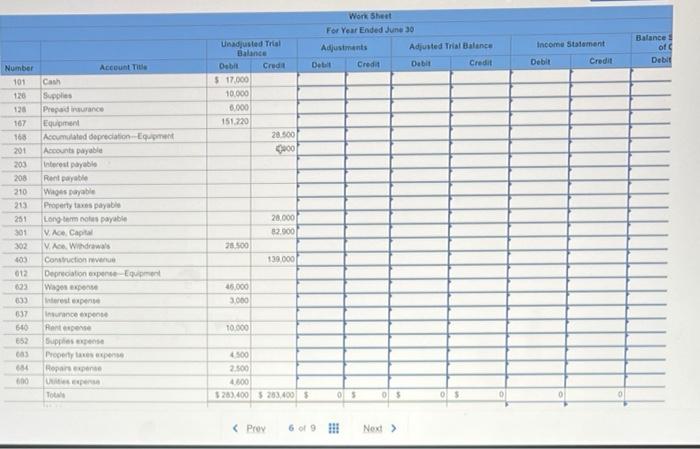

please help me complete the 10 column worksheet!

Expert Answer

Work Sheet Account Title Unadjusted Trial Balance Adjustments Credit Debit Credit Cash $17,000.00 Supplies $10,000.00 $6,400.00 Prepaid Insurance $6,0