Home /

Expert Answers /

Economics /

please-answer-this-question-nbsp-4-supply-and-demand-for-loanable-funds-the-following-graph-shows-pa976

(Solved): please answer this question 4. Supply and demand for loanable funds The following graph shows ...

please answer this question

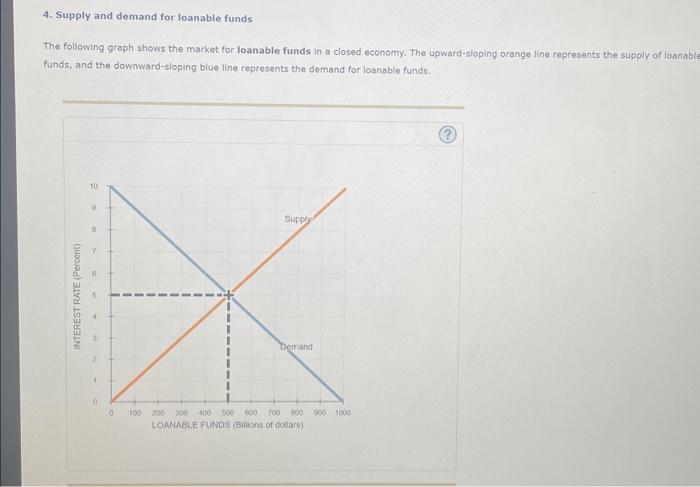

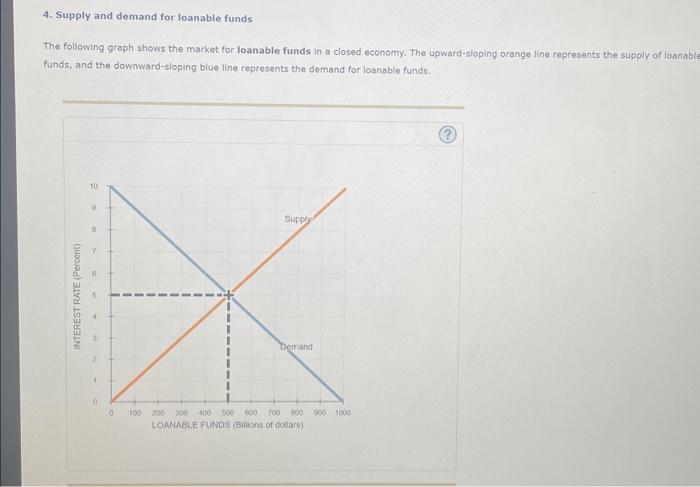

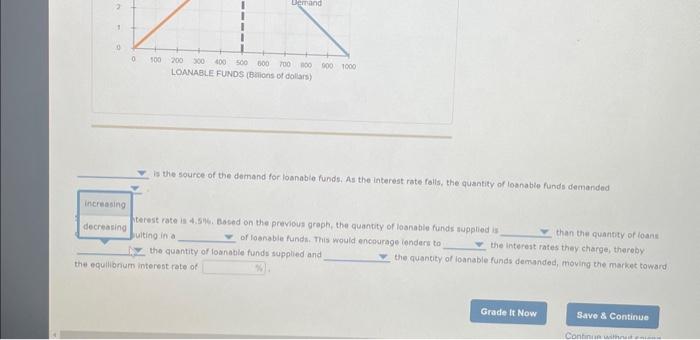

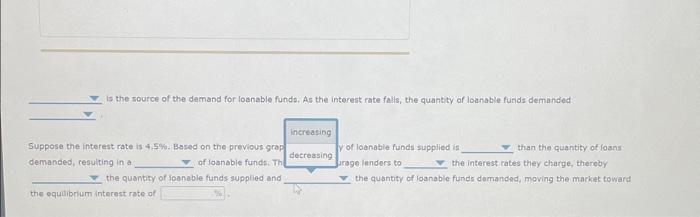

4. Supply and demand for loanable funds The following graph shows the market for loanable funds in a closed economy. The upward-sloping orange fine represents the supply of loanabl. funds, and the dowmward-sloping blue line represents the demand for loanable funds.

is the source of the demand foe loaneble funde. As the interest rate fails, the quantity of loanable funds dernanded Hest rate is \( 4.5 \% \), Based on the previous graph, the quantity of loanable funds supplied is than the quantity of loans iting in a of icanable funds, This would ancourage ienders to the interest rates they charge, theroby the quontity of Joanable funds supplied and the quantity of loanable funds demanded, moving the marlcet toward the equilibnum interest rate of

is the source of the demand for loanable funds. As the interest rate falls, the quantity of loanable funds demanded terest rate is 4.5\%. Based on the previous graph, the quantity of loanable funds supplied is than the quantity of loan!l ulting in a. of loanable funds. This would encourage lenders to the interest rates they charge, thereby the quantity of loanable funds supplied and the equilibrim interest rate of the quantsty of loandble funds demanded, moving the market toward

lis the source of the demand for loanable funds; As the interest rate folls, the quanticy of loanable funds demanded. Suppose the interest rate is \( 4.5 \% \). Eased on the previous graph, the quantity or loanable funds supplied ith dernanded, resuitang in 0 of loanable funds. This would encourage lenders to than the quantity of foans the quantity of loanable funds supplied and the quantity of loanabie fu ateis they charge, thereby. the equili brium interest rate of ded, moving the market toward

is the seurce of the demand for loanable funds. As the interest rate fals, the quantity of loanable funds demanded Suppose the interest rete Sed on the previous graph, the quantity of loanable funds supplied is than the quantity of loons demanded, resuiting in o of loanable funds. This would encourage lenders to the interest rates they charge, thereby. the quantity of lonnable funds supplied and the quantity of losmable funds demanded, mowing the market toward the equilibrium interest rate of

is the source of the demand for loanable funds. As the interest rate falls, the guantity of loanable funds demanded. Suppose the interest rate is 4.5\%. Based on the previous graph, the quantity of loanahile fur dermanded, resulting in a of loanable funds. This would encourage lenders to ed is than the quantity of loans the guantity of loareble funds suppiled and the intarest rates they charge, thereby. the equilibriume interest fate of the quantify of loanable funder demanded, moving the market foward

is the source of the demand for losnabie funds. As the interest rate falls, the quantity of loanabie funds demanded Drest rate is 4.514. Based on the previous greph, the quantity of loanable funds supplied is. Iting in a of loanable fundh. This would encourage lenders to than the quantity of loant the quantity of foon atile funds supplied and the equilibnum interest rate of the quantity of ioanable funds demanded, moying the market toward

Is the source of the demand for loanable funds. As the interest rate falls, the quantity of loanable funds demanded Suppose the interest rate is \( 4.5 \% \). Based on the previous gro! rof loanable funds supplied is than the quantity of loans demanded, resulting in a rage innders to the interest rates they charge, thereby the quanticy of loanable funds supplied and the quantity of loanable funds domanded, moving the markek toward the equitibrium interest rate of

Expert Answer

1. Savings 2. Increases 3. Greater 4. Surplus 5. Lower 6. Increases 7. Decreases 8. 4.