Home /

Expert Answers /

Accounting /

petroleum-inc-owns-a-lease-to-extract-crude-oil-from-sea-it-is-considering-the-construction-of-a-pa113

(Solved): Petroleum Inc. owns a lease to extract crude oil from sea. It is considering the construction of a ...

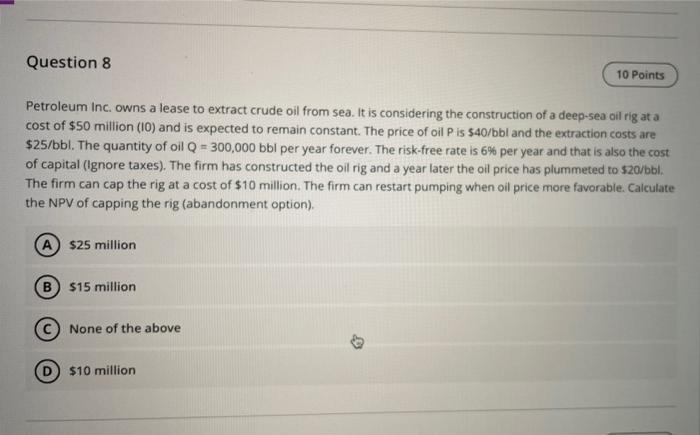

Petroleum Inc. owns a lease to extract crude oil from sea. It is considering the construction of a deep-sea oil rig at a cost of \( \$ 50 \) million \( (10) \) and is expected to remain constant. The price of oil \( \mathrm{P} \) is \( \$ 40 / \mathrm{bbl} \) and the extraction costs are \( \$ 25 / \mathrm{bbl} \). The quantity of oil \( \mathrm{Q}=300,000 \) bbl per year forever. The risk-free rate is \( 6 \% \) per year and that is also the cost of capital (Ignore taxes). The firm has constructed the oil rig and a year later the oil price has plummeted to \( \$ 20 / b b l \). The firm can cap the rig at a cost of \( \$ 10 \) million. The firm can restart pumping when oil price more favorable. Calculate the NPV of capping the rig (abandonment option). \( \$ 25 \) million 515 million None of the above 510 million

Expert Answer

Ans- : $25millon net present value =( 40/bbl-25