Home /

Expert Answers /

Operations Management /

our-bookstore-sells-mugs-for-a-special-event-unsold-mugs-are-sold-after-the-event-for-4-00-pa731

(Solved): Our bookstore sells mugs for a special event. Unsold mugs are sold after the event for \( \$ 4.00 ...

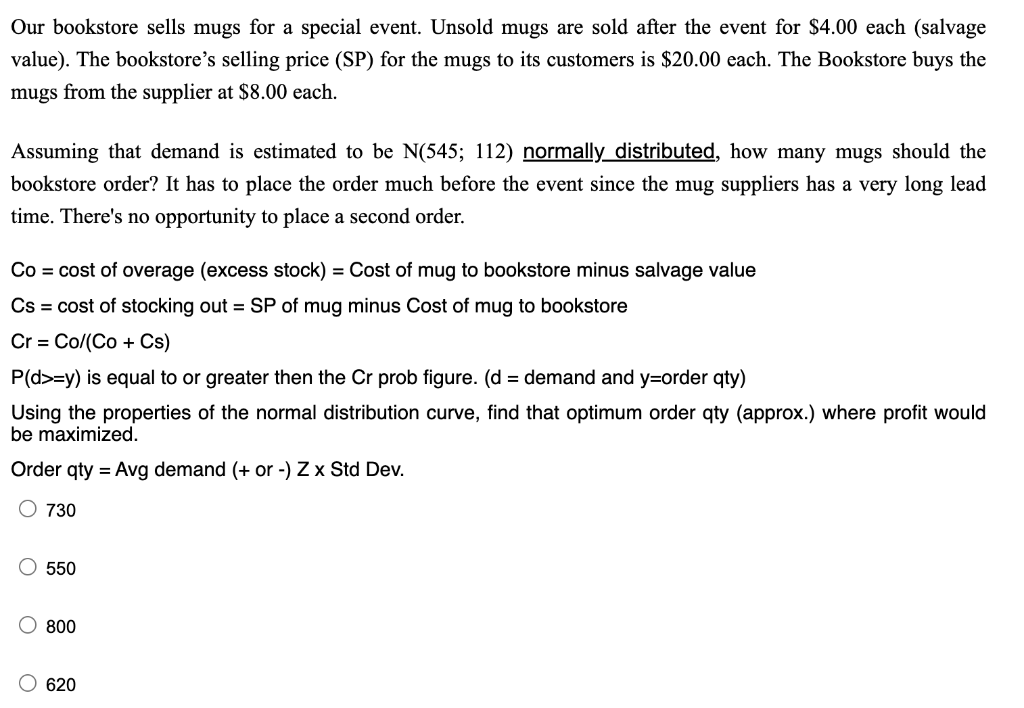

Our bookstore sells mugs for a special event. Unsold mugs are sold after the event for \( \$ 4.00 \) each (salvage value). The bookstore's selling price (SP) for the mugs to its customers is \( \$ 20.00 \) each. The Bookstore buys the mugs from the supplier at \( \$ 8.00 \) each. Assuming that demand is estimated to be \( \mathrm{N}(545 ; 112) \) normally distributed, how many mugs should the bookstore order? It has to place the order much before the event since the mug suppliers has a very long lead time. There's no opportunity to place a second order. Co \( = \) cost of overage (excess stock) \( = \) Cost of mug to bookstore minus salvage value \( \mathrm{Cs}= \) cost of stocking out \( =\mathrm{SP} \) of mug minus Cost of mug to bookstore \( \mathrm{Cr}=\mathrm{Co} /(\mathrm{Co}+\mathrm{Cs}) \) \( \mathrm{P}(\mathrm{d}>=\mathrm{y}) \) is equal to or greater then the Cr prob figure. ( \( \mathrm{d}= \) demand and \( \mathrm{y}= \) order qty) Using the properties of the normal distribution curve, find that optimum order qty (approx.) where profit would be maximized. Order qty \( = \) Avg demand \( (+ \) or \( -) \mathrm{Z} \times \) Std Dev. 730 550 800 620