Home /

Expert Answers /

Accounting /

one-division-of-the-marvin-educational-enterprises-has-depreciable-assets-costing-4-000-000-the-c-pa898

(Solved): One division of the Marvin Educational Enterprises has depreciable assets costing $4,000,000. The c ...

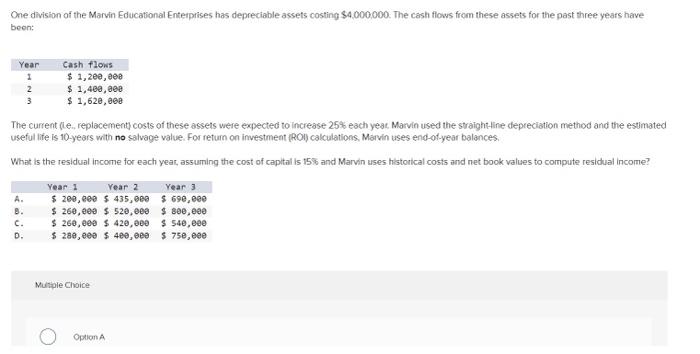

One division of the Marvin Educational Enterprises has depreciable assets costing $4,000,000. The cash flows from these assets for the past three years have been: Year 1 2 3 A. B. C. D. Cash flows $ 1,200,000 $ 1,400,000 $ 1,620,000 The current (Le.. replacement) costs of these assets were expected to increase 25% each year, Marvin used the straight-line depreciation method and the estimated useful life is 10-years with no salvage value. For return on investment (ROI) calculations, Marvin uses end-of-year balances. What is the residual income for each year, assuming the cost of capital is 15% and Marvin uses historical costs and net book values to compute residual income? Year 1 Year 2 $ 200,000 $ 435,000 $ 260,000 $ 520,000 $ 260,000 $ 420,000 $ 280,000 $ 400,000 Multiple Choice Option A Year 3 $ 690,000 $ 800,000 $540,000 $750,000