(Solved): On September 1, 2023, following graduation from Dominican University's online MSA program, you begin ...

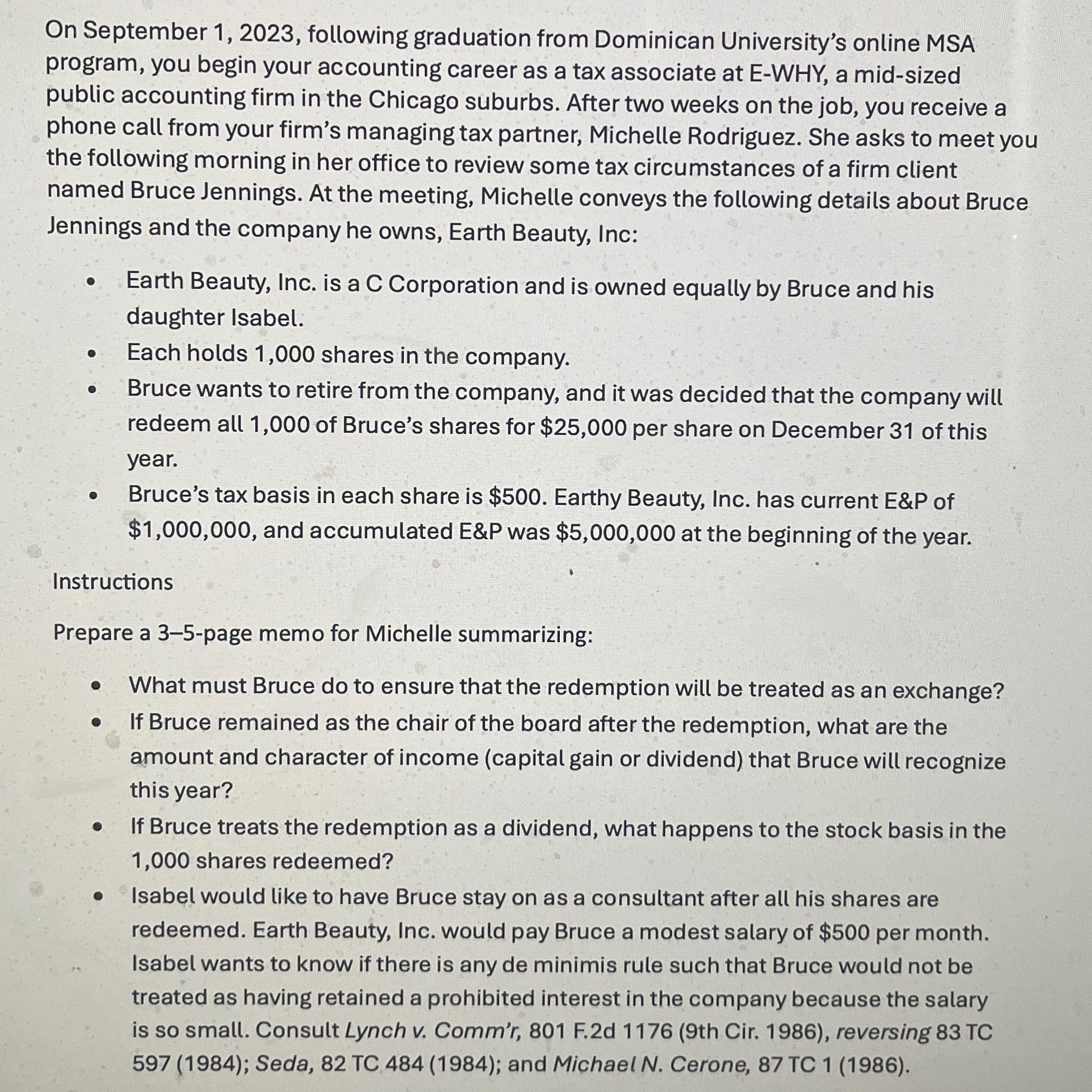

On September 1, 2023, following graduation from Dominican University's online MSA program, you begin your accounting career as a tax associate at E-WHY, a mid-sized public accounting firm in the Chicago suburbs. After two weeks on the job, you receive a phone call from your firm's managing tax partner, Michelle Rodriguez. She asks to meet you the following morning in her office to review some tax circumstances of a firm client named Bruce Jennings. At the meeting, Michelle conveys the following details about Bruce Jennings and the company he owns, Earth Beauty, Inc: Earth Beauty, Inc. is a C Corporation and is owned equally by Bruce and his daughter Isabel. Each holds 1,000 shares in the company. Bruce wants to retire from the company, and it was decided that the company will redeem all 1,000 of Bruce's shares for

$25,000per share on December 31 of this year. Bruce's tax basis in each share is

$500. Earthy Beauty, Inc. has current E&P of

$1,000,000, and accumulated E&P was

$5,000,000at the beginning of the year. Instructions Prepare a 3-5-page memo for Michelle summarizing: What must Bruce do to ensure that the redemption will be treated as an exchange? If Bruce remained as the chair of the board after the redemption, what are the amount and character of income (capital gain or dividend) that Bruce will recognize this year? If Bruce treats the redemption as a dividend, what happens to the stock basis in the 1,000 shares redeemed? Isabel would like to have Bruce stay on as a consultant after all his shares are redeemed. Earth Beauty, Inc. would pay Bruce a modest salary of

$500per month. Isabel wants to know if there is any de minimis rule such that Bruce would not be treated as having retained a prohibited interest in the company because the salary is so small. Consult Lynch v. Comm'r, 801 F.2d 1176 (9th Cir. 1986), reversing 83 TC 597 (1984); Seda, 82 TC 484 (1984); and Michael N. Cerone, 87 TC 1 (1986).