Home /

Expert Answers /

Accounting /

on-july-31-2022-keeds-company-had-a-cash-balance-per-books-of-6-140-the-statement-from-dakota-pa796

(Solved): On July 31, 2022, Keeds Company had a cash balance per books of $6,140. The statement from Dakota ...

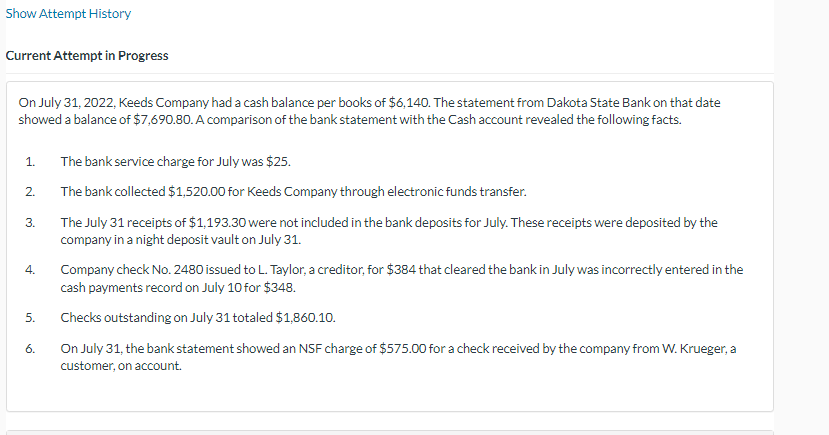

On July 31, 2022, Keeds Company had a cash balance per books of . The statement from Dakota State Bank on that date showed a balance of . A comparison of the bank statement with the Cash account revealed the following facts. 1. The bank service charge for July was . 2. The bank collected for Keeds Company through electronic funds transfer. 3. The July 31 receipts of were not included in the bank deposits for July. These receipts were deposited by the company in a night deposit vault on July 31. 4. Company check No. 2480 issued to L. Taylor, a creditor, for that cleared the bank in July was incorrectly entered in the cash payments record on July 10 for . 5. Checks outstanding on July 31 totaled . 6. On July 31, the bank statement showed an NSF charge of for a check received by the company from W. Krueger, a customer, on account.

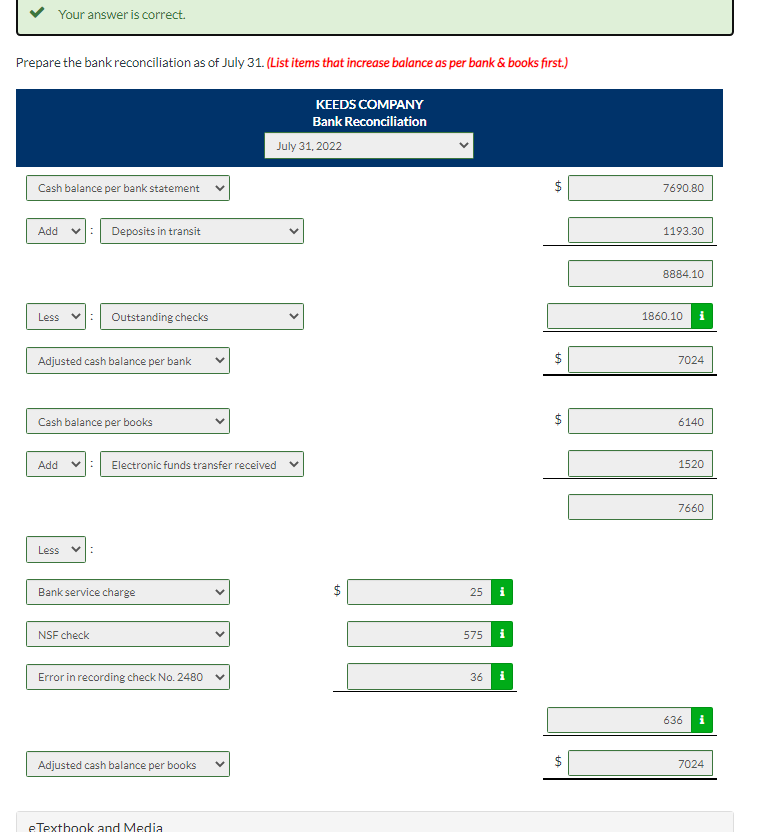

Your answer is correct. Prepare the bank reconciliation as of July 31 . (List items that increase balance as per bank \& books first.) KEEDS COMPANY Bank Reconciliation July 31,2022 Cash balance per bank statement Add Deposits in transit Less Outstanding checks Cash balance per books Add : Electronic funds transfer received Less : Bank service charge 25 NSF check Error in recording check No. 2480 \begin{tabular}{|l|l|} \hline 36 & \\ \hline \end{tabular}

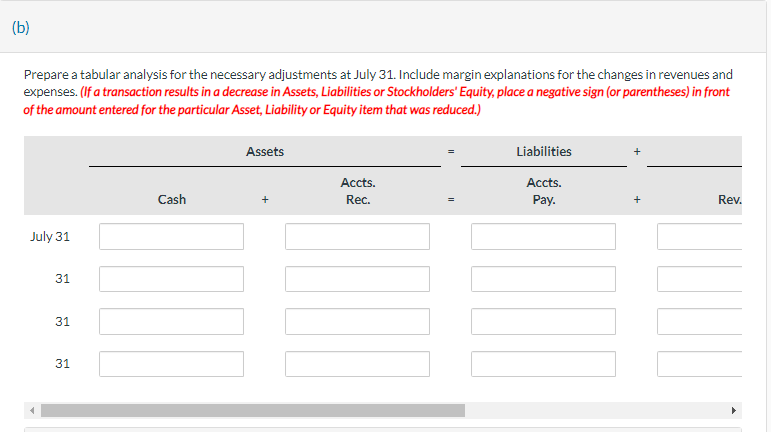

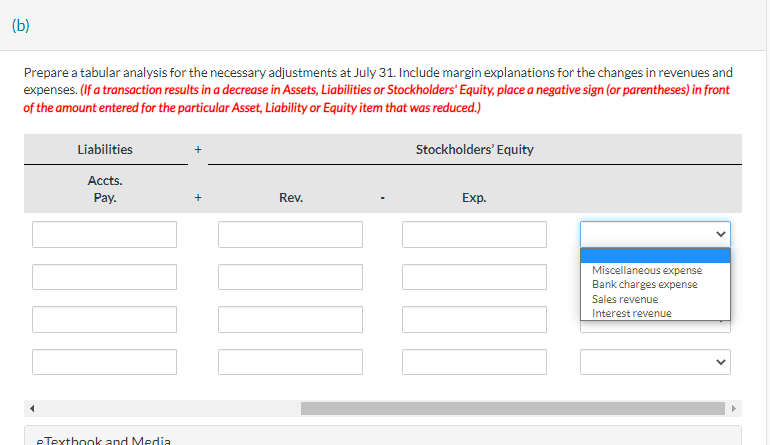

Prepare a tabular analysis for the necessary adjustments at July 31 . Include margin explanations for the changes in revenues and expenses. (If a transaction results in a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.)

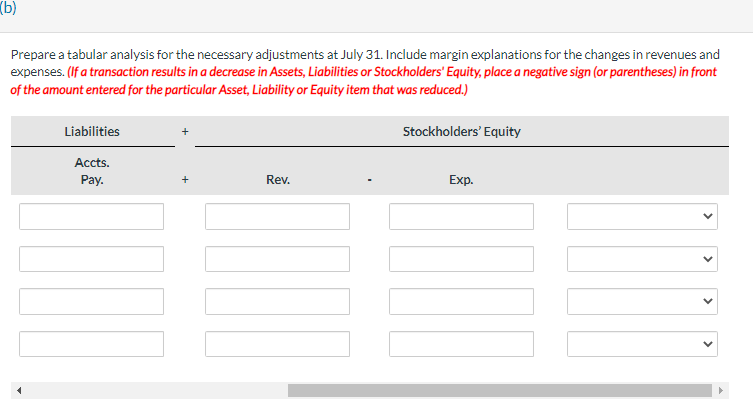

Prepare a tabular analysis for the necessary adjustments at July 31 . Include margin explanations for the changes in revenues and expenses. (If a transaction results in a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.)

Prepare a tabular analysis for the necessary adjustments at July 31 . Include margin explanations for the changes in revenues and expenses. (If a transaction results in a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.)