Home /

Expert Answers /

Accounting /

on-january-8-the-end-of-the-first-weekly-pay-period-of-the-year-regis-company-39-s-employees-earne-pa487

(Solved): On January 8 , the end of the first weekly pay period of the year, Regis Company's employees earne ...

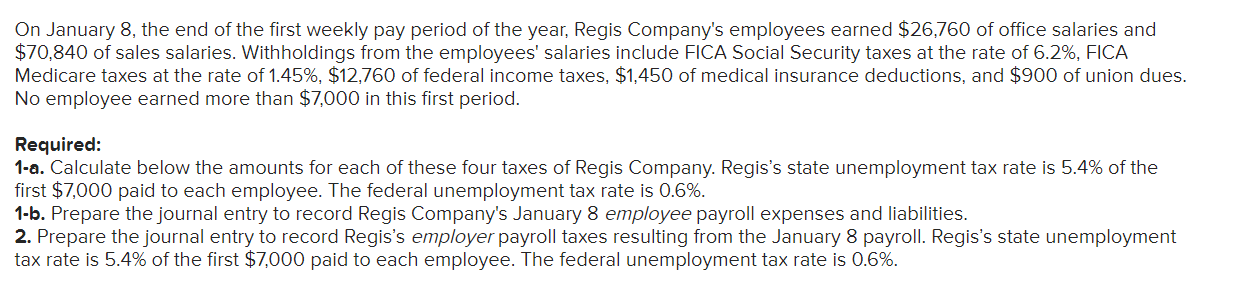

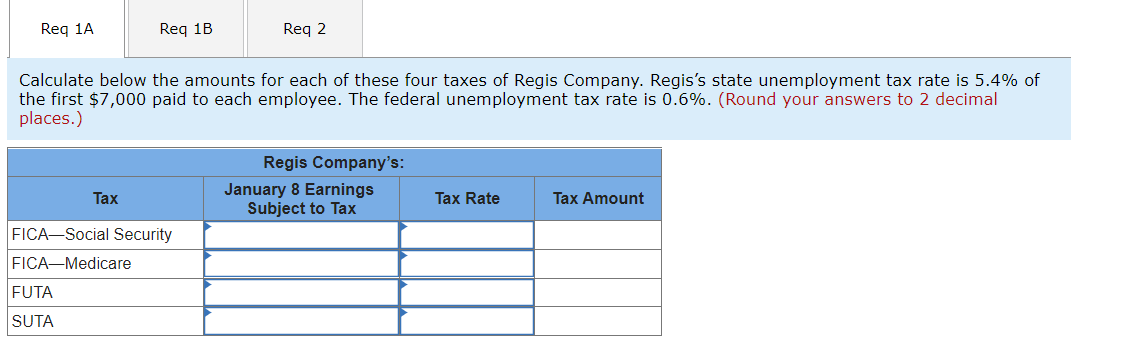

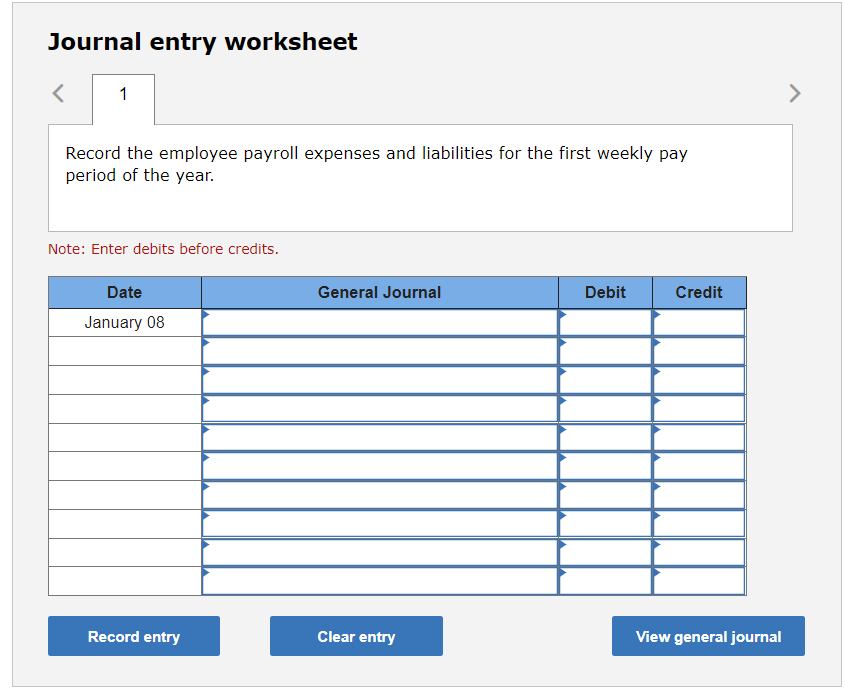

On January 8 , the end of the first weekly pay period of the year, Regis Company's employees earned \( \$ 26,760 \) of office salaries and \( \$ 70,840 \) of sales salaries. Withholdings from the employees' salaries include FICA Social Security taxes at the rate of \( 6.2 \% \), FICA Medicare taxes at the rate of \( 1.45 \%, \$ 12,760 \) of federal income taxes, \( \$ 1,450 \) of medical insurance deductions, and \( \$ 900 \) of union dues. No employee earned more than \( \$ 7,000 \) in this first period. Required: 1-a. Calculate below the amounts for each of these four taxes of Regis Company. Regis's state unemployment tax rate is \( 5.4 \% \) of the first \( \$ 7,000 \) paid to each employee. The federal unemployment tax rate is \( 0.6 \% \). 1-b. Prepare the journal entry to record Regis Company's January 8 employee payroll expenses and liabilities. 2. Prepare the journal entry to record Regis's employer payroll taxes resulting from the January 8 payroll. Regis's state unemployment tax rate is \( 5.4 \% \) of the first \( \$ 7,000 \) paid to each employee. The federal unemployment tax rate is \( 0.6 \% \).

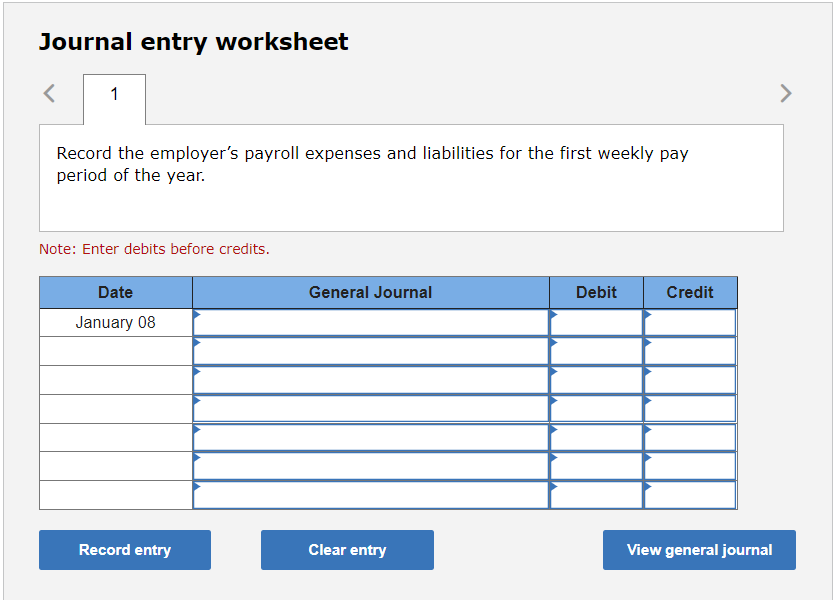

Calculate below the amounts for each of these four taxes of Regis Company. Regis's state unemployment tax rate is \( 5.4 \% \) of the first \( \$ 7,000 \) paid to each employee. The federal unemployment tax rate is \( 0.6 \% \). (Round your answers to 2 decimal places.)

Journal entry worksheet Record the employee payroll expenses and liabilities for the first weekly pay period of the year. Note: Enter debits before credits.

Journal entry worksheet Record the employer's payroll expenses and liabilities for the first weekly pay period of the year. Note: Enter debits before credits.

Expert Answer

jan Tax rate Tax amnt FICA Social security 97600 6.20% 6051.2 FICA Medicare 97600 1.45% 1415.2 FUTA 97600 0.60% 585.6 SUTA