(Solved): On January 1, 2024, Maywood Hydraulics leased drilling equipment from Aqua Leasing for a four-year p ...

On January 1, 2024, Maywood Hydraulics leased drilling equipment from Aqua Leasing for a four-year period ending December 31, 2027, at which time possession of the leased asset will revert back to Aqua. The equipment cost Aqua

$429,029and has an expected economic life of five years. Aqua and Maywood expect the residual value at December 31, 2027, to be

$65,000. Negotiations led to Maywood guaranteeing a $92,500 residual value. Equal payments under the lease are

$130,000and are due on December 31 of each year with the first payment being made on December 31, 2024. Maywood is aware that Aqua used a

6%interest rate when calculating lease payments. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: On January 1, 2024, Maywood Hydraulics leased drilling equipment from Aqua Leasing for a four-year period ending December 31, 2027, at which time possession of the leased asset will revert back to Aqua. The equipment cost Aqua

$429,029and has an expected economic life of five years. Aqua and Maywood expect the residual value at December 31, 2027, to be

$65,000. Negotiations led to Maywood guaranteeing a $92,500 residual value. Equal payments under the lease are

$130,000and are due on December 31 of each year with the first payment being made on December 31, 2024. Maywood is aware that Aqua used a

6%interest rate when calculating lease payments. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: On January 1, 2024, Maywood Hydraulics leased drilling equipment from Aqua Leasing for a four-year period ending December 31, 2027, at which time possession of the leased asset will revert back to Aqua. The equipment cost Aqua

$429,029and has an expected economic life of five years. Aqua and Maywood expect the residual value at December 31, 2027, to be

$65,000. Negotiations led to Maywood guaranteeing a $92,500 residual value. Equal payments under the lease are

$130,000and are due on December 31 of each year with the first payment being made on December 31, 2024. Maywood is aware that Aqua used a

6%interest rate when calculating lease payments. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: On January 1, 2024, Maywood Hydraulics leased drilling equipment from Aqua Leasing for a four-year period ending December 31, 2027, at which time possession of the leased asset will revert back to Aqua. The equipment cost Aqua

$429,029and has an expected economic life of five years. Aqua and Maywood expect the residual value at December 31, 2027, to be

$65,000. Negotiations led to Maywood guaranteeing a $92,500 residual value. Equal payments under the lease are

$130,000and are due on December 31 of each year with the first payment being made on December 31, 2024. Maywood is aware that Aqua used a

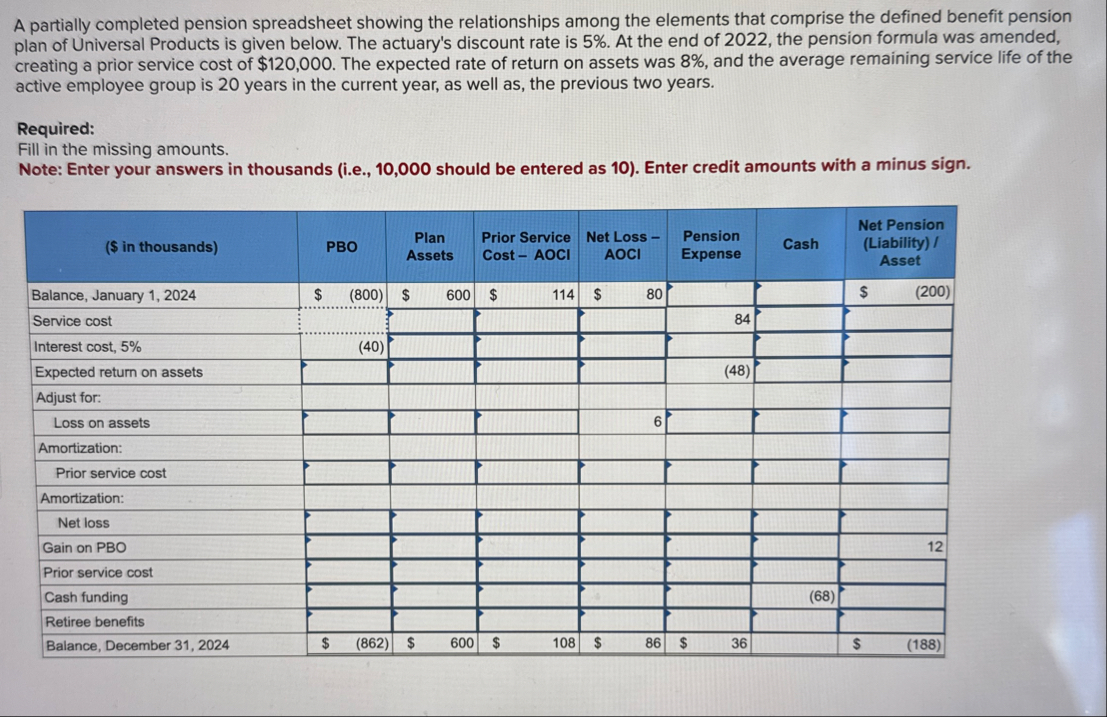

6%interest rate when calculating lease payments. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: A partially completed pension spreadsheet showing the relationships among the elements that comprise the defined benefit pension plan of Universal Products is given below. The actuary's discount rate is

5%. At the end of 2022, the pension formula was amended, creating a prior service cost of

$120,000. The expected rate of return on assets was

8%, and the average remaining service life of the active employee group is 20 years in the current year, as well as, the previous two years. Required: Fill in the missing amounts. Note: Enter your answers in thousands (i.e., 10,000 should be entered as 10 ). Enter credit amounts with a minus sign. \table[[($ in thousands),PBO,Plan Assets,Prior Service Cost - AOCl,Net Loss AOCI,Pension Expense,Cash,Net Pension (Liability) / Asset],[Balance, January 1, 2024,,(800),$,600,$,114,$,80,,,,$,(200)],[Service cost

_(c )A partially completed pension spreadsheet showing the relationships among the elements that comprise the defined benefit pension plan of Universal Products is given below. The actuary's discount rate is

5%. At the end of 2022, the pension formula was amended, creating a prior service cost of

$120,000.