(Solved): On January 1, 2022, Oriole Corporation acquires a building at a cost of $195,000. The building is ...

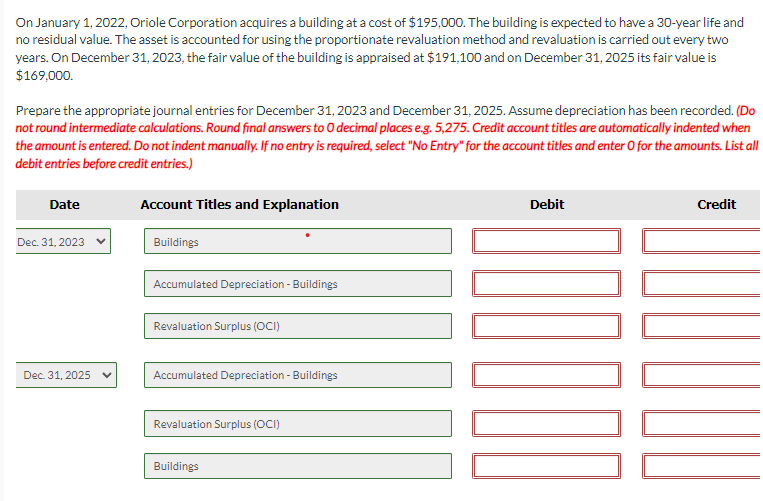

On January 1, 2022, Oriole Corporation acquires a building at a cost of

$195,000. The building is expected to have a 30 -year life and no residual value. The asset is accounted for using the proportionate revaluation method and revaluation is carried out every two years. On December 31,2023 , the fair value of the building is appraised at

$191,100and on December 31,2025 its fair value is

$169,000. Prepare the appropriate journal entries for December 31, 2023 and December 31, 2025. Assume depreciation has been recorded. (Do not round intermediate calculations. Round final answers to 0 decimal places e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) Revaluation Surplus (OCl) Accumulated Depreciation - Buildings Revaluation Surplus (OCI)