Home /

Expert Answers /

Accounting /

on-april-1-2023-nicky-llc-sells-a-two-year-cloud-software-subscription-to-moose-cash-moose-pays-pa735

(Solved): On April 1, 2023, Nicky LLC, sells a two year cloud software subscription to Moose cash. Moose pays ...

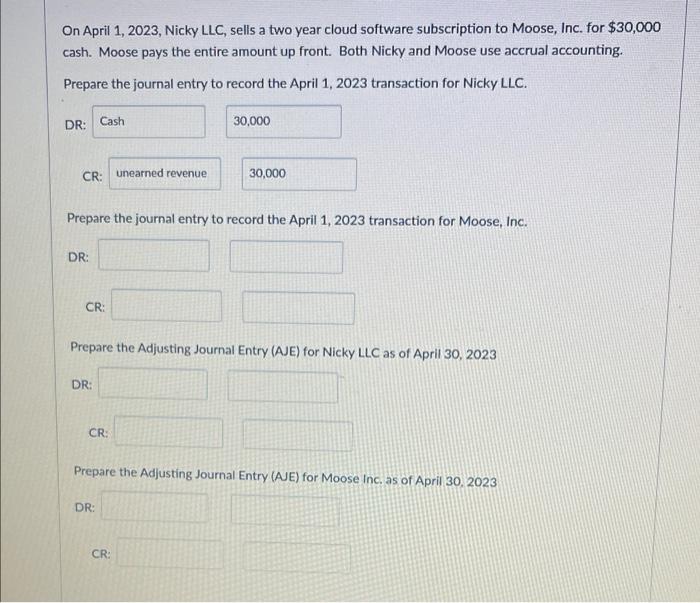

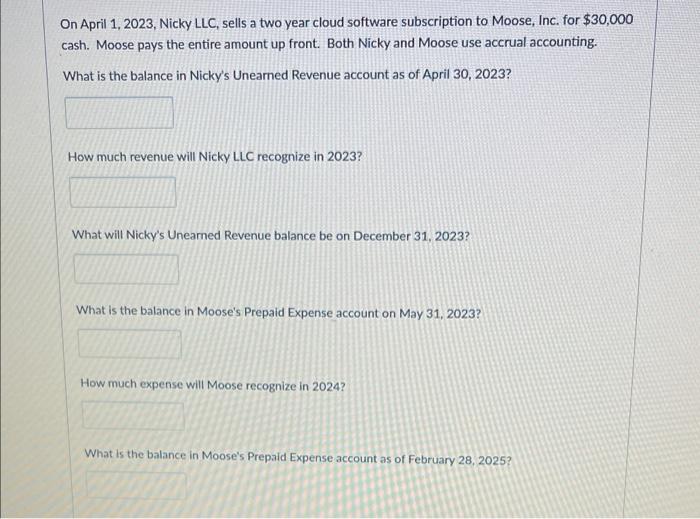

On April 1, 2023, Nicky LLC, sells a two year cloud software subscription to Moose cash. Moose pays the entire amount up front. Both Nicky and Moose use accrual Prepare the journal entry to record the April 1, 2023 transaction for Nicky LLC. DR: Prepare the journal entry to record the April 1, 2023 transaction for Moose, Inc. DR: Prepare the Adjusting Journal Entry (AJE) for Nicky LLC as of April 30, 2023 DR: Prepare the Adjusting Journal Entry (AJE) for Moose Inc. as of April 30, 2023 DR: On April 1, 2023, Nicky LLC, sells a two year cloud software subscription to Moose, Inc. for \( \$ 30,000 \) cash. Moose pays the entire amount up front. Both Nicky and Moose use accrual accounting. What is the balance in Nicky's Unearned Revenue account as of April 30, 2023? How much revenue will Nicky LLC recognize in 2023? What will Nicky's Uneamed Revenue balance be on December 31, 2023? What is the balance in Moose's Prepaid Expense account on May 31, 2023? How much expense will Moose recognize in 2024? What is the balance in Moose's Prepaid Expense account as of February 28, 2025?

Expert Answer

Accrual Accounting Method This accounting method r