Home /

Expert Answers /

Finance /

o13-2-investments-e-and-f-are-mutually-exclusive-and-have-physical-lives-of-five-and-10-years-res-pa892

(Solved): (O13-2) Investments E and F are mutually exclusive and have physical lives of five and 10 years, res ...

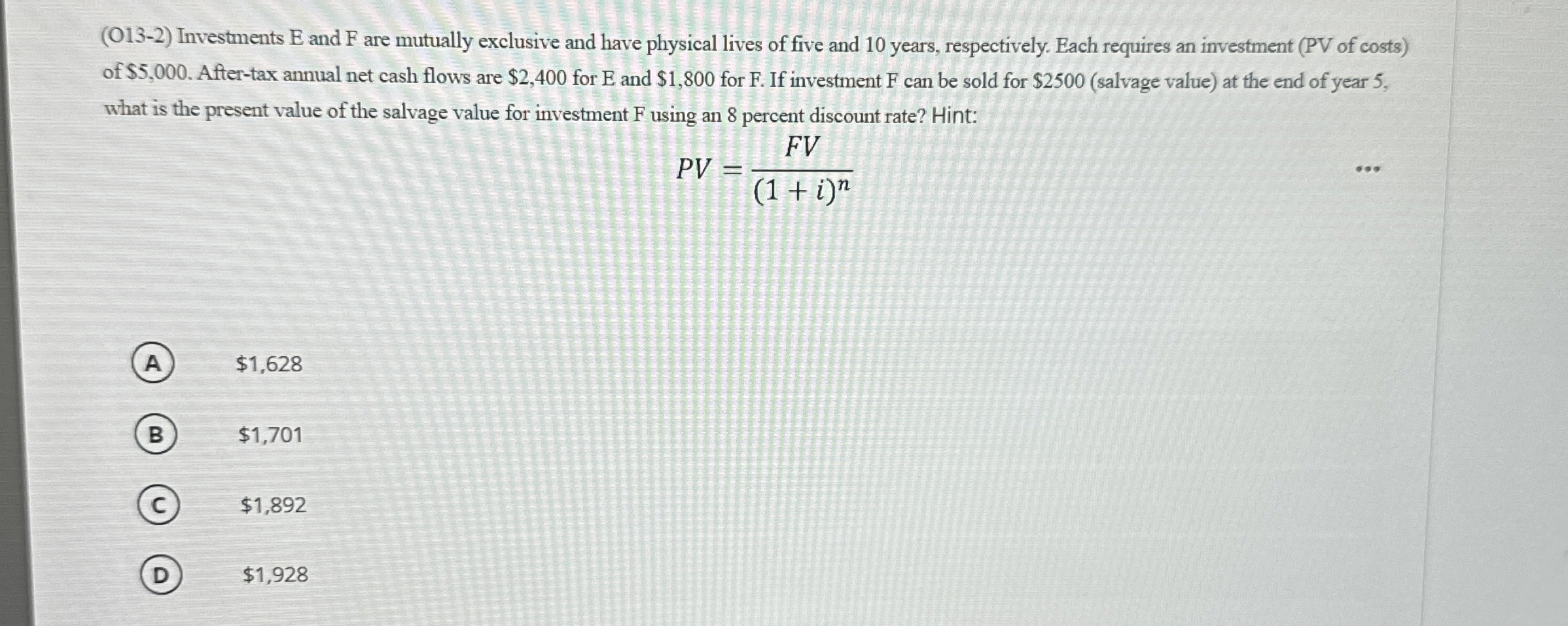

(O13-2) Investments E and F are mutually exclusive and have physical lives of five and 10 years, respectively. Each requires an investment (PV of costs) of

$5,000. After-tax annual net cash flows are

$2,400for

Eand

$1,800for

F. If investment

Fcan be sold for

$2500(salvage value) at the end of year 5 , what is the present value of the salvage value for investment

Fusing an 8 percent discount rate? Hint:

PV=(FV)/((1+i)^(n))

$1,628

$1,701

$1,892

$1,928