Home /

Expert Answers /

Accounting /

not-understanding-this-at-all-jk-buidiers-was-incorporated-on-july-1-the-follewing-ase-the-compan-pa778

(Solved): not understanding this at all. JK. Buidiers was incorporated on July 1. The follewing ase the compan ...

not understanding this at all.

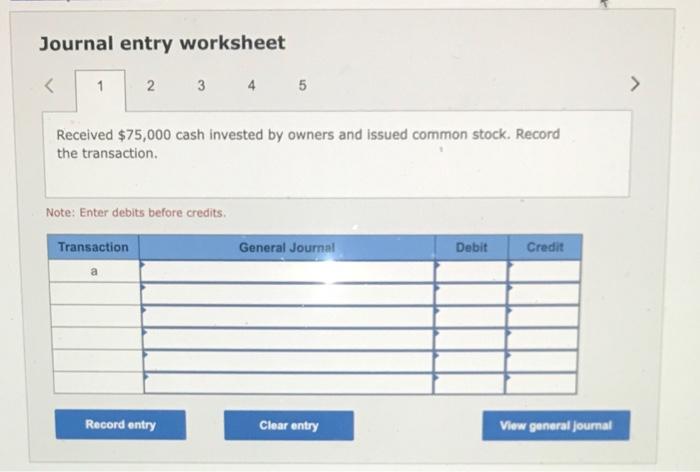

JK. Buidiers was incorporated on July 1. The follewing ase the companys transactions for the morth of July a. Received \( \$ 75,000 \) eash invested by owners and issued coenmon stock b. Booght an unused field from a local farmer by poying 565,000 cash. As a corstruction sate for snuser projects if a ensmated to be worth \( \$ 70.000 \) to \( \mathrm{JK} \). Buiders. \$15.000, but the supplier gave JK. Bullders a 12 percent discount. \( 2 \mathrm{~K} \). Bullden has not yet recesed the \( 30.200 \) sif from the supplier, d. Borrowed \( \$ 30,000 \) trom the bank with a pian to use the funds to build a small workshop in Auguate. The foan must be repaid in tho yoars. e. One of the owners soid \( \$ 15.000 \) worth of his carnmon stock to another shareholder for \( \$ 15.000 \) Required Prepare journal entries for the above transctions from the first morith of buminess; af ne entry is required for a transactionievent. select "No Joumal Entry Required" in the first account feid.)

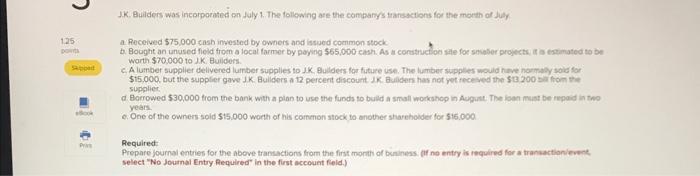

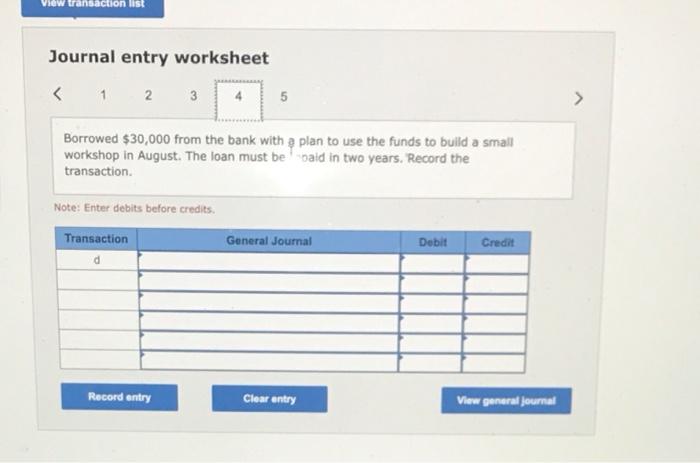

Journal entry worksheet \( \begin{array}{llll}2 & 3 & 4 & 5\end{array} \) Received \( \$ 75,000 \) cash invested by owners and issued common stock. Record the transaction. Note: Enter debits before credits.

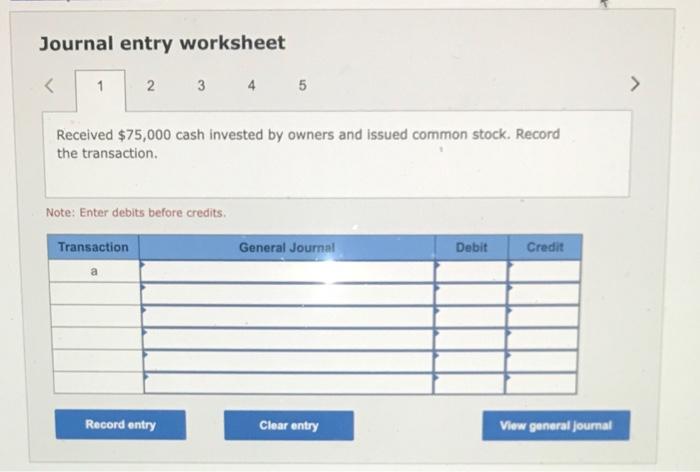

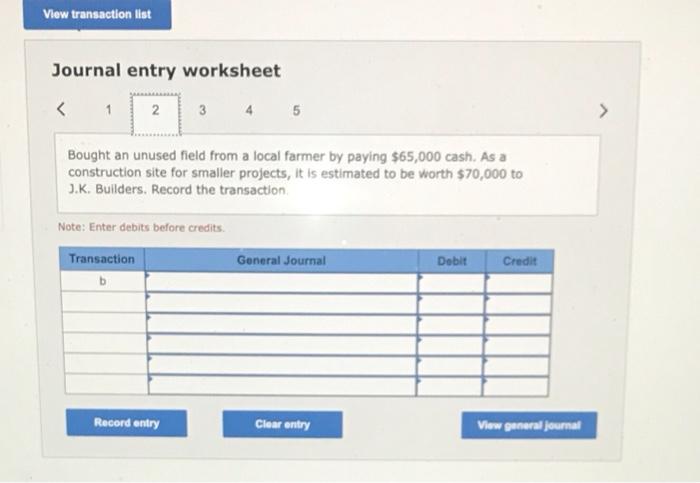

Journal entry worksheet Bought an unused field from a local farmer by paying \( \$ 65,000 \) cash. As a construction site for smaller projects, it is estimated to be worth \( \$ 70,000 \) to J.K. Builders. Record the transaction. Note: Enter debits before credits.

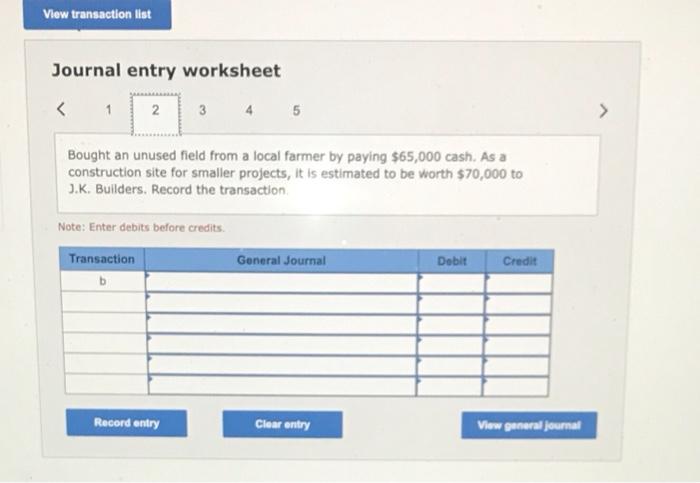

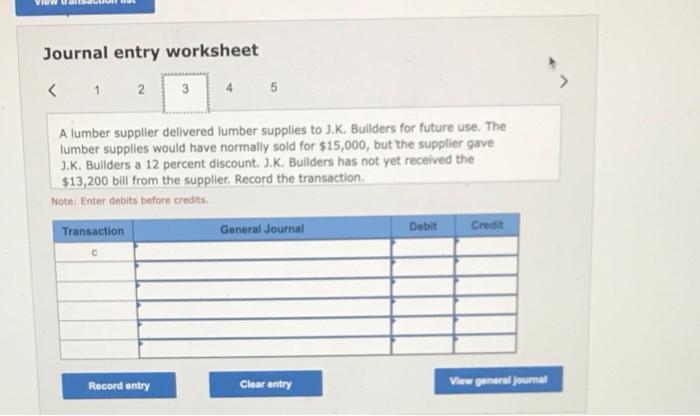

Journal entry worksheet A lumber supplier delivered lumber supplies to J.K. Builders for future use. The lumber supplies would have normally sold for \( \$ 15,000 \), but the supplier gave J.K. Buliders a 12 percent discount. J.K. Builders has not yet received the \( \$ 13,200 \) bill from the supplier. Record the transaction. Note: Enter debits before credits.

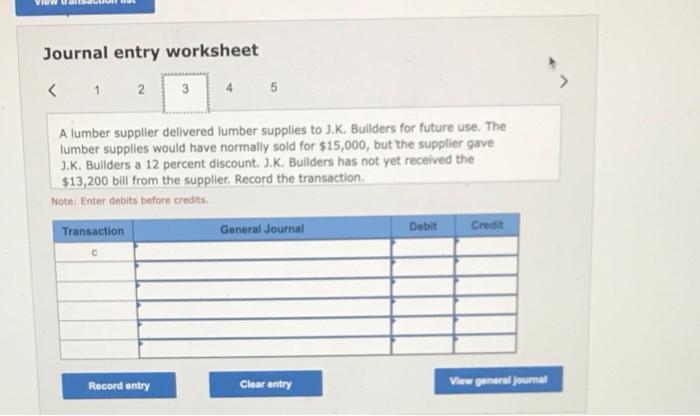

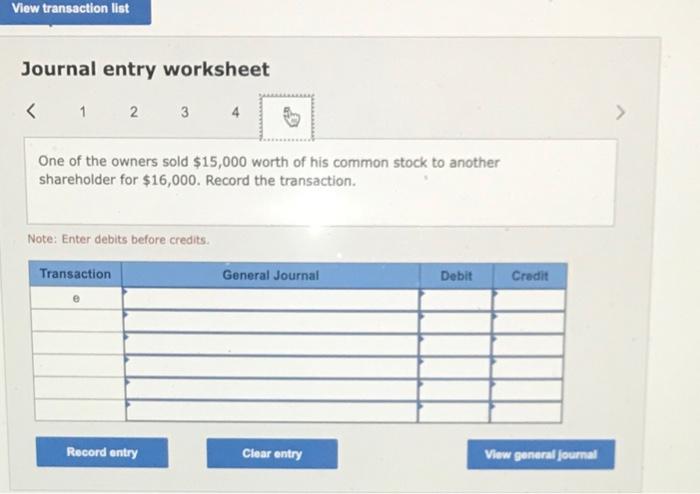

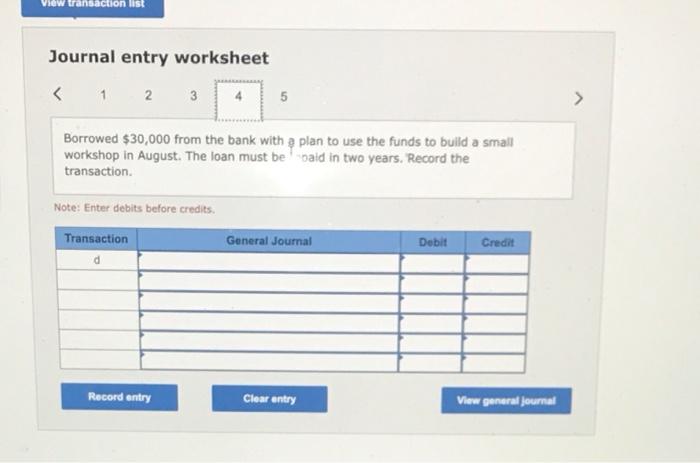

Journal entry worksheet Borrowed \( \$ 30,000 \) from the bank with a plan to use the funds to bulld a small workshop in August. The loan must be oaid in two years. Record the transaction. Note: Enter debits before credits.

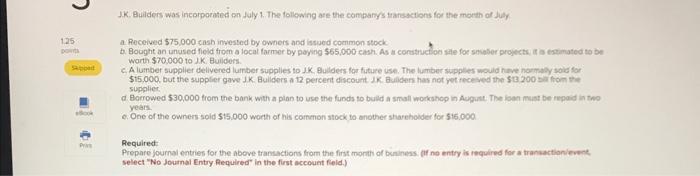

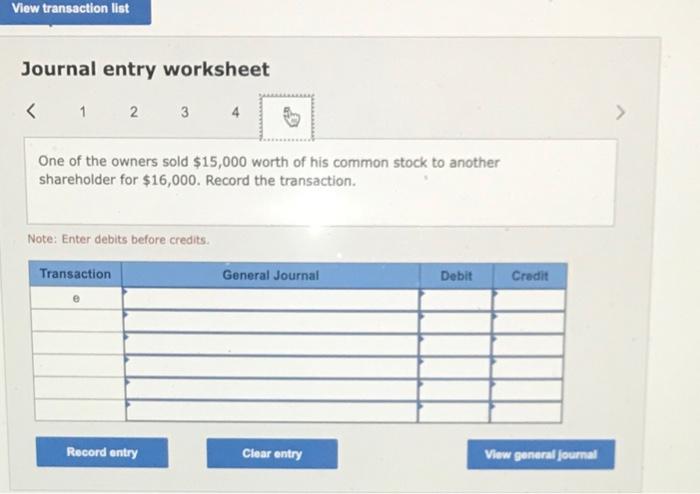

Journal entry worksheet \( <\quad 1 \quad 2 \quad 3 \) One of the owners sold \( \$ 15,000 \) worth of his common stock to another shareholder for \( \$ 16,000 \). Record the transaction. Note: Enter debits before credits.

Expert Answer

Solution: Transaction General Journal Debit Credit a. Cash 75000 Common stock 75000 (Being cash recei