Home /

Expert Answers /

Economics /

need-help-2-suppose-that-larry-is-preparing-to-file-his-taxes-he-is-single-and-currently-lives-in-n-pa239

(Solved): need help 2 Suppose that Larry is preparing to file his taxes. He is single and currently lives in N ...

need help 2

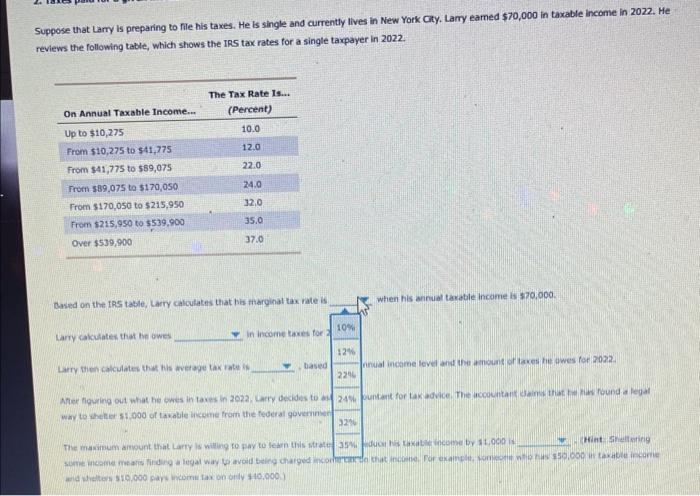

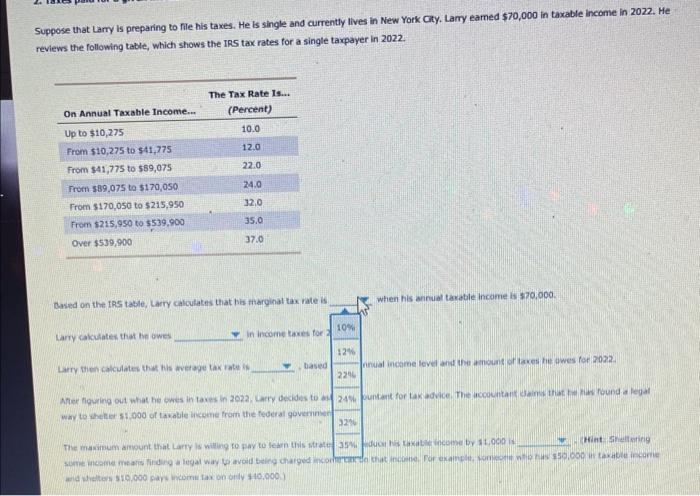

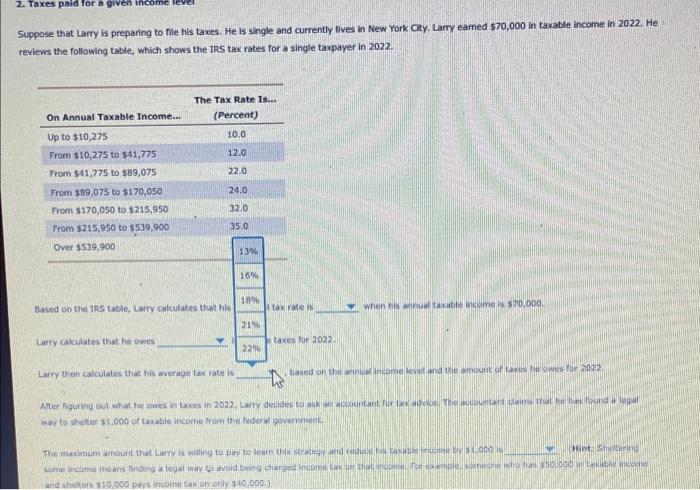

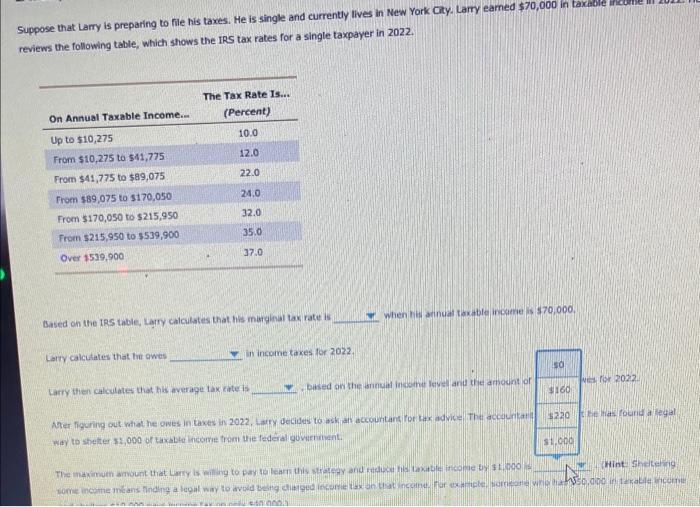

Suppose that Larry is preparing to file his taxes. He is single and currently lives in New York Gty. Lamy eamed 570,000 in taxable income in 2022 . He reviews the following table, which shows the IRS tax rates for a single taxpayer in 2022. Bened on the tRS table, Larry calculates that his ftharginat tax rate is when his annual tacatile income is spo,0od. Larry calculates that tie owes

Suppose that Larry is preparing to file his taves. He is single and currently lives in New York Cky. Lamy eamed \( \$ 70,000 \) in taxable income in 2022 . He reviews the following table, which shows the IRS tax rates for a single taxpayer in 2022. Based on the 1RS table, Larry calculates that his marginal tax rate is when his annuat taxable income is \( \$ 70,000 \). Larry cakculotes that he owes in income taxes for 2022.

Suppose that Lamy is preparing to file his taxes. He is single and currently lives in New York City. Larry earned 570,000 in taxable income in 2022. He revlews the following table, which shows the IRS tax rates for a single taxpayer in 2022. way to theker 81,000 of taxable income trom the treyeral goverrment.

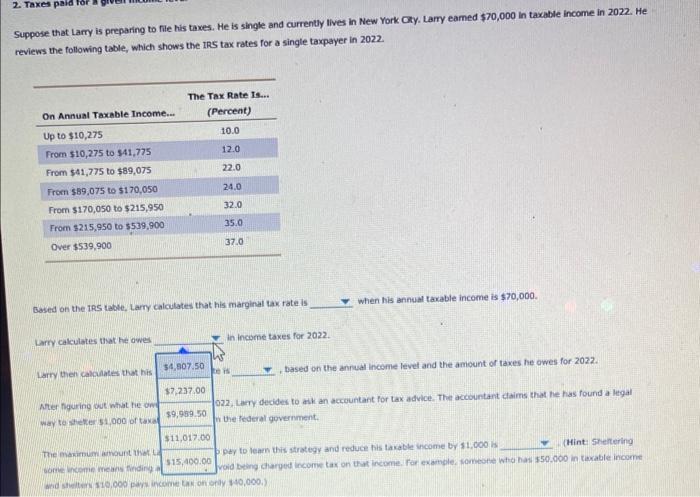

Suppose that Larry is preparing to file his taxes. He is single and currently Itves in New York City. Larry eamed \( \$ 70,000 \) in taxable reviews the following table, which shows the IRS tax rates for a single taxpayer in 2022 . Based on the IRs table, Larry calculates that, his marglnai tax rate is When he arinuat twxable incuere is 570,000 . Larry calchtates that he owes Larry then calculates thot his average tax cate is way to shetter 51,000 of taxable incorre tram the federal govarnment. Wint Sheleeling

Expert Answer

Larry's income =$70000. marginal tax rate =22% Total tax due= [(10