(Solved): Leverage Indifference. Top Corp. is considering a restructuring. Currently, it is all-equity finance ...

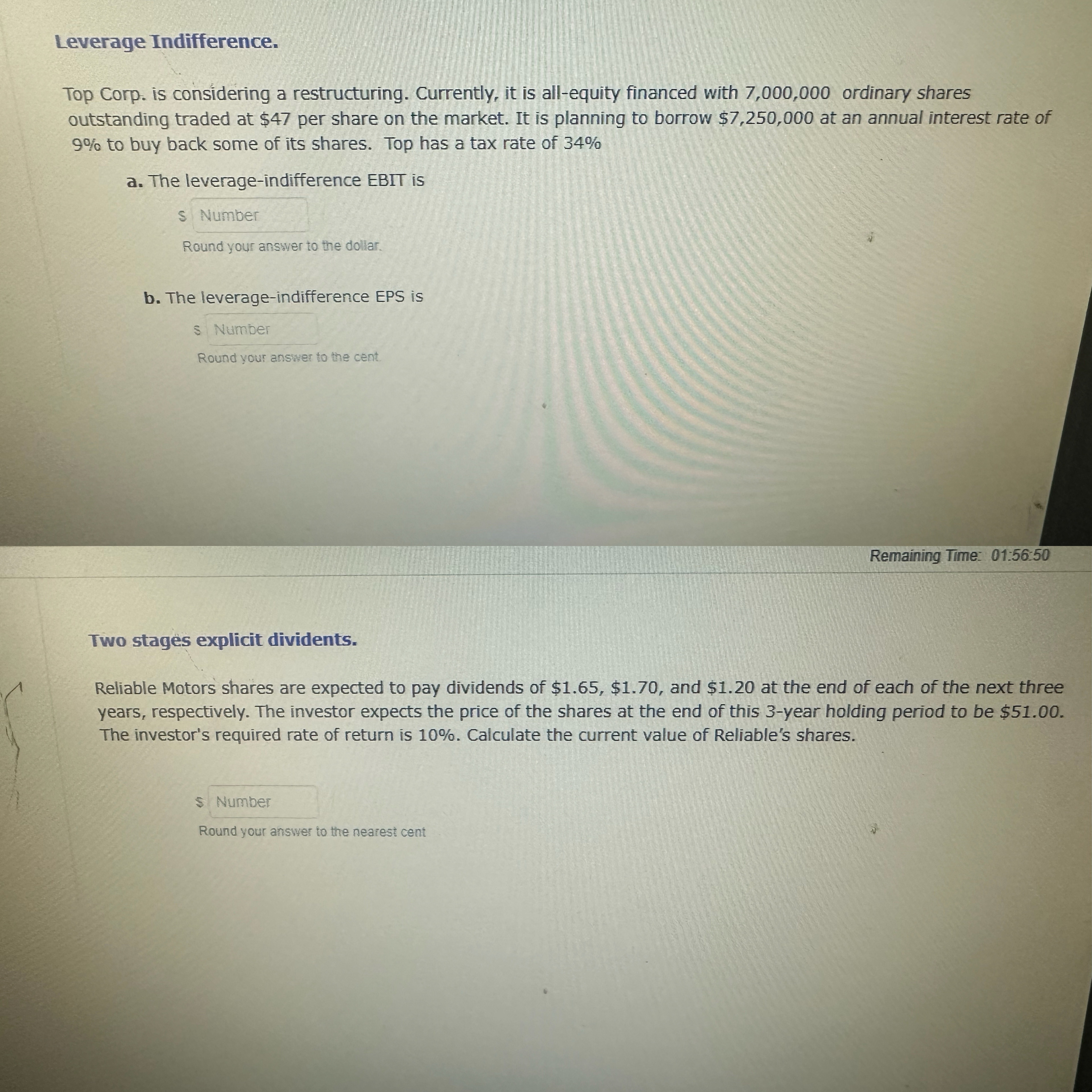

Leverage Indifference. Top Corp. is considering a restructuring. Currently, it is all-equity financed with

7,000,000ordinary shares outstanding traded at

$47per share on the market. It is planning to borrow

$7,250,000at an annual interest rate of

9%to buy back some of its shares. Top has a tax rate of

34%a. The leverage-indifference EBIT is s Number Round your answer to the dollar. b. The leverage-indifference EPS is s Number Round your answer to the cent. Remaining Time:

01:56:50Two stages explicit dividents. Reliable Motors shares are expected to pay dividends of

$1.65,$1.70, and

$1.20at the end of each of the next three years, respectively. The investor expects the price of the shares at the end of this 3-year holding period to be

$51.00. The investor's required rate of return is

10%. Calculate the current value of Reliable's shares. Round your answer to the nearest cent