Home /

Expert Answers /

Accounting /

kareem-is-a-full-time-graduate-student-at-the-university-working-toward-his-ph-d-in-chemistry-in-t-pa815

(Solved): Kareem is a full time graduate student at the University working toward his Ph.D. in chemistry. In t ...

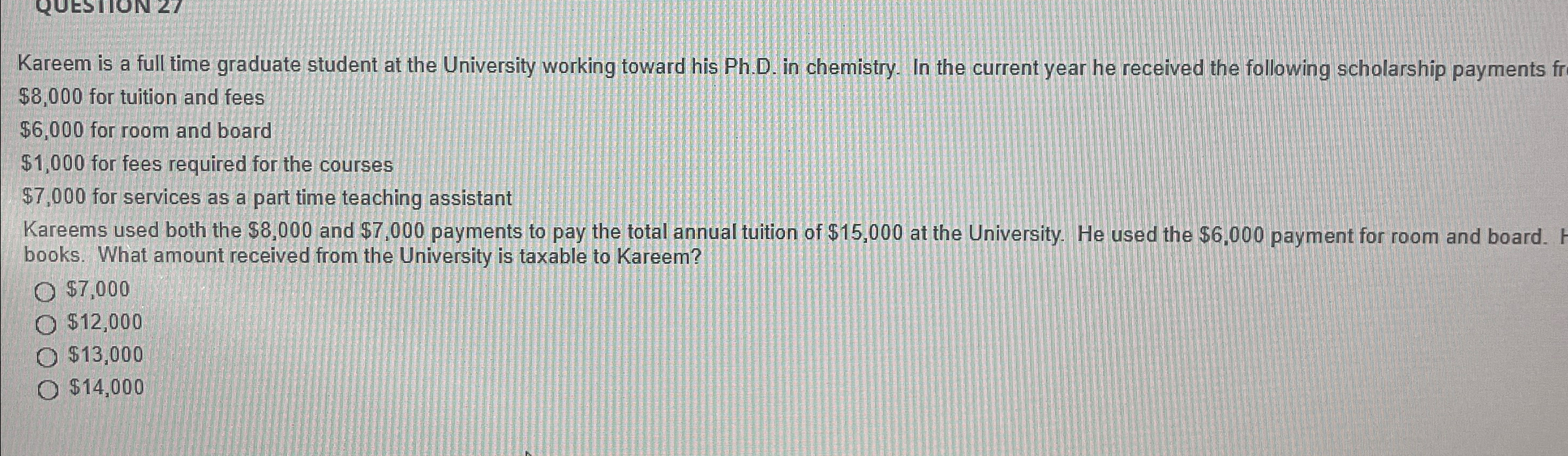

Kareem is a full time graduate student at the University working toward his Ph.D. in chemistry. In the current year he received the following scholarship payments fr

$8,000for tuition and fees

$6,000for room and board

$1,000for fees required for the courses

$7,000for services as a part time teaching assistant Kareems used both the

$8,000and

$7,000payments to pay the total annual tuition of

$15,000at the University. He used the

$6,000payment for room and board. books. What amount received from the University is taxable to Kareem?

$7,000

$12,000

$13,000

$14,000