Home /

Expert Answers /

Accounting /

journalizing-sales-sales-returns-and-allowances-and-cash-receipts-prepare-journal-entries-for-the-pa545

(Solved): Journalizing Sales, Sales Returns and Allowances, and Cash Receipts Prepare journal entries for the ...

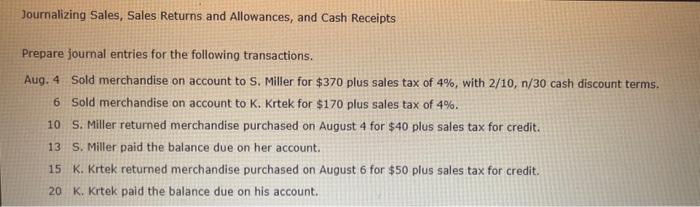

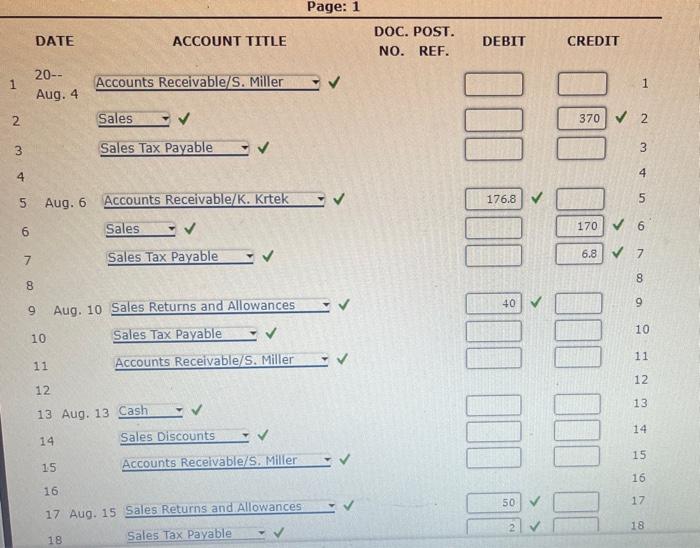

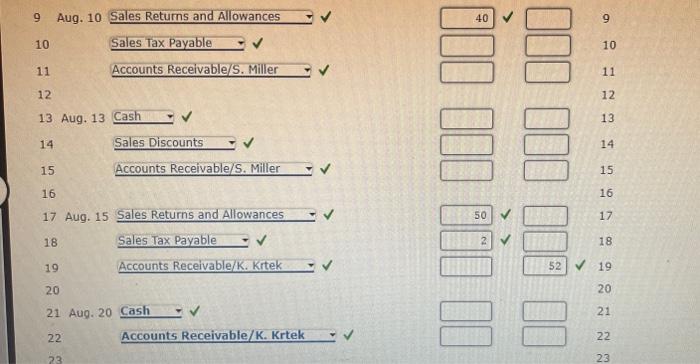

Journalizing Sales, Sales Returns and Allowances, and Cash Receipts Prepare journal entries for the following transactions. Aug. 4 Sold merchandise on account to S. Miller for \( \$ 370 \) plus sales tax of \( 4 \% \), with \( 2 / 10, n / 30 \) cash discount terms. 6 Sold merchandise on account to K. Krtek for \( \$ 170 \) plus sales tax of \( 4 \% \). 10 5. Miller retumed merchandise purchased on August 4 for \( \$ 40 \) plus sales tax for credit. 13 5. Miller paid the balance due on her account. 15 K. Krtek returned merchandise purchased on August 6 for \( \$ 50 \) plus sales tax for credit. 20 K. Krtek paid the balance due on his account.

Page: 1

Expert Answer

Required :Prepare journal entries for the following transactions. Aug. 4 Sold merchandise on account to S. Miller for $370 plus sales tax of 4%, with