Home /

Expert Answers /

Accounting /

information-for-james-company-is-as-follows-accounts-receivable-at-december-31-year-1-allowance-pa812

(Solved): Information for James Company is as follows: Accounts Receivable at December 31 , Year 1 Allowance ...

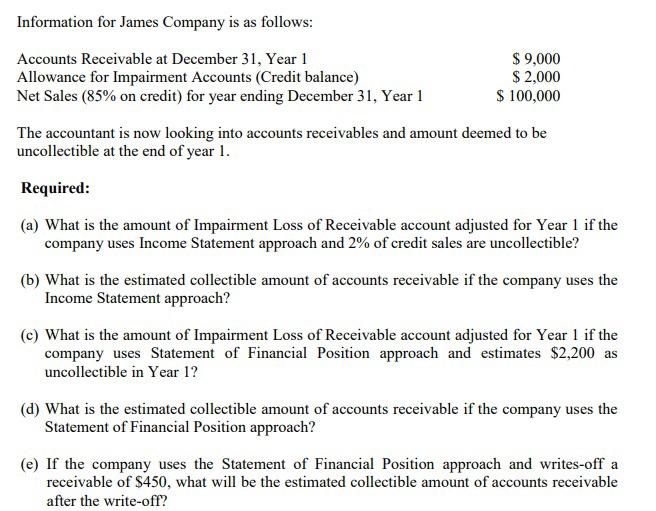

Information for James Company is as follows: Accounts Receivable at December 31 , Year 1 Allowance for Impairment Accounts (Credit balance) Net Sales ( on credit) for year ending December 31 , Year 1 The accountant is now looking into accounts receivables and amount deemed to be uncollectible at the end of year 1 . Required: (a) What is the amount of Impairment Loss of Receivable account adjusted for Year 1 if the company uses Income Statement approach and of credit sales are uncollectible? (b) What is the estimated collectible amount of accounts receivable if the company uses the Income Statement approach? (c) What is the amount of Impairment Loss of Receivable account adjusted for Year 1 if the company uses Statement of Financial Position approach and estimates as uncollectible in Year 1? (d) What is the estimated collectible amount of accounts receivable if the company uses the Statement of Financial Position approach? (e) If the company uses the Statement of Financial Position approach and writes-off a receivable of , what will be the estimated collectible amount of accounts receivable after the write-off?