Home /

Expert Answers /

Accounting /

in-january-1-2024-company-issues-780-000-of-10-bonds-due-in-seven-years-with-i-pa986

(Solved): in January 1,2024, company issues \( \$ 780,000 \) of \( 10 \% \) bonds, due in seven years, with i ...

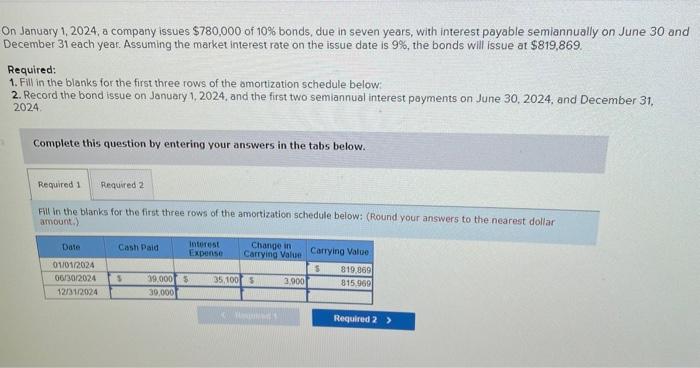

in January 1,2024, company issues \( \$ 780,000 \) of \( 10 \% \) bonds, due in seven years, with interest payable semiannually on June 30 and December 31 each year. Assuming the market interest rate on the issue date is \( 9 \% \), the bonds will issue at \( \$ 819,869 \). Required: 1. Fill in the blanks for the first three rows of the amortization schedule below 2. Record the bond issue on January 1, 2024, and the first two semiannual interest payments on June 30, 2024, and December 31 . 2024 Complete this question by entering your answers in the tabs below. Fil in the blanks for the first three rows of the amortization schedule below: (Round your answers to the nearest dollar amount.)

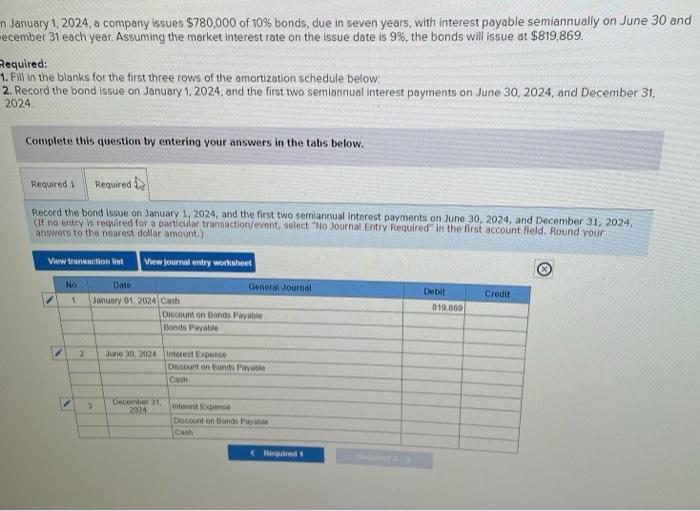

January 1, 2024, a company issues \( \$ 780,000 \) of \( 10 \% \) bonds, due in seven years, with interest payable semiannually on June 30 and cember 31 each year. Assuming the market interest rate on the issue date is \( 9 \% \), the bonds will issue at \( \$ 819,869 \). equired: . Fill in the blanks for the first three rows of the amorization schedule below: 2. Record the bond issue on January 1. 2024, and the first two semiannual interest payments on June 30, 2024, and December 31 , 2024 Complete this question by entering your answers in the tabs below. Record the bond issoe on January 1, 2024, and the first two semiannual interest payments on June 30, 2024, and December \( 31,2024 \). (it no entry be reguired for a particulas transaction/event, select "No Journal Entiy Required" in the first account field. Round your

Expert Answer

Requirement 1 Date Cash Paid Interest Expense Change in CV Carrying Value 1/1/2024 819,869 6/30/2024 39,000 36,894 2,106 817,763 12/31/2024 39,000 36,