Home /

Expert Answers /

Economics /

if-elasticity-of-demand-is-1-8-elasticity-of-supply-is-0-7-and-a-20-percent-excise-tax-is-levied-pa495

(Solved): If elasticity of demand is 1.8 , elasticity of supply is 0.7 , and a 20 percent excise tax is levied ...

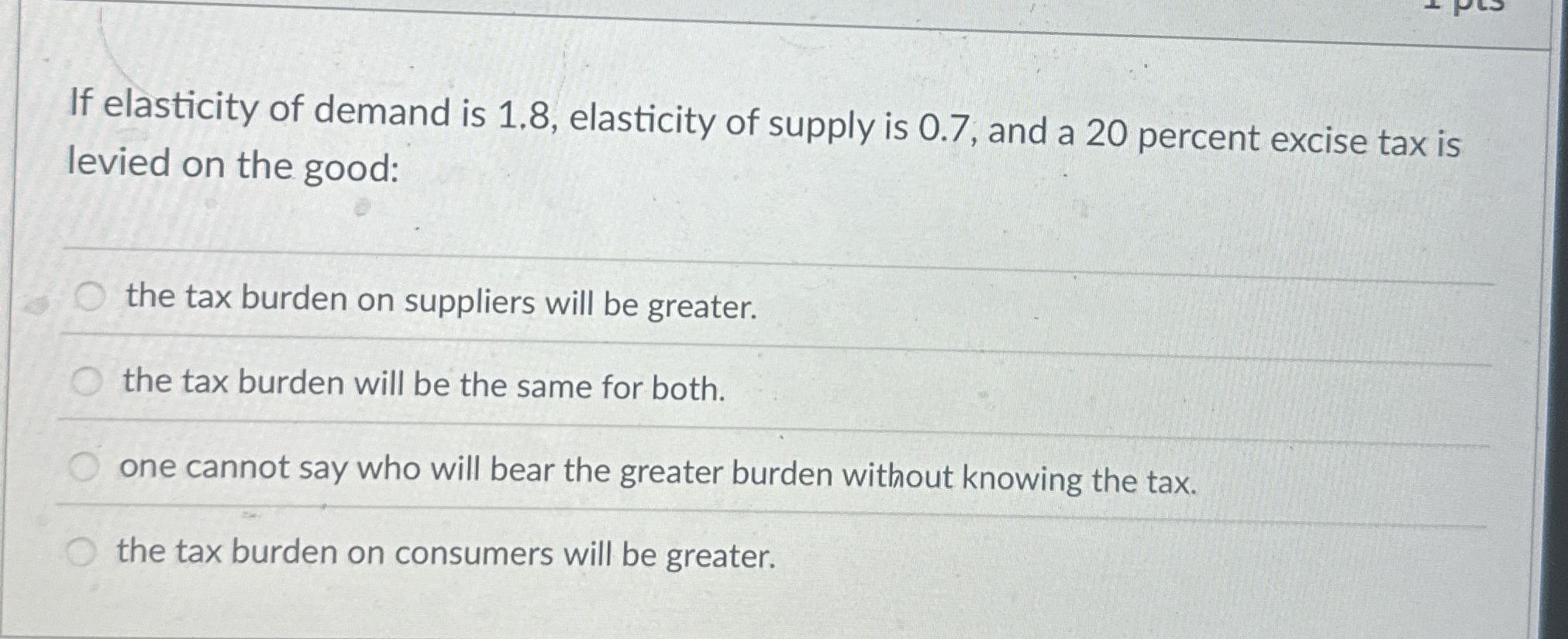

If elasticity of demand is 1.8 , elasticity of supply is 0.7 , and a 20 percent excise tax is levied on the good: the tax burden on suppliers will be greater. the tax burden will be the same for both. one cannot say who will bear the greater burden without knowing the tax. the tax burden on consumers will be greater.