Home /

Expert Answers /

Accounting /

how-is-reporting-for-other-comprehensive-income-oci-different-between-u-s-gaap-and-ifrs-a-both-pa715

(Solved): How is reporting for other comprehensive income (OCI) different between U.S. GAAP and IFRS? A. Both ...

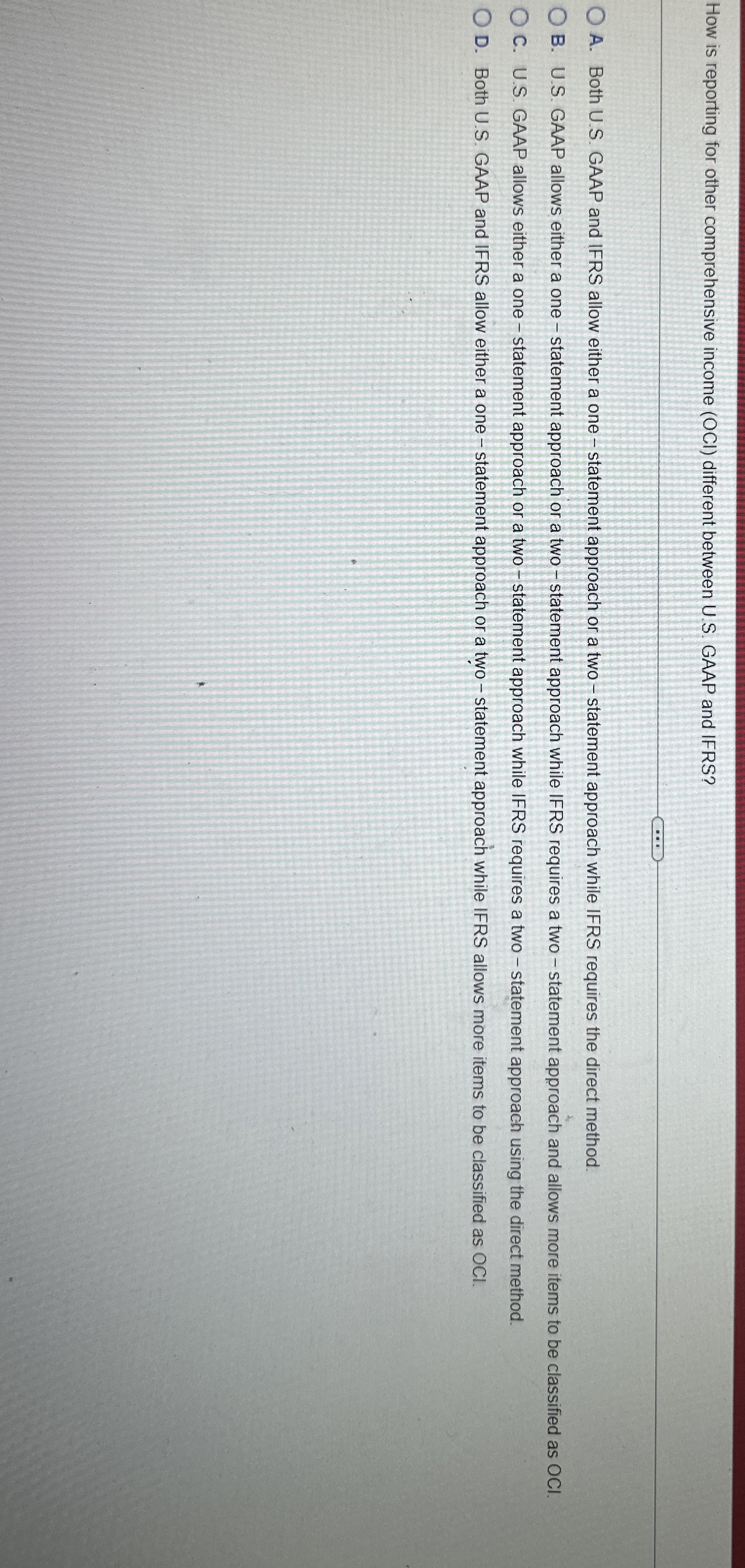

How is reporting for other comprehensive income (OCI) different between U.S. GAAP and IFRS? A. Both U.S. GAAP and IFRS allow either a one - statement approach or a two - statement approach while IFRS requires the direct method. B. U.S. GAAP allows either a one - statement approach or a two-statement approach while IFRS requires a two - statement approach and allows more items to be classified as OCI. C. U.S. GAAP allows either a one - statement approach or a two-statement approach while IFRS requires a two - statement approach using the direct method. D. Both U.S. GAAP and IFRS allow either a one - statement approach or a two-statement approach while IFRS allows more items to be classified as OCI.