Home /

Expert Answers /

Accounting /

forest-products-incorporated-manufactures-three-products-fp-10-fp-20-and-fp-40-from-a-single-pa939

(Solved): Forest Products, Incorporated, manufactures three products (FP-10, FP-20, and FP-40) from a single ...

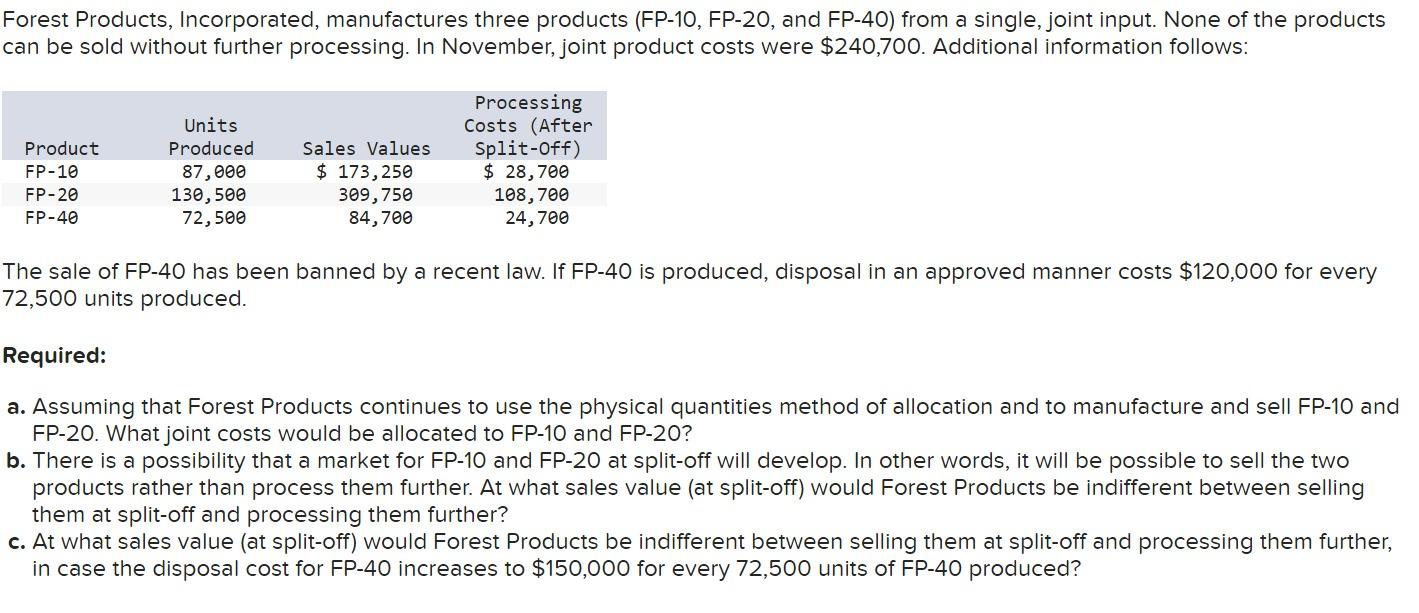

Forest Products, Incorporated, manufactures three products (FP-10, FP-20, and FP-40) from a single, joint input. None of the products can be sold without further processing. In November, joint product costs were \( \$ 240,700 \). Additional information follows: The sale of FP-40 has been banned by a recent law. If FP-40 is produced, disposal in an approved manner costs \( \$ 120,000 \) for every 72,500 units produced. Required: a. Assuming that Forest Products continues to use the physical quantities method of allocation and to manufacture and sell FP-10 and FP-20. What joint costs would be allocated to FP-10 and FP-20? b. There is a possibility that a market for FP-10 and FP-20 at split-off will develop. In other words, it will be possible to sell the two products rather than process them further. At what sales value (at split-off) would Forest Products be indifferent between selling them at split-off and processing them further? c. At what sales value (at split-off) would Forest Products be indifferent between selling them at split-off and processing them further, in case the disposal cost for FP-40 increases to \( \$ 150,000 \) for every 72,500 units of FP-40 produced?

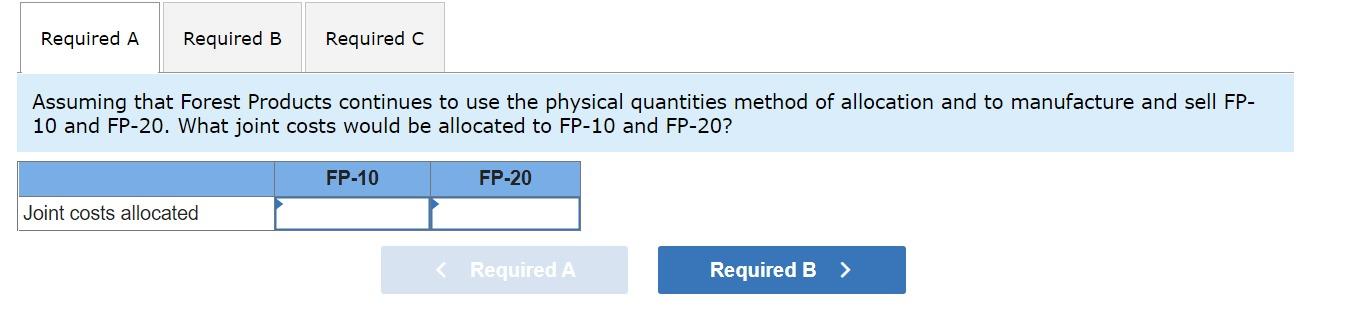

Assuming that Forest Products continues to use the physical quantities method of allocation and to manufacture and sell FP10 and FP-20. What joint costs would be allocated to FP-10 and FP-20?

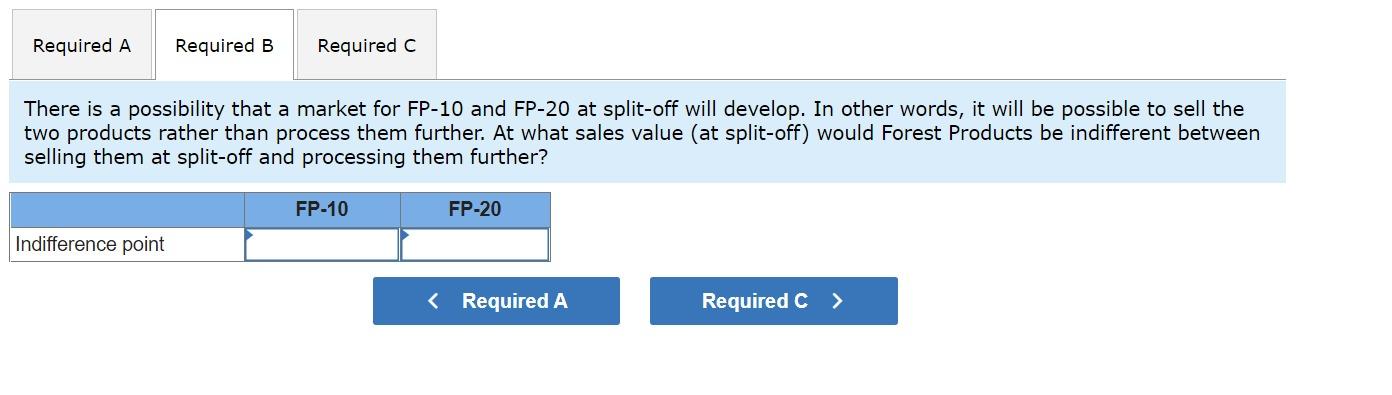

There is a possibility that a market for FP-10 and FP-20 at split-off will develop. In other words, it will be possible to sell the wo products rather than process them further. At what sales value (at split-off) would Forest Products be indifferent between selling them at split-off and processing them further?

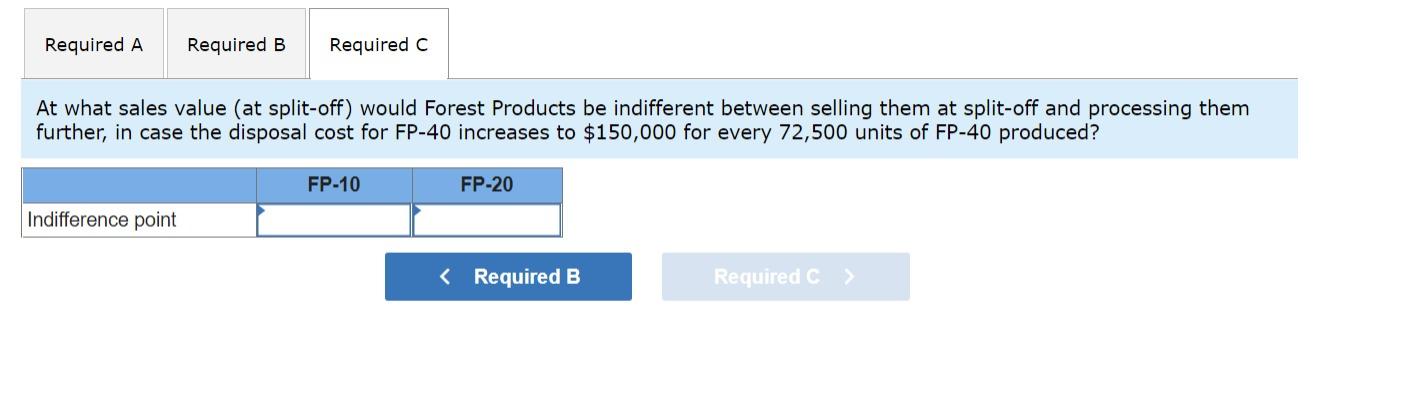

At what sales value (at split-off) would Forest Products be indifferent between selling them at split-off and processing them further, in case the disposal cost for FP-40 increases to \( \$ 150,000 \) for every 72,500 units of FP-40 produced?

Expert Answer

Allocation of Joint Cost using a Physical Measures Method Allocation per unit= Joint Cost/Total unit Allocation per unit= $240600/21