Home /

Expert Answers /

Accounting /

for-all-payroll-calculations-use-the-following-tax-rates-and-round-amounts-to-the-nearest-cent-em-pa228

(Solved): For all payroll calculations, use the following tax rates and round amounts to the nearest cent. Em ...

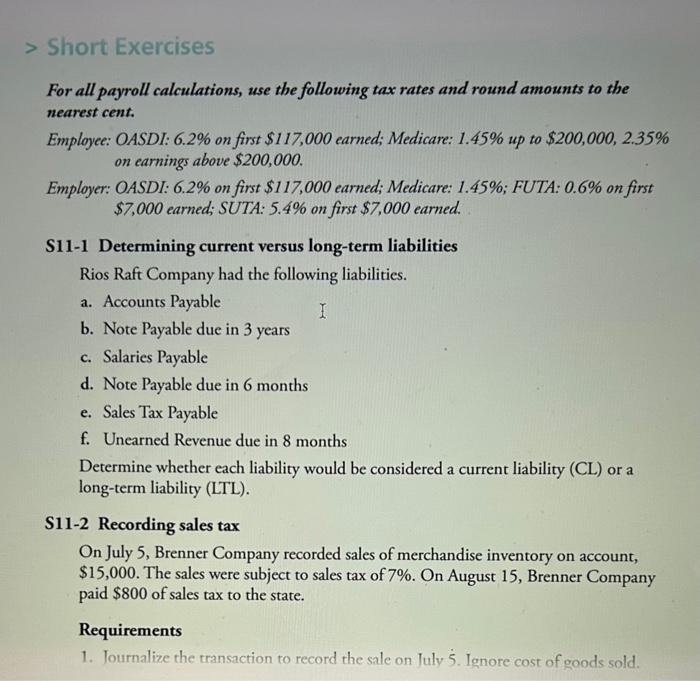

For all payroll calculations, use the following tax rates and round amounts to the nearest cent. Employee: OASDI: \( 6.2 \% \) on first \( \$ 117,000 \) earned; Medicare: \( 1.45 \% \) up to \( \$ 200,000,2.35 \% \) on earnings above \( \$ 200,000 \). Employer: OASDI: \( 6.2 \% \) on first \( \$ 117,000 \) earned; Medicare: \( 1.45 \% ; F U T A: 0.6 \% \) on first \( \$ 7,000 \) earned; SUTA: \( 5.4 \% \) on first \( \$ 7,000 \) earned. S11-1 Determining current versus long-term liabilities Rios Raft Company had the following liabilities. a. Accounts Payable b. Note Payable due in 3 years c. Salaries Payable d. Note Payable due in 6 months e. Sales Tax Payable f. Unearned Revenue due in 8 months Determine whether each liability would be considered a current liability (CL) or a long-term liability (LTL). S11-2 Recording sales tax On July 5, Brenner Company recorded sales of merchandise inventory on account, \( \$ 15,000 \). The sales were subject to sales tax of \( 7 \% \). On August 15 , Brenner Company paid \( \$ 800 \) of sales tax to the state. Requirements 1. Journalize the transaction to record the sale on July 5 . Ignore cost of goods sold.

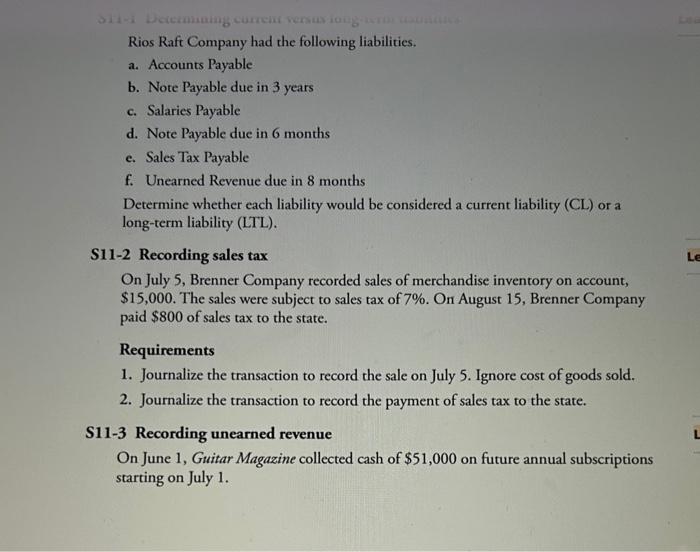

Rios Raft Company had the following liabilities. a. Accounts Payable b. Note Payable due in 3 years c. Salaries Payable d. Note Payable due in 6 months e. Sales Tax Payable f. Unearned Revenue due in 8 months Determine whether each liability would be considered a current liability (CL) or a long-term liability (LTL). S11-2 Recording sales tax On July 5, Brenner Company recorded sales of merchandise inventory on account, \( \$ 15,000 \). The sales were subject to sales tax of \( 7 \% \). On August 15, Brenner Company paid \( \$ 800 \) of sales tax to the state. Requirements 1. Journalize the transaction to record the sale on July 5 . Ignore cost of goods sold. 2. Journalize the transaction to record the payment of sales tax to the state. S11-3 Recording unearned revenue On June 1, Guitar Magazine collected cash of \( \$ 51,000 \) on future annual subscriptions starting on July 1.

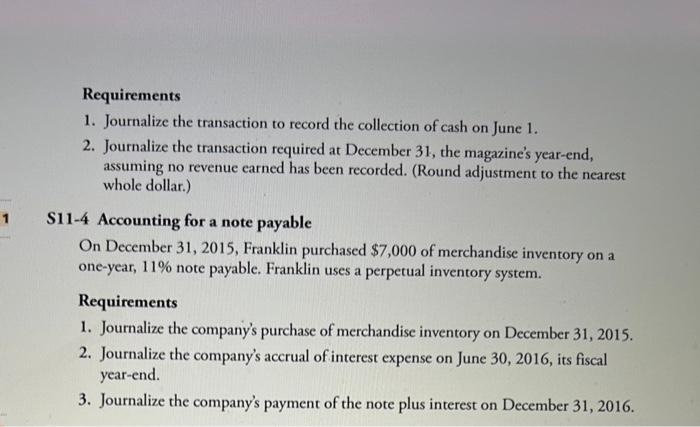

Requirements 1. Journalize the transaction to record the collection of cash on June 1. 2. Journalize the transaction required at December 31 , the magazine's year-end, assuming no revenue earned has been recorded. (Round adjustment to the nearest whole dollar.) S11-4 Accounting for a note payable On December 31, 2015, Franklin purchased \( \$ 7,000 \) of merchandise inventory on a one-year, \( 11 \% \) note payable. Franklin uses a perpetual inventory system. Requirements 1. Journalize the company's purchase of merchandise inventory on December \( 31,2015 \). 2. Journalize the company's accrual of interest expense on June 30,2016 , its fiscal year-end. 3. Journalize the company's payment of the note plus interest on December \( 31,2016 \).

Expert Answer

Answer 1 Table is drawn the explanation of Employee benifits. Employee benefits expen