Home /

Expert Answers /

Accounting /

farmer-company-purchased-equipment-on-january-1-year-1-for-141-000-the-machines-are-est-pa819

(Solved): Farmer Company purchased equipment on January 1 , Year 1 for \( \$ 141,000 \). The machines are est ...

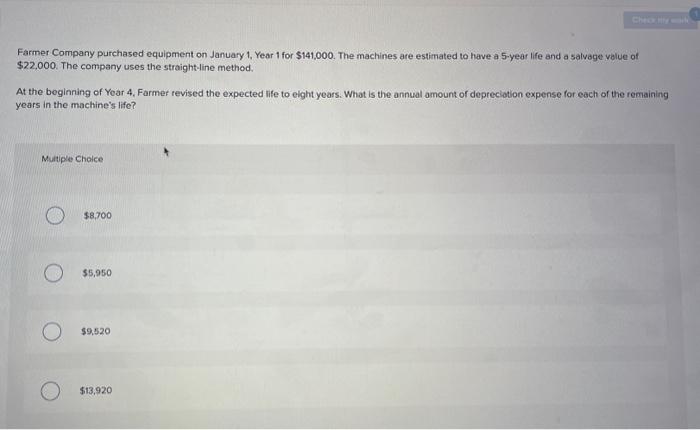

Farmer Company purchased equipment on January 1 , Year 1 for \( \$ 141,000 \). The machines are estimated to have a 5 -year life and a salvage value of \( \$ 22,000 \). The company uses the straight-line method. At the beginning of Yoar 4, Farmer revised the expected life to elght years. What is the annual amount of depreciotion expense for each of the remaining years in the machine's life? Muitiple Chatce \[ \$ 8,700 \] \[ \$ 5,950 \] \[ \$ 9,520 \] \[ \$ 13,920 \]

Expert Answer

The computation of the depreciation expense is shown below:- Depreciatio