Home /

Expert Answers /

Accounting /

exercise-5-5-algo-present-value-single-amount-lo-5-3-the-four-actors-below-have-just-signed-a-pa296

(Solved): Exercise 5-5 (Algo) Present value; single amount (LO 5-3) The four actors below have just signed a ...

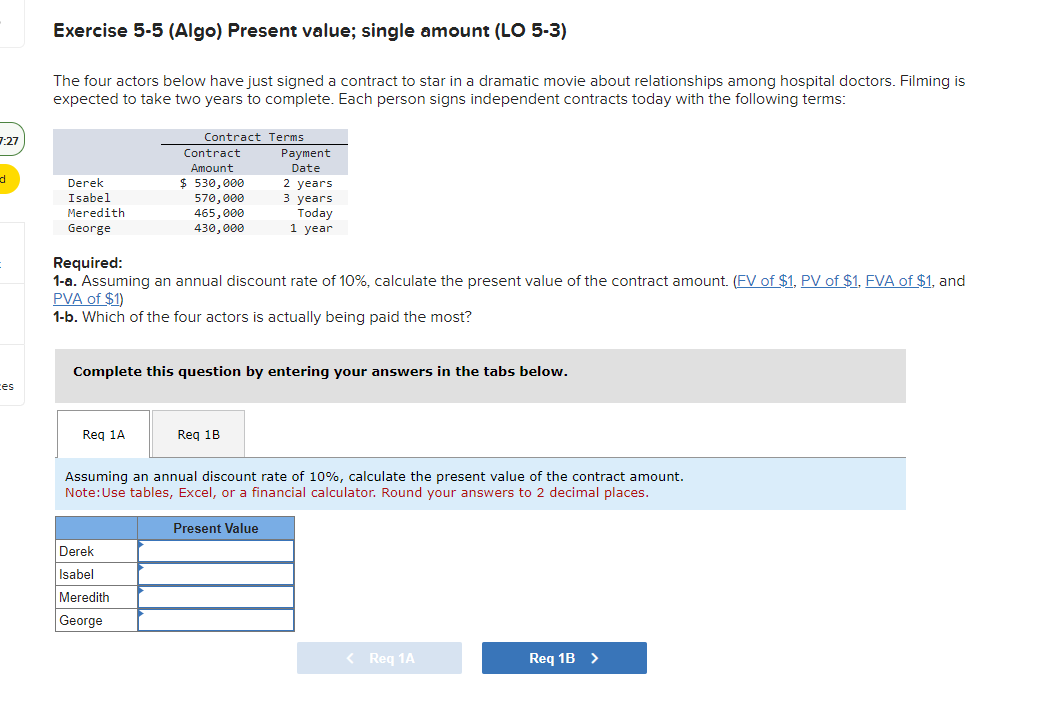

Exercise 5-5 (Algo) Present value; single amount (LO 5-3) The four actors below have just signed a contract to star in a dramatic movie about relationships among hospital doctors. Filming is expected to take two years to complete. Each person signs independent contracts today with the following terms: Required: 1-a. Assuming an annual discount rate of \( 10 \% \), calculate the present value of the contract amount. (FV of \( \$ 1 \), PV of \( \$ 1 \), FVA of \( \$ 1 \), and PVA of \( \$ 1) \) 1-b. Which of the four actors is actually being paid the most? Complete this question by entering your answers in the tabs below. Assuming an annual discount rate of \( 10 \% \), calculate the present value of the contract amount. Note:Use tables, Excel, or a financial calculator. Round your answers to 2 decimal places.

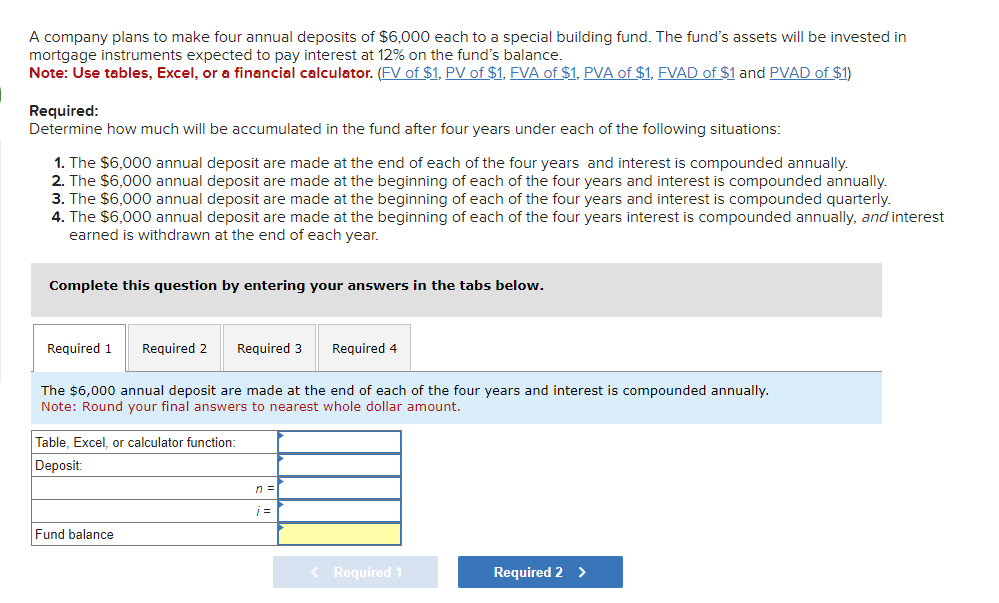

A company plans to make four annual deposits of \( \$ 6,000 \) each to a special building fund. The fund's assets will be invested in mortgage instruments expected to pay interest at \( 12 \% \) on the fund's balance. Note: Use tables, Excel, or a financial calculator. (FV of \( \$ 1 \), PV of \( \$ 1 \), FVA of \( \$ 1 \), PVA of \( \$ 1 \), FVAD of \( \$ 1 \) and \( \underline{P V A D} \) of \( \$ 1 \) ) Required: Determine how much will be accumulated in the fund after four years under each of the following situations: 1. The \( \$ 6,000 \) annual deposit are made at the end of each of the four years and interest is compounded annually. 2. The \( \$ 6,000 \) annual deposit are made at the beginning of each of the four years and interest is compounded annually. 3. The \( \$ 6,000 \) annual deposit are made at the beginning of each of the four years and interest is compounded quarterly. 4. The \( \$ 6,000 \) annual deposit are made at the beginning of each of the four years interest is compounded annually, and interest earned is withdrawn at the end of each year. Complete this question by entering your answers in the tabs below. The \( \$ 6,000 \) annual deposit are made at the end of each of the four years and interest is compounded annually. Note: Round your final answers to nearest whole dollar amount.

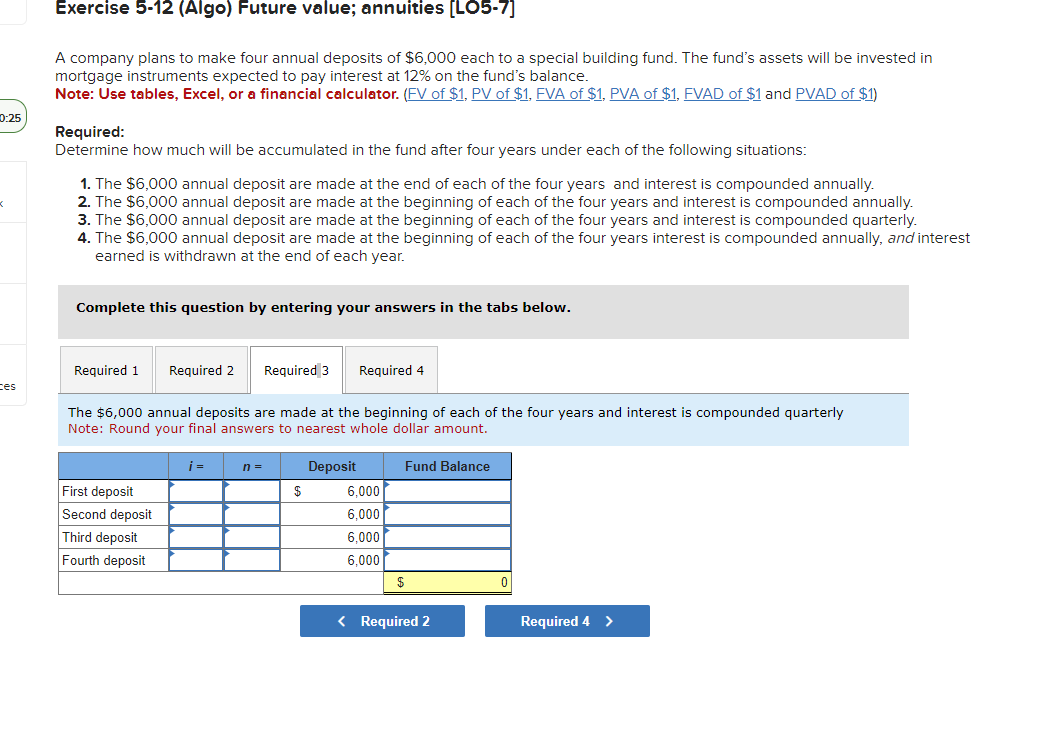

Exercise 5-12 (Algo) Future value; annuities [LO5-7] A company plans to make four annual deposits of \( \$ 6,000 \) each to a special building fund. The fund's assets will be invested in mortgage instruments expected to pay interest at \( 12 \% \) on the fund's balance. Note: Use tables, Excel, or a financial calculator. (FV of \( \$ 1, P V \) of \( \$ 1 \), FVA of \( \$ 1 \), PVA of \( \$ 1 \), FVAD of \( \$ 1 \) and \( P V A D \) of \( \$ 1 \) ) Required: Determine how much will be accumulated in the fund after four years under each of the following situations: 1. The \( \$ 6,000 \) annual deposit are made at the end of each of the four years and interest is compounded annually. 2. The \( \$ 6,000 \) annual deposit are made at the beginning of each of the four years and interest is compounded annually. 3. The \( \$ 6,000 \) annual deposit are made at the beginning of each of the four years and interest is compounded quarterly. 4. The \( \$ 6,000 \) annual deposit are made at the beginning of each of the four years interest is compounded annually, and interest earned is withdrawn at the end of each year. Complete this question by entering your answers in the tabs below. The \( \$ 6,000 \) annual deposits are made at the beginning of each of the four years and interest is compounded annually. Note: Round your final answers to nearest whole dollar amount.

A company plans to make four annual deposits of \( \$ 6,000 \) each to a special building fund. The fund's assets will be invested in mortgage instruments expected to pay interest at \( 12 \% \) on the fund's balance. Note: Use tables, Excel, or a financial calculator. (FV of \( \$ 1 \), PV of \( \$ 1 \), FVA of \( \$ 1 \), PVA of \( \$ 1 \), FVAD of \( \$ 1 \) and PVAD of \( \$ 1 \) ) Required: Determine how much will be accumulated in the fund after four years under each of the following situations: 1. The \( \$ 6,000 \) annual deposit are made at the end of each of the four years and interest is compounded annually. 2. The \( \$ 6,000 \) annual deposit are made at the beginning of each of the four years and interest is compounded annually. 3. The \( \$ 6,000 \) annual deposit are made at the beginning of each of the four years and interest is compounded quarterly. 4. The \( \$ 6,000 \) annual deposit are made at the beginning of each of the four years interest is compounded annually, and interest earned is withdrawn at the end of each year. Complete this question by entering your answers in the tabs below. The \( \$ 6,000 \) annual deposits are made at the beginning of each of the four years and interest is compounded quarterly Note: Round your final answers to nearest whole dollar amount.

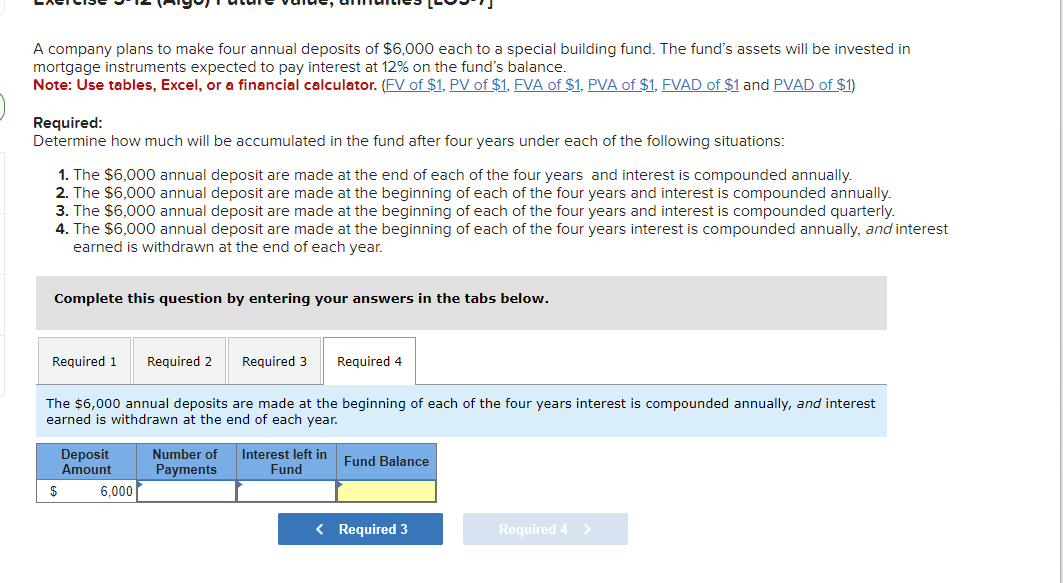

A company plans to make four annual deposits of \( \$ 6,000 \) each to a special building fund. The fund's assets will be invested in mortgage instruments expected to pay interest at \( 12 \% \) on the fund's balance. Note: Use tables, Excel, or a financial calculator. (FV of \( \$ 1, \underline{P V} \) of \( \$ 1, \underline{F V A} \) of \( \$ 1, \underline{P V A} \) of \( \$ 1, \underline{F V D} \) of \( \$ 1 \) and \( \underline{P V A D} \) of \( \$ 1 \) ) Required: Determine how much will be accumulated in the fund after four years under each of the following situations: 1. The \( \$ 6,000 \) annual deposit are made at the end of each of the four years and interest is compounded annully. 2. The \( \$ 6,000 \) annual deposit are made at the beginning of each of the four years and interest is compounded annully. 3. The \( \$ 6,000 \) annual deposit are made at the beginning of each of the four years and interest is compounded quarterly. 4. The \( \$ 6,000 \) annual deposit are made at the beginning of each of the four years interest is compounded annually, and interest earned is withdrawn at the end of each year. Complete this question by entering your answers in the tabs below. The \( \$ 6,000 \) annual deposits are made at the beginning of each of the four years interest is compounded annually, and interest earned is withdrawn at the end of each year.

Expert Answer

Answer to 5-5: Use the PV formula in excel to solve the present value of the contract = PV(rate,nper,pmt,fv,type)

![Exercise 5-12 (Algo) Future value; annuities [LO5-7]

A company plans to make four annual deposits of \( \$ 6,000 \) each to a](https://media.cheggcdn.com/media/106/106c8f69-4e34-4b01-9c30-1e8039ebc689/phpAOBuqX)