Home /

Expert Answers /

Accounting /

exercise-2-11-preparing-comprehensive-income-statement-lo2-5-lo2-9-jdw-corporation-reported-the-pa136

(Solved): Exercise 2-11 Preparing comprehensive income statement (LO2-5, LO2-9) JDW Corporation reported the ...

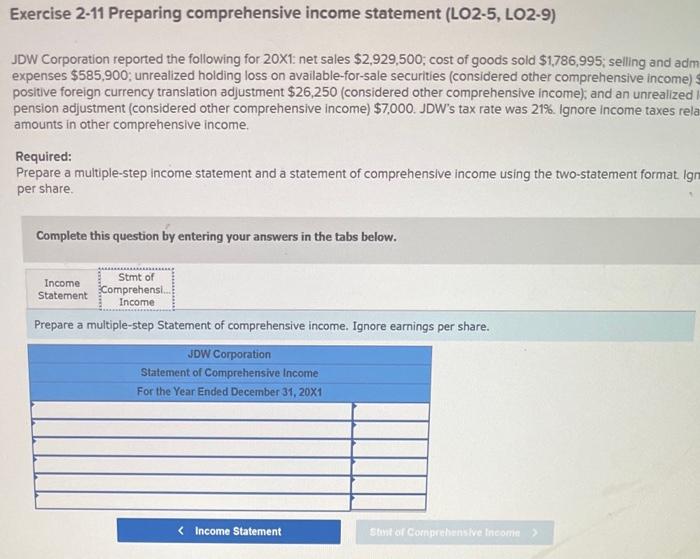

Exercise 2-11 Preparing comprehensive income statement (LO2-5, LO2-9) JDW Corporation reported the following for : net sales ; cost of goods sold ; selling and administrative expenses \$585,900; unrealized holding loss on avallable-for-sale securities (considered other comprehensive income) ; a positive foreign currency transiation adjustment (considered other comprehensive income); and an unrealized loss from pension adjustment (considered other comprehensive income) . JDW's tax rate was . Ignore income taxes related to amounts in other comprehensive income. Required: Prepare a multiple-step income statement and a statement of comprehensive income using the two-statement format. Ignore earnings per share. Complete this question by entering your answers in the tabs below. Prepare a multiple-step income statement. Ignore earnings per share. (Round your final answers to nearest whole dollar.)

Exercise 2-11 Preparing comprehensive income statement (LO2-5, LO2-9) JDW Corporation reported the following for 20X1: net sales ; cost of goods sold ; selling and adn expenses ; unrealized holding loss on available-for-sale securities (considered other comprehensive income) positive foreign currency translation adjustment (considered other comprehensive income); and an unrealized pension adjustment (considered other comprehensive income) . JDW's tax rate was . Ignore income taxes rela amounts in other comprehensive income. Required: Prepare a multiple-step income statement and a statement of comprehensive income using the two-statement format igi per share. Complete this question by entering your answers in the tabs below. Prepare a multiple-step Statement of comprehensive income. Ignore earnings per share.

Expert Answer

Preparation of a multiple - step income statement for the year ended December 31, 20X1