Home /

Expert Answers /

Accounting /

entries-for-payroll-and-payroll-taxes-the-following-information-about-the-payroll-for-the-week-ende-pa253

(Solved): Entries for Payroll and Payroll Taxes The following information about the payroll for the week ende ...

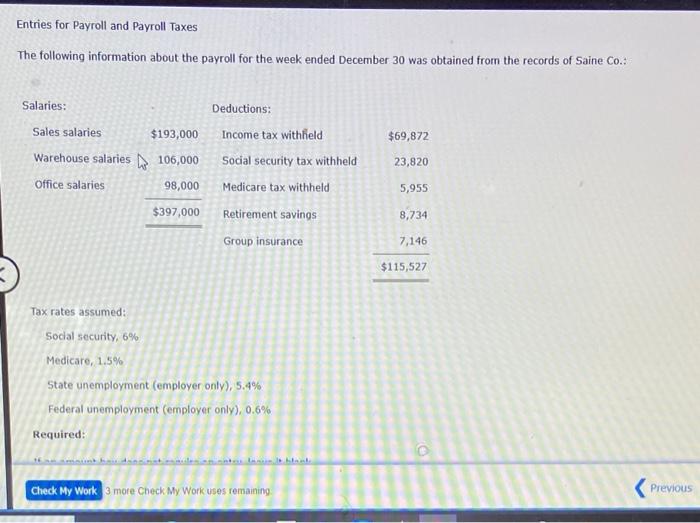

Entries for Payroll and Payroll Taxes The following information about the payroll for the week ended December 30 was obtained from the records of 5 aine Co.:

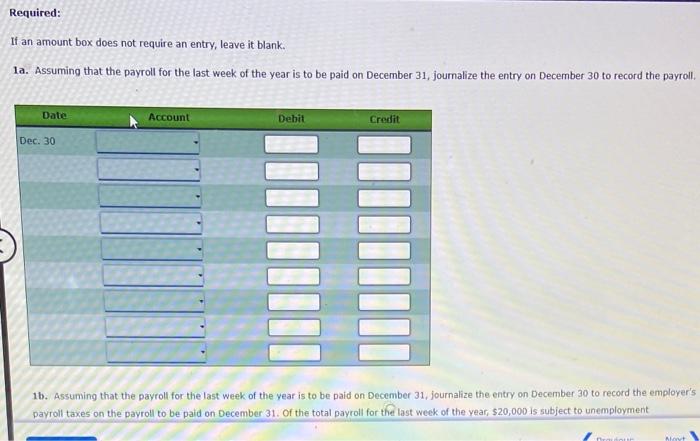

If an amount box does not require an entry, leave it blank. 1a. Assuming that the payroll for the last week of the year is to be paid on December 31 , joumalize the entry on December 30 to record the payroll. 1b. Assuming that the payroll for the last week of the year is to be paid on December 31 , journalize the entry on December 30 to record the employer's payroll taxes on the payroll to be paid on December 31 . Of the total payroll for the last week of the year, \( \$ 20,000 \) is subject to unemployment

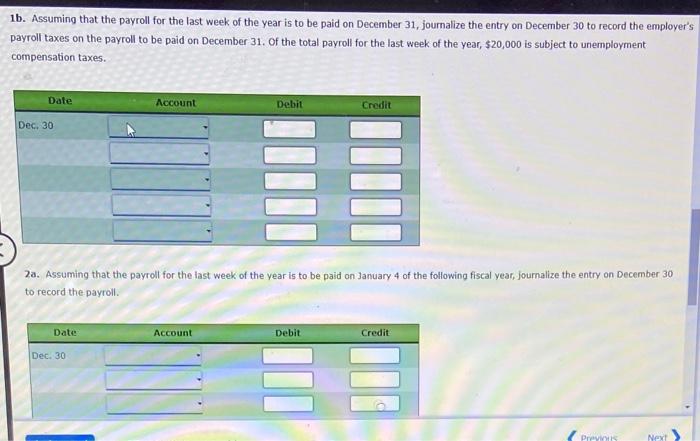

1b. Assuming that the payroll for the last week of the year is to be paid on December 31 , journalize the entry on December 30 to record the employer's payroll taxes on the payroll to be paid on December 31 . Of the total payroll for the last week of the year, \( \$ 20,000 \) is subject to unemployment compensation taxes. 2a. Assuming that the payroll for the last week of the year is to be paid on lanuary 4 of the following fiscal year, journalize the entry on December 30 to record the payroll.

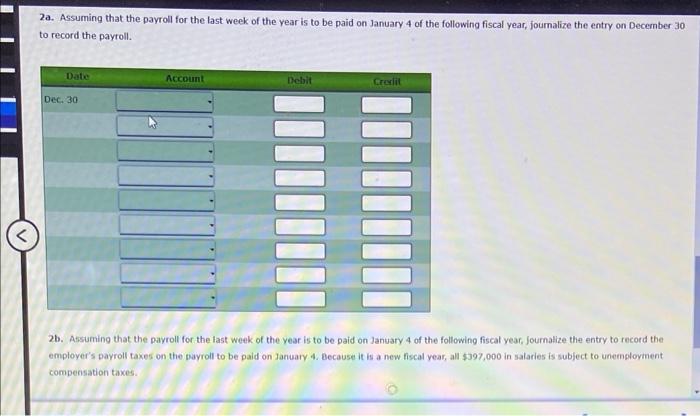

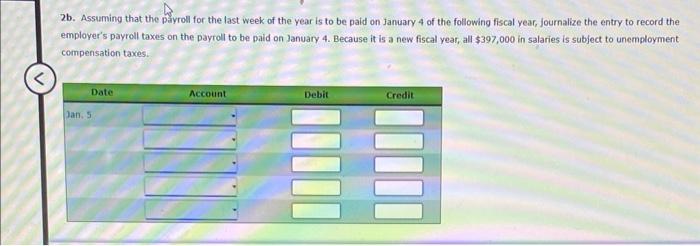

2a. Assuming that the payroll for the last week of the year is to be paid on January 4 of the following fiscal year, journalize the entry on December 30 . to record the payroll. 26. Ansuming that the payroll for the last week of the year is to be paid on January 4 of the following fiscal year, journalize the entry to record the employer's bayroll taxes on the payroll to be paid on January 4. Because it is a new fiscal year, all \( \$ 397,000 \) in salaries is subject to uneeneloyinent compensation taxes.

2b. Assuming that the payrol for the last week of the year is to be paid on january 4 of the following fiscal year, Journalize the entry to record the employer's payroll taxes on the payroll to be paid on lanuary \( 4 . \) Because it is a new fiscal year, all \( \$ 397,000 \) in salaries is subject to unemployment compensation taxes.