Home /

Expert Answers /

Finance /

during-2021-raines-umbrella-corporation-had-sales-of-700-000-cost-of-goods-sold-administrative-a-pa702

(Solved): During 2021, Raines Umbrella Corporation had sales of $700,000. Cost of goods sold, administrative a ...

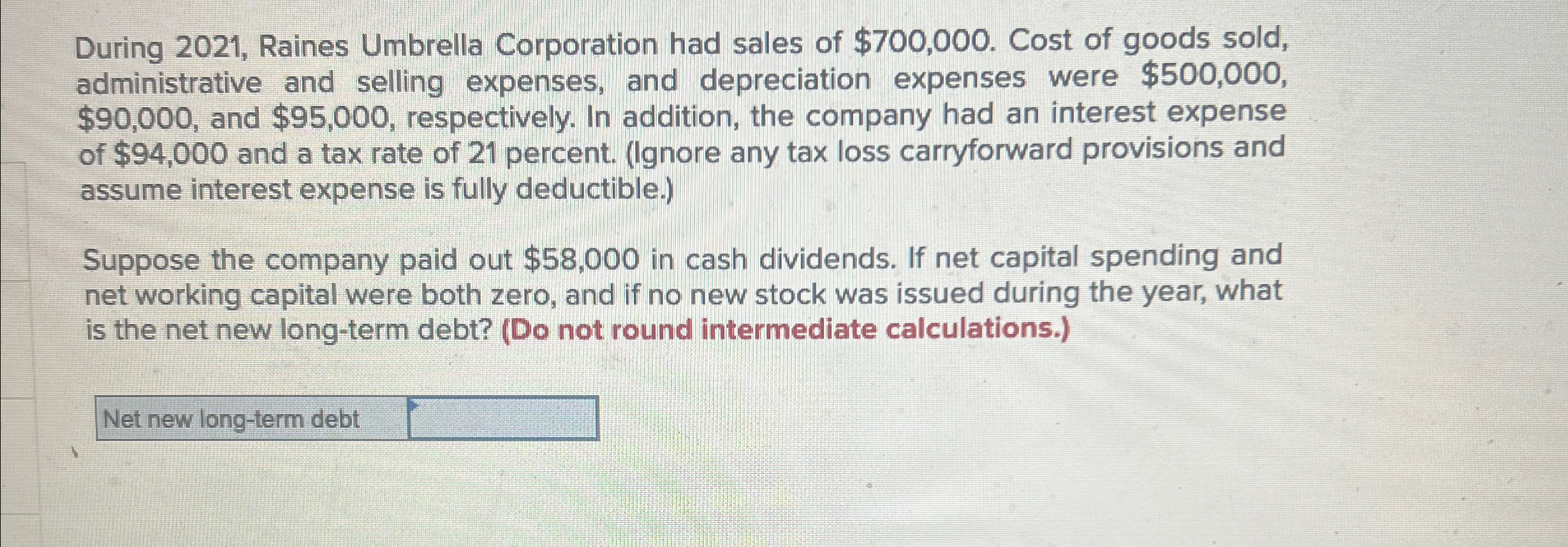

During 2021, Raines Umbrella Corporation had sales of

$700,000. Cost of goods sold, administrative and selling expenses, and depreciation expenses were

$500,000,

$90,000, and

$95,000, respectively. In addition, the company had an interest expense of

$94,000and a tax rate of 21 percent. (Ignore any tax loss carryforward provisions and assume interest expense is fully deductible.) Suppose the company paid out

$58,000in cash dividends. If net capital spending and net working capital were both zero, and if no new stock was issued during the year, what is the net new long-term debt? (Do not round intermediate calculations.) Net new long-term debt