Home /

Expert Answers /

Finance /

digital-organics-do-has-the-opportunity-to-invest-1-14-million-now-t-0-and-expe-pa582

(Solved): Digital Organics (DO) has the opportunity to invest \( \$ 1.14 \) million now \( (t=0) \) and expe ...

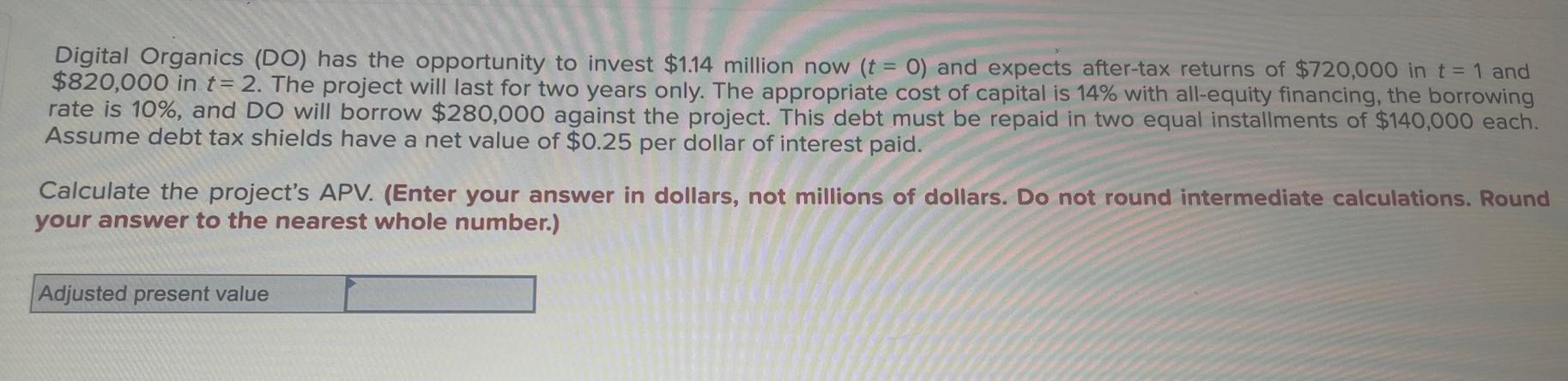

Digital Organics (DO) has the opportunity to invest \( \$ 1.14 \) million now \( (t=0) \) and expects after-tax returns of \( \$ 720,000 \) in \( t=1 \) and \( \$ 820,000 \) in \( t=2 \). The project will last for two years only. The appropriate cost of capital is \( 14 \% \) with all-equity financing, the borrowing rate is \( 10 \% \), and DO will borrow \( \$ 280,000 \) against the project. This debt must be repaid in two equal installments of \( \$ 140,000 \) each. Assume debt tax shields have a net value of \( \$ 0.25 \) per dollar of interest paid. Calculate the project's APV. (Enter your answer in dollars, not millions of dollars. Do not round intermediate calculations. Round your answer to the nearest whole number.)