(Solved): Dickinson Company has $12,100,000 million in assets. Currently hall of these assets are financed wit ...

Dickinson Company has

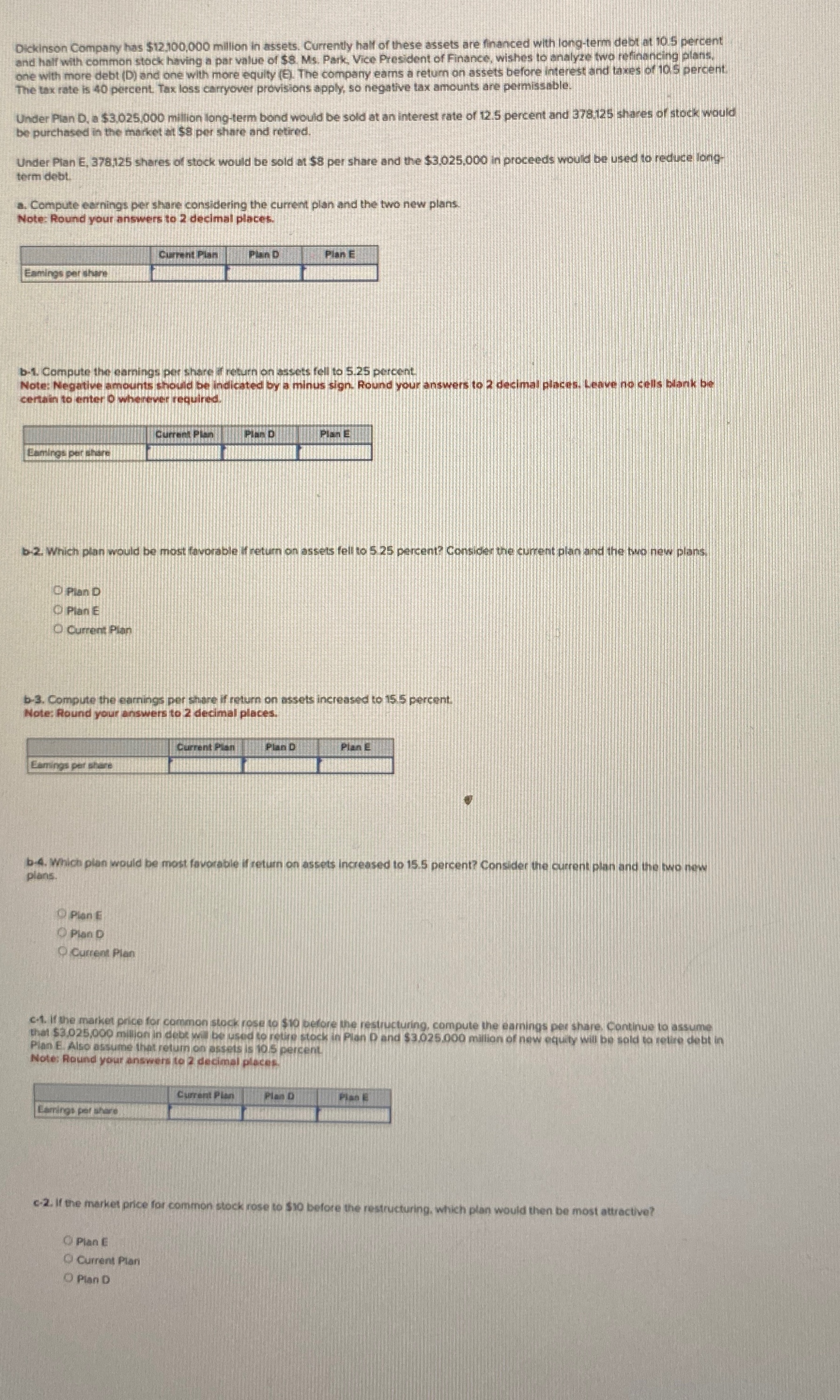

$12,100,000million in assets. Currently hall of these assets are financed with long-term debt at 10 . 5 percent and hall with common stock having a par value of

$8. Ms. Park, Vice President of Finance, wishes to analyce two refinancing plans. one with more debt (D) and one with more equity (E). The company eams a retum on assets before interest and taces of

10Spercent The tax rate is 40 percent. Tax loss carryover provisions apply, so negative tax amounts are permissable. Under Plan D, a

$3,025,000million long-term bond would be sold at an interest rate of 12.5 percent and 378125 shares of stock would be purchased in the market at

$8per share and retired. Under Plan E, 378,125 shares of stock would be sold at

$8per share and the

$3,025,000in proceeds would be used to reduce longterm debt. a. Compute earnings per share considering the currem plan and the two new plans. Note: Round your answers to 2 decimal places. \table[[,Ciment Plan,Pian D,Plan E],[Eamings per theme,,,]] b-1. Compute the earnings per share ir return on assets fell to 5.25 percent Note: Negative amounts should be indicated by a minus sign. Round your answers to 2 decimal places, Leave no cells blank be certain to enter o wherever required. \table[[,Current Plin,Plan D,PlanE],[Eanings per sthare,,,]] b-2. Wrich plan would be most fovorable ifreturn on assets fell to 525 percent? Consider the current plan and the two new plans. O piand O PIanE O Current Plan b-3. Compute the earnings per share if retum on ossets increased to 15.5 percent. Note: Round your answers to 2 decimal places. \table[[,Current Plan,Plan D,PlanE],[Cemings per stare,,,]] b-4. Which plan would be most fovorable if return on assets increased to 15.5 percent? Consider the current plan and the two new plans. Pion E Pion D Q Current Plan c-1. If the market price for common stock rose to

$10before the restructuring, compute the earnings per share continue to assume that

$3,025,000million in debe will be used to retire stock io Plan

Dand

$3.025.000million of new equity will be sold ta retire debt in Pian E. Also ossume that retum on assets is 10 s percent. Nole: Aound your answers to 2 decimal places. \table[[,Current Pien,Plan D,Plan E],[,,,]] c.2. If the market price for common stock rose to

$10before the restructuring, which plan would then be most atractive? OPIanE O Current Plan O Pian D