(Solved): Consider three bonds with 6.20% coupon rates, all making annual coupon payments and all selling at ...

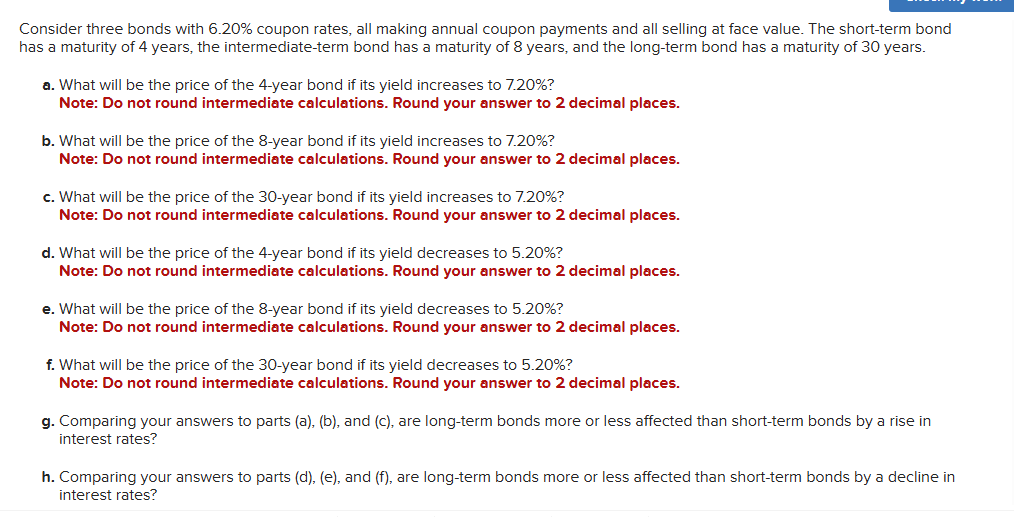

Consider three bonds with

6.20%coupon rates, all making annual coupon payments and all selling at face value. The short-term bond has a maturity of 4 years, the intermediate-term bond has a maturity of 8 years, and the long-term bond has a maturity of 30 years. a. What will be the price of the 4 -year bond if its yield increases to

7.20%? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. b. What will be the price of the 8 -year bond if its yield increases to

7.20%? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. c. What will be the price of the 30 -year bond if its yield increases to

7.20%? Note: Do not round intermediate calculations. Round your answer to

2decimal places. d. What will be the price of the 4 -year bond if its yield decreases to

5.20%? Note: Do not round intermediate calculations. Round your answer to

2decimal places. e. What will be the price of the 8 -year bond if its yield decreases to

5.20%? Note: Do not round intermediate calculations. Round your answer to

2decimal places. f. What will be the price of the 30 -year bond if its yield decreases to

5.20%? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. g. Comparing your answers to parts (a), (b), and (c), are long-term bonds more or less affected than short-term bonds by a rise in interest rates? h. Comparing your answers to parts (d), (e), and (f), are long-term bonds more or less affected than short-term bonds by a decline in interest rates?