Home /

Expert Answers /

Accounting /

certain-taxpayers-may-be-able-to-adjust-their-gross-income-on-schedule-1-form-1040-if-they-have-pa960

(Solved): Certain taxpayers may be able to adjust their gross income on Schedule 1 (Form 1040), if they have ...

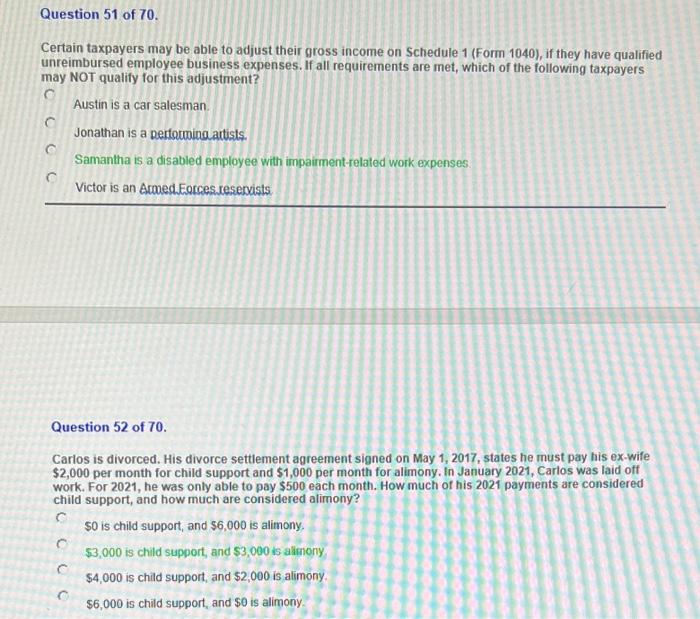

Certain taxpayers may be able to adjust their gross income on Schedule 1 (Form 1040), if they have qualified unreimbursed employee business expenses. If all requirements are met, which of the following taxpayers may NOT qualify for this adjustment? Austin is a car salesman. Jonathan is a perfotminga attists. Samantha is a disabled employee with impairment-related work expenses. Victor is an Acmed. Eorces reservists. Question 52 of 70. Carlos is divorced. His divorce settlement agreement signed on May 1, 2017, states he must pay his ex-wife \( \$ 2,000 \) per month for child support and \( \$ 1,000 \) per month for alimony. In January 2021, Carlos was laid off work. For 2021, he was only able to pay \( \$ 500 \) each month. How much of his 2021 payments are considered child support, and how much are considered alimony? \( \$ 0 \) is child support, and \( \$ 6,000 \) is alimony. \( \$ 3,000 \) is child support, and \( \$ 3,000 \) is allmony. \( \$ 4,000 \) is child support, and \( \$ 2,000 \) is alimony. \( \$ 6,000 \) is child support, and \( \$ 0 \) is alimony.

Expert Answer

1. Certain taxpayers may be able to adjust their gross income on