Home /

Expert Answers /

Accounting /

cain-incorporated-reports-net-income-of-19-000-its-comparative-balance-sheet-shows-the-following-c-pa365

(Solved): Cain Incorporated reports net income of $19,000. Its comparative balance sheet shows the following c ...

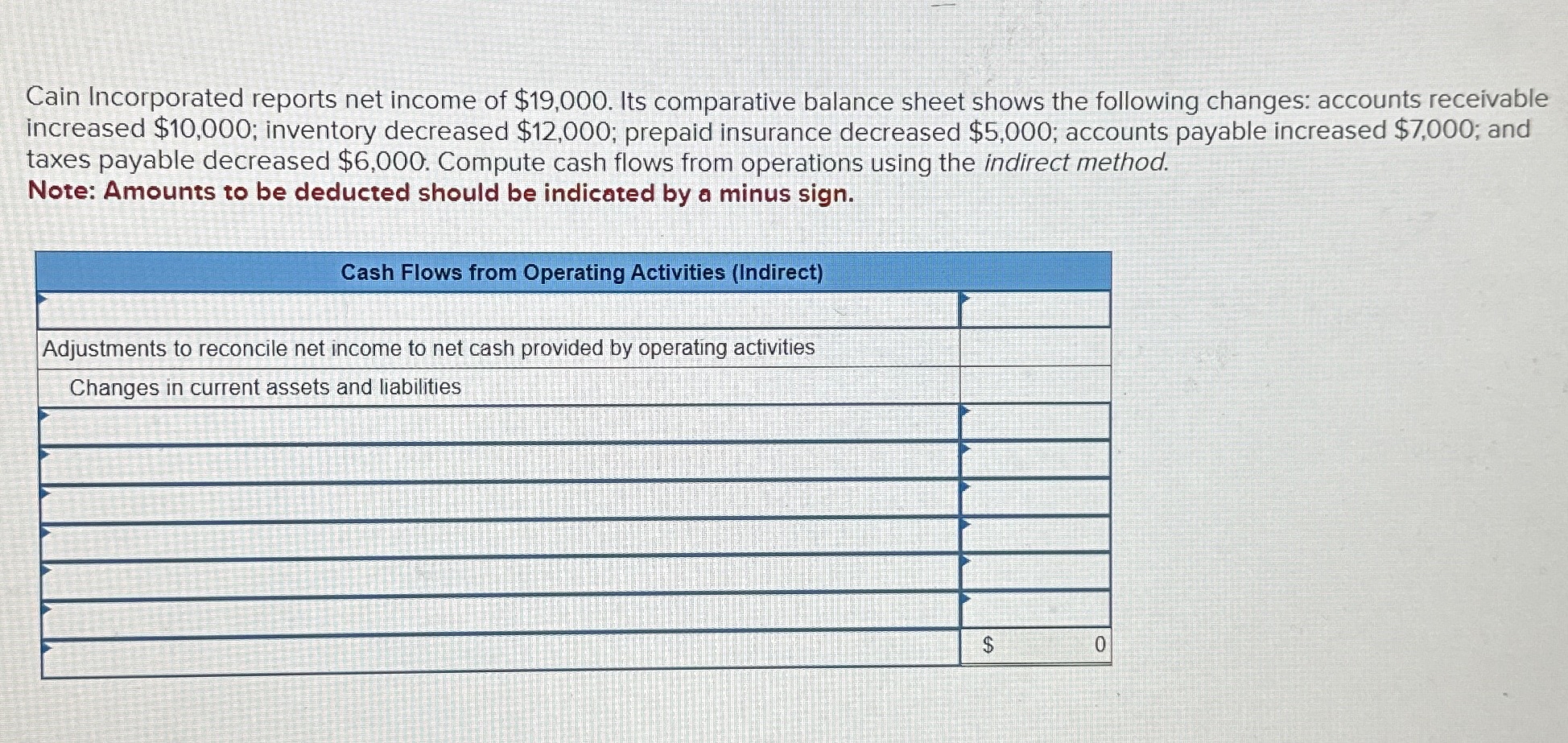

Cain Incorporated reports net income of

$19,000. Its comparative balance sheet shows the following changes: accounts receivable increased

$10,000; inventory decreased

$12,000; prepaid insurance decreased

$5,000; accounts payable increased

$7,000; and taxes payable decreased

$6,000. Compute cash flows from operations using the indirect method. Note: Amounts to be deducted should be indicated by a minus sign. \table[[Cash Flows from Operating Activities (Indirect)],[,],[Adjustments to reconcile net income to net cash provided by operating activities,],[Changes in current assets and liabilities,],[,],[,],[,],[,]]