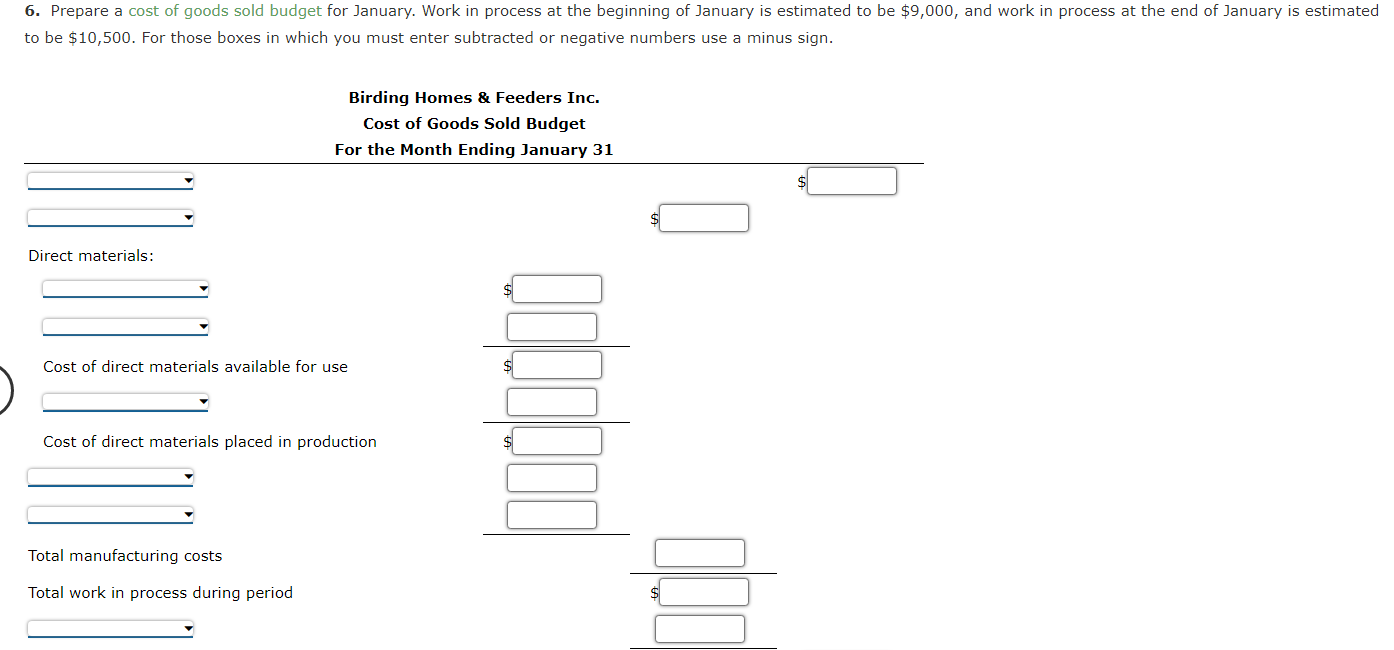

(Solved): Budgeted income statement and supporting budgetsThe budget director of Birding Homes & Fe ...

Budgeted income statement and supporting budgets

The budget director of Birding Homes & Feeders Inc., with the assistance of the controller, treasurer, production manager, and sales manager, has gathered the following data for use in developing the budgeted income statement for January:

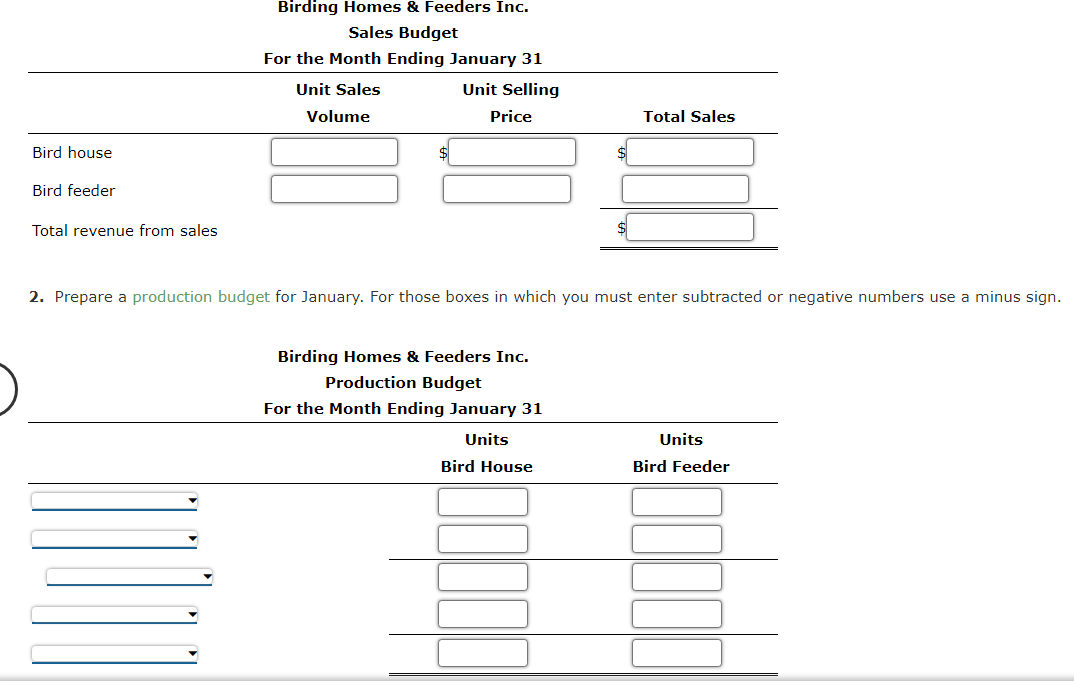

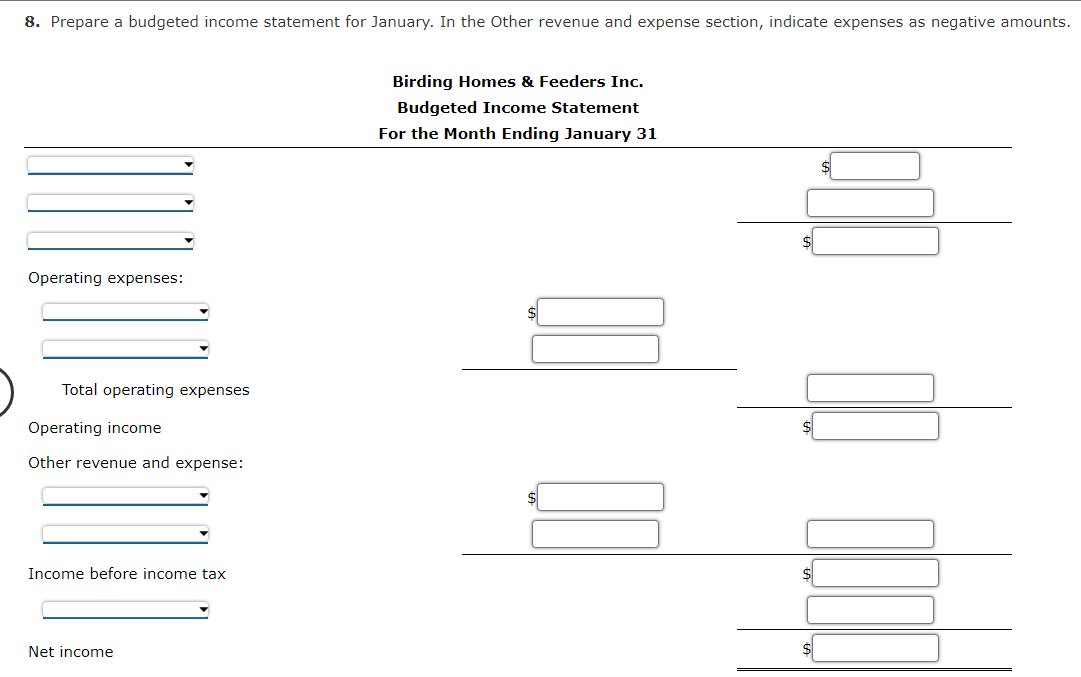

a. Estimated sales for January:

Bird house 15,000 units at $25 per unit

Bird feeder 40,000 units at $15 per unit

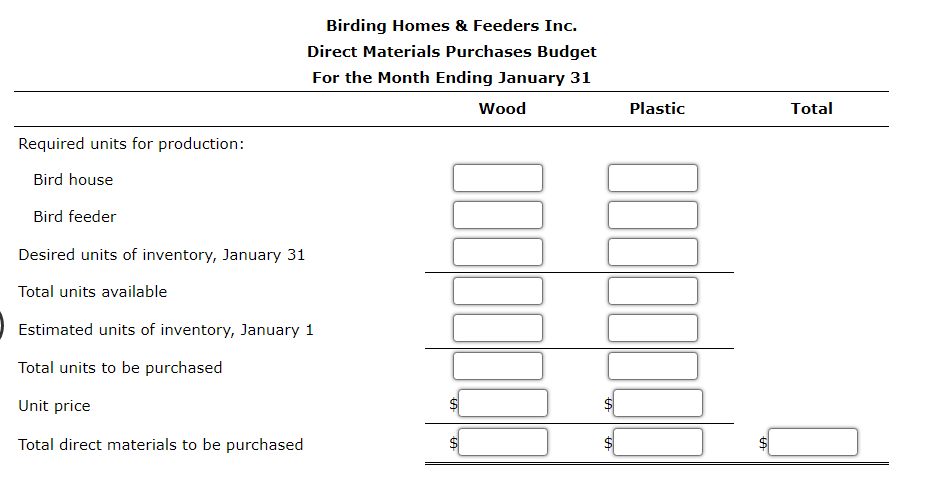

b. Estimated inventories at January 1:

Direct materials:

Wood 600 ft.

Plastic 1,000 lbs.

Finished products:

Bird house 1,000 units at $15 per unit

Bird feeder 2,500 units at $8 per unit

c. Desired inventories at January 31:

Direct materials:

Wood 500 ft.

Plastic 1,250 lbs.

Finished products:

Bird house 1,500 units at $15 per unit

Bird feeder 3,000 units at $8 per unit

d. Direct materials used in production:

In manufacture of Bird House:

Wood 0.80 ft. per unit of product

Plastic 0.10 lb. per unit of product

In manufacture of Bird Feeder:

Wood 0.20 ft. per unit of product

Plastic 1.00 lb. per unit of product

e. Anticipated cost of purchases and beginning and ending inventory of direct materials:

Wood $2.50 per ft. Plastic $0.80 per lb.

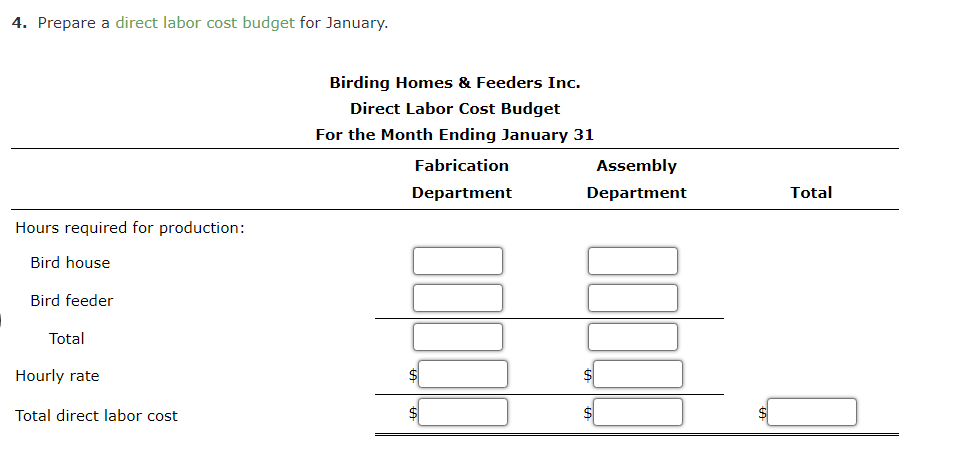

f. Direct labor requirements:

Bird House:

Fabrication Department 0.40 hr. at $18 per hr.

Assembly Department 0.20 hr. at $12 per hr.

Bird Feeder:

Fabrication Department 0.25 hr. at $18 per hr.

Assembly Department 0.10 hr. at $12 per hr.

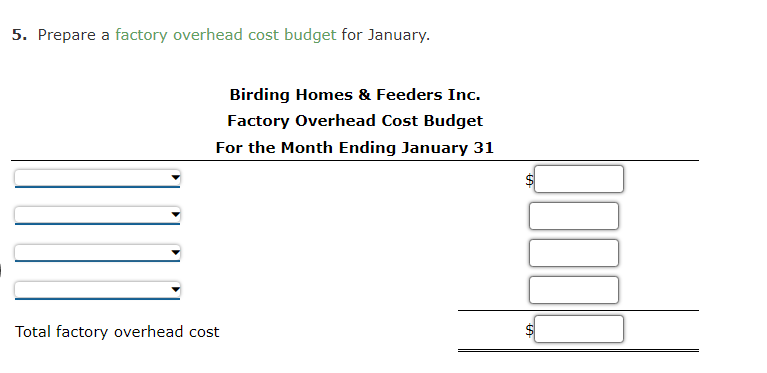

g. Estimated factory overhead costs for January:

| Line Item Description | Amount |

|---|---|

| Indirect factory wages | $40,000 |

| Depreciation of plant and equipment | 20,000 |

| Power and light | 10,000 |

| Insurance and property tax | 5,000 |

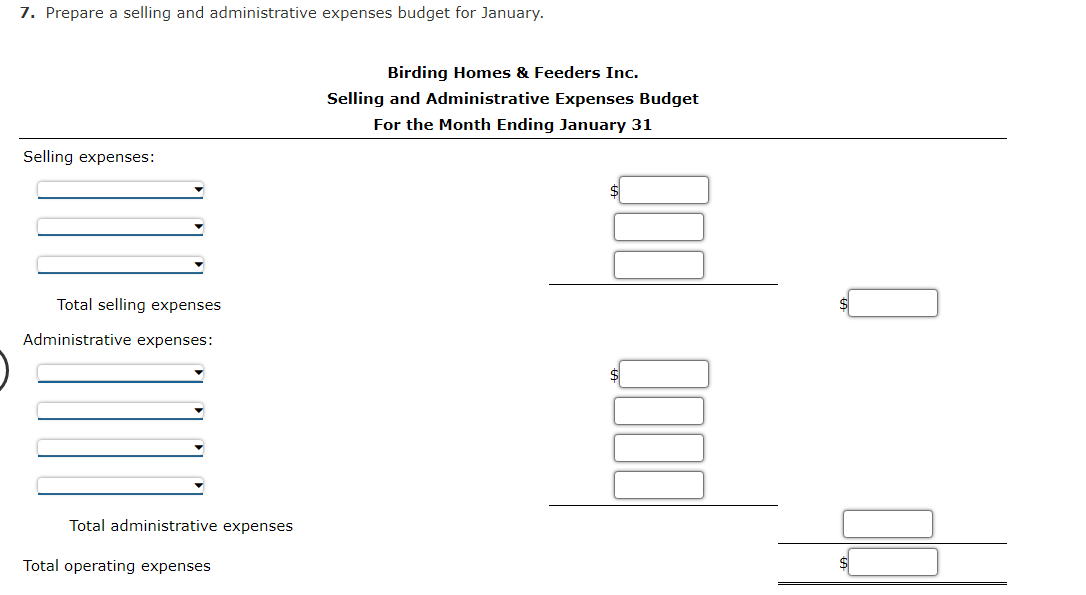

h. Estimated operating expenses for January:

| Line Item Description | Amount |

|---|---|

| Sales salaries expense | $125,000 |

| Advertising expense | 80,000 |

| Office salaries expense | 40,000 |

| Depreciation expense—office equipment | 4,000 |

| Travel expense—selling | 25,000 |

| Office supplies expense | 2,500 |

| Miscellaneous administrative expense | 3,500 |

i. Estimated other revenue and expense for January:

| Line Item Description | Amount |

|---|---|

| Interest revenue | $4,540 |

| Interest expense | 3,000 |

j. Estimated tax rate: 25%

Required:

1. Prepare a sales budget for January.