Home /

Expert Answers /

Accounting /

brown-cow-dairy-uses-the-aging-approach-to-estimate-bad-debt-expense-the-balance-of-each-account-r-pa814

(Solved): Brown Cow Dairy uses the aging approach to estimate Bad Debt Expense. The balance of each account r ...

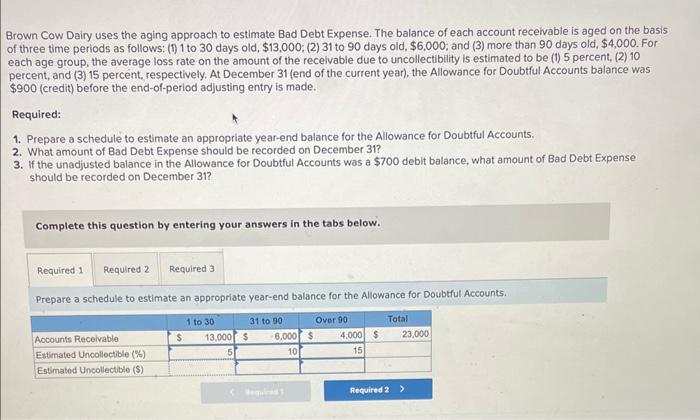

Brown Cow Dairy uses the aging approach to estimate Bad Debt Expense. The balance of each account recelvable is aged on the basis of three time periods as follows: (1) 1 to 30 days old, \( \$ 13,000 \); (2) 31 to 90 days old, \( \$ 6,000 \); and (3) more than 90 days old, \( \$ 4,000 \). For each age group, the average loss rate on the amount of the recelvable due to uncollectibility is estimated to be (1) 5 percent, (2) 10 percent, and (3) 15 percent, respectively. At December 31 (end of the current year), the Allowance for Doubtful Accounts balance was \( \$ 900 \) (credit) before the end-of-period adjusting entry is made. Required: 1. Prepare a schedule to estimate an appropriate year-end balance for the Allowance for Doubtful Accounts. 2. What amount of Bad Debt Expense should be recorded on December 31 ? 3. If the unadjusted balance in the Allowance for Doubtful Accounts was a \( \$ 700 \) debit balance, what amount of Bad Debt Expense should be recorded on December 31 ? Complete this question by entering your answers in the tabs below. Prepare a schedule to estimate an appropriate year-end balance for the Allowance for Doubtful Accounts.

Required: 1. Prepare a schedule to estimate an appropriate year-end balance for the Allowance for Doubtful Accounts. 2. What amount of Bad Debt Expense should be recorded on December 31 ? 3. If the unadjusted balance in the Allowance for Doubtful Accounts was a \( \$ 700 \) debit balance, what amount of Bad Debt Expense should be recorded on December 31 ? Complete this question by entering your answers in the tabs below. What amount of Bad Debt Expense should be recorded on December 31 ?

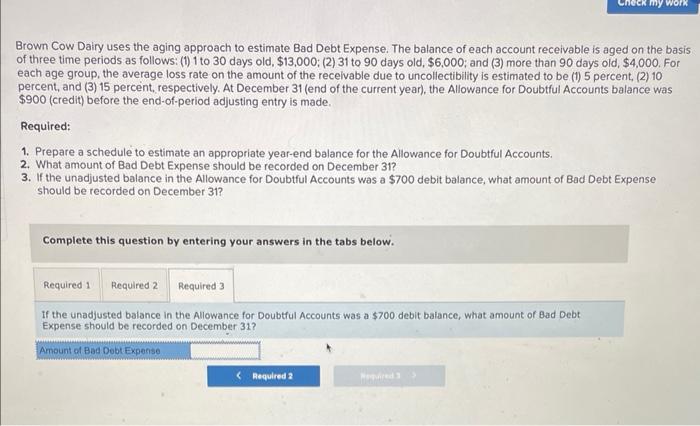

Brown Cow Dairy uses the aging approach to estimate Bad Debt Expense. The balance of each account receivable is aged on the basis of three time periods as follows: (1) 1 to 30 days old, \( \$ 13,000 \); (2) 31 to 90 days old, \( \$ 6,000 \); and (3) more than 90 days old, \( \$ 4,000 \). For each age group, the average loss rate on the amount of the recelvable due to uncollectibility is estimated to be (1) 5 percent, (2) 10 percent, and (3) 15 percent, respectively. At December 31 (end of the current year), the Allowance for Doubtful Accounts balance was \( \$ 900 \) (credit) before the end-of-period adjusting entry is made. Required: 1. Prepare a schedule to estimate an appropriate year-end balance for the Allowance for Doubtful Accounts, 2. What amount of Bad Debt Expense should be recorded on December 31 ? 3. If the unadjusted balance in the Allowance for Doubtful Accounts was a \( \$ 700 \) debit balance, what amount of Bad Debt Expense should be recorded on December 31 ? Complete this question by entering your answers in the tabs below. If the unadjusted balance in the Allowance for Doubtful Accounts was a \( \$ 700 \) debit balance, what amount of Bad Debt Expense should be recorded on December 31 ?

Expert Answer

1) The schedule is as follows 1-30