Home /

Expert Answers /

Finance /

bethesda-mining-company-reports-the-following-balance-sheet-information-for-2021-and-2022-pa740

(Solved): Bethesda Mining Company reports the following balance sheet information for 2021 and \( 2022 . \) ...

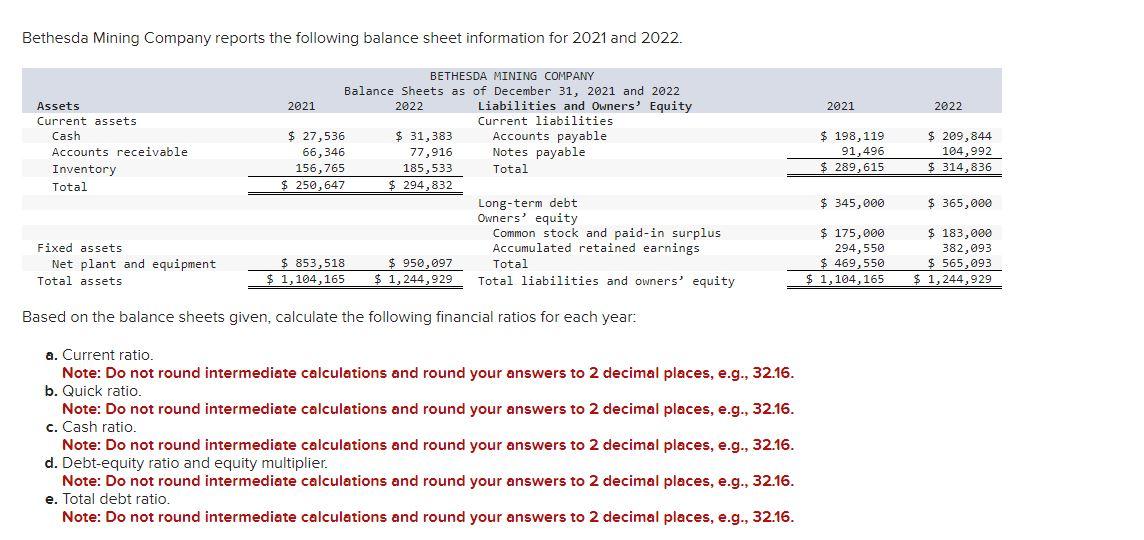

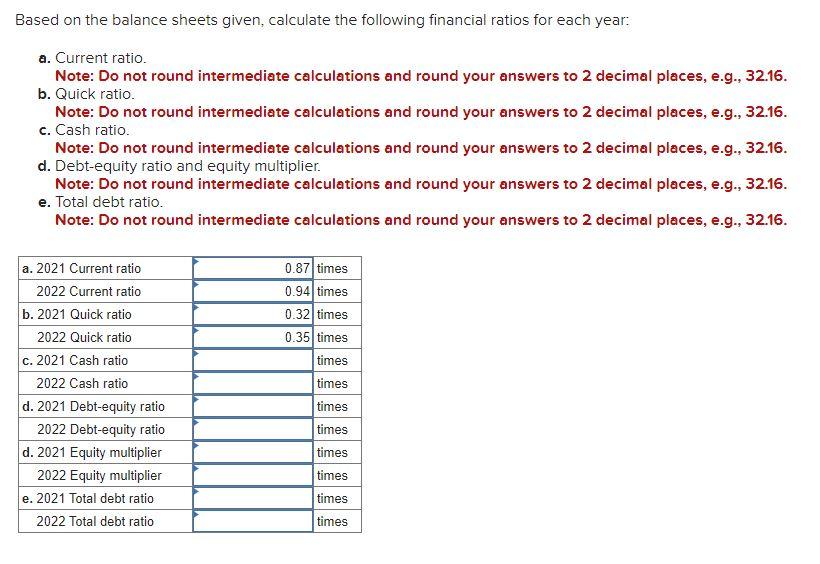

Bethesda Mining Company reports the following balance sheet information for 2021 and \( 2022 . \) Based on the balance sheets given, calculate the following financial ratios for each year: a. Current ratio. Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., \( 32.16 . \) b. Quick ratio. Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., \( 32.16 . \) c. Cash ratio. Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., \( 32.16 . \) d. Debt-equity ratio and equity multiplier. Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., \( 32.16 . \) e. Total debt ratio. Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., \( 32.16 . \) Based on the balance sheets given, calculate the following financial ratios for each year: a. Current ratio. Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., \( 32.16 . \) b. Quick ratio. Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., \( 32.16 . \) c. Cash ratio. Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., \( 32.16 . \) d. Debt-equity ratio and equity multiplier. Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., \( 32.16 . \) e. Total debt ratio. Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., \( 32.16 . \)

Expert Answer

2021: Current ratio = Current assets / Current liabilities Current ratio = $250,647 / $289,615 Current ratio = 0.87 times Quick ratio = (Current assets - Inventory) / Current liabilities Quick ratio = ($250,647 - $156,765) / $289,615 Quick ratio = 0.