Home /

Expert Answers /

Accounting /

backflush-versus-traditional-costing-variation-1-potter-company-has-installed-a-jit-purchasing-and-pa133

(Solved): Backflush versus Traditional Costing: Variation 1 Potter Company has installed a JIt purchasing and ...

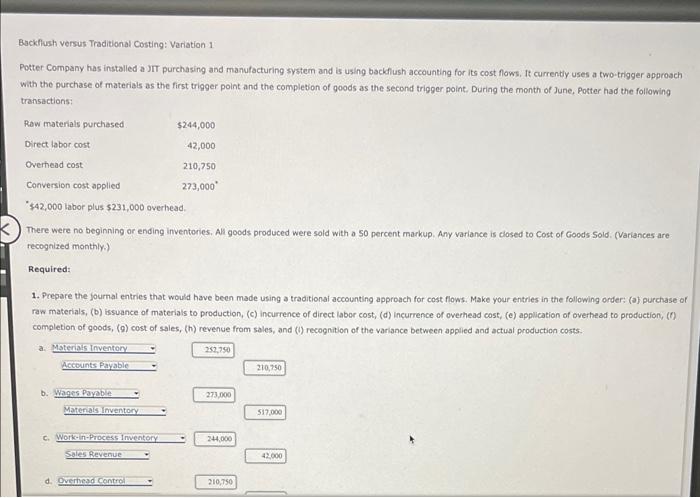

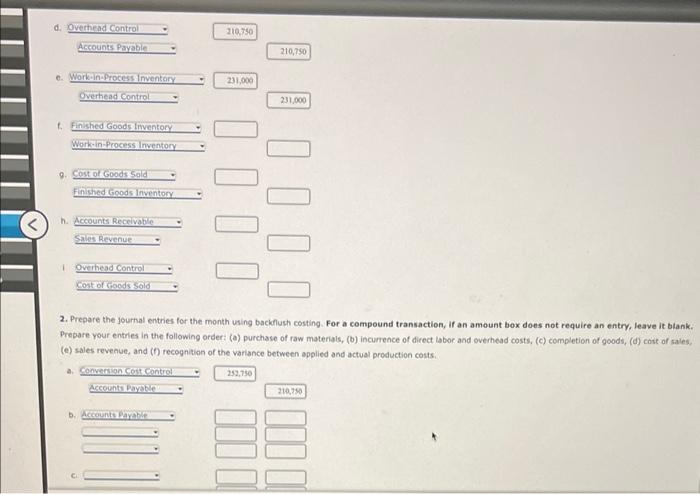

Backflush versus Traditional Costing: Variation 1 Potter Company has installed a JIt purchasing and manufacturing system and is using backflush accounting for its cost flows, It currently uses a two trigger approsch with the purchase of materials as the first trigger point and the completion of goods as the second trigger point, During the month of June, Potter had the following transactions: "\$42,000 labor plus \( \$ 231,000 \) overhead. There were no beginning or ending inventories, All goods produced were sold with a 50 percent markup. Amy variance is ciosed to Cost of Goods Sold. (Variances are recognized monthly.) Required: 1. Prepare the journal entries that would have been made using a traditional accounting approach for cost flows. Make your entries in the following order: (a) purchase of raw materials, (b) issuance of materiais to production, (c) incurrence of direct labor cost, (d) incurrence of overhead cost, (e) application of overhead to production, (f) completion of goods, \( (9) \) cost of saies, \( (h) \) revenue from sales, and (i) recognition of the variance between applied and actual production conts.

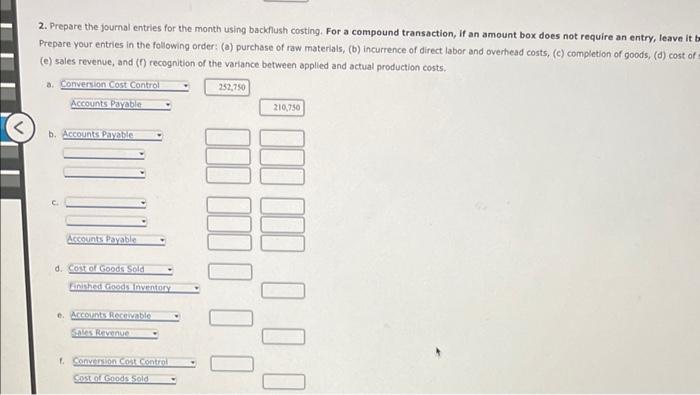

2. Prepare the jourhal entries for the month using backflush costing. For a compound transaction, If an amount box does not require an entry, leave it blank. Prebare your entries in the following order: (a) purchase of raw materials, (b) incurrence of dicect labor and overhead costs, (c) completion of goods, (d) cost of sales. (e) sales revenue, and (f) recognition of the variance between applied and actual production costs;

2. Prepare the joumal entries for the month using backfiush costing. For a compound transaction, if an amount box does not require an entry, leave it t Prepare your entries in the following order: (a) purchase of raw materials, (b) incurrence of direct labor and overhead costs, (c) completion of goods, (d) cost of (e) sales revenue, and (f) recognition of the variance between anolied and actual production costs.

Expert Answer

A) Journal entries . Date Account Dr Cr Material Inventory $244,000 Acounts Payable $244,000 (a) Date Account Dr Cr Work in Process Inventory $244,000