Home /

Expert Answers /

Finance /

attempts-net-cash-flows-central-laundry-and-cleaners-is-considering-replacing-an-existing-piece-of-pa664

(Solved): attempts) Net cash flows Central Laundry and Cleaners is considering replacing an existing piece of ...

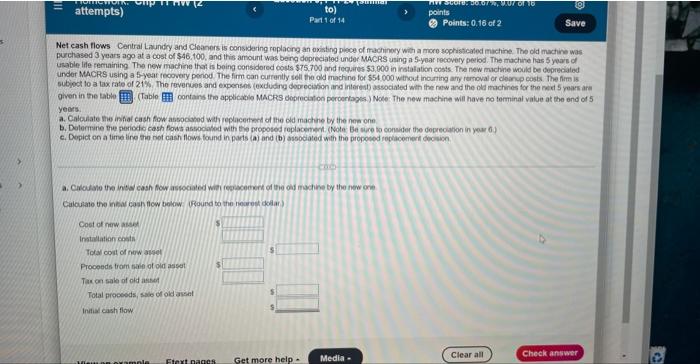

attempts) Net cash flows Central Laundry and Cleaners is considering replacing an existing piece of machinery with a more sophisticated machine. The old machine was purchased 3 years ago at a cost of $46.100, and this amount was being depreciated under MACRS using a 5-year recovery period. The machine has 5 years of usable life remaining. The new machine that is being considered costs $75.700 and requires $3,000 in installation costs. The new machine would be depreciated under MACRS using a 5-year recovery period. The firm can currently sell the old machine for $54.000 without incurring any removal or cleanup costs. The firm is subject to a tax rate of 21%. The revenues and expenses (excluding depreciation and interest) associated with the new and the old machines for the next 5 years are given in the table (Table contains the applicable MACRS depreciation percentages) Note: The new machine will have no terminal value at the end of 5 Cost of new asset Installation costs Total cost of new asset Proceeds from sale of old assot Tax on sale of old asset Total proceeds, sale of old asset Initial cash flow to) Part 1 of 14 years. a. Calculate the initial cash flow associated with replacement of the old machine by the new one b. Determine the periodic cash flows associated with the proposed replacement. (Note: Be sure to consider the depreciation in year 6.) c. Depict on a time line the net cash flows found in parts (a) and (b) associated with the proposed replacement decision a. Calculate the initial cash flow associated with replacement of the old machine by the new one Calculate the initial cash flow below (Round to the nearest dolar) View on example Etext pages Tsummar Get more help. AVF Stord: 30.07%, 9.07 of 1 points Points: 0.16 of 2 Media - Clear all Save Check answer

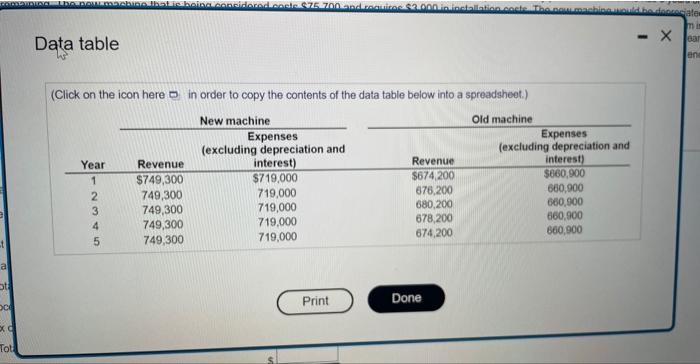

t a ot Oc xC Tot LOO the new machine that is being considered.coste $75 700 and requires $2.000 in installation coste The new Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) New machine Old machine Year 1 2345 Revenue $749,300 749,300 749,300 749,300 749,300 Expenses (excluding depreciation and interest) $719,000 719,000 719,000 719,000 719,000 Print Revenue $674,200 676,200 680,200 678,200 674,200 Done Expenses (excluding depreciation and interest) $660,900 660,900 660,900 660,900 660,900 doorociater mis ear ene - X

(Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Recovery year 1 2 8 9 10 11 Totals 3 years 33% 45% 15% 7% Percentage by recovery year* 5 years 20% Print 32% 19% 12% 12% 5% 6% 6% 6% 4% 100% 100% 100% 100% *These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention. 7 years 14% 25% 18% 12% Done 10 years 10% 18% 14% 12% 9% 8%